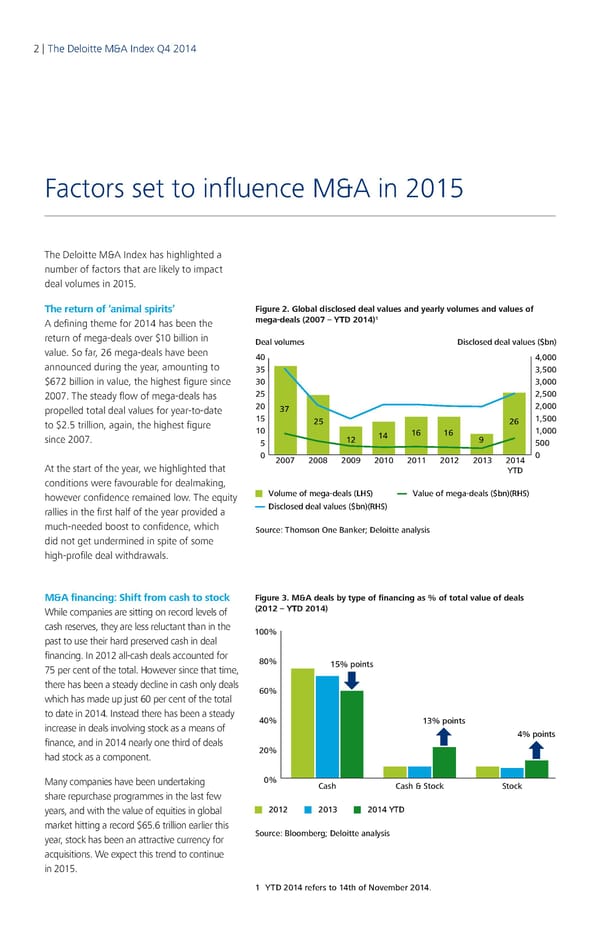

2 | The Deloitte M&A Index Q4 2014 3 | Factors set to influence M&A in 2015 The Deloitte M&A Index has highlighted a number of factors that are likely to impact deal volumes in 2015. The return of ‘animal spirits’ Figure 2. Global disclosed deal values and yearly volumes and values of 1 A defining theme for 2014 has been the mega-deals (2007 – YTD 2014) return of mega-deals over $10 billion in Deal volumes Disclosed deal values ($bn) value. So far, 26 mega-deals have been 40 4,000 announced during the year, amounting to 35 3,500 $672 billion in value, the highest figure since 30 3,000 2007. The steady flow of mega-deals has 25 2,500 propelled total deal values for year-to-date 20 37 2,000 to $2.5 trillion, again, the highest figure 15 25 26 1,500 10 14 16 16 1,000 since 2007. 5 12 9 500 0 2007 2008 2009 2010 2011 2012 2013 2014 0 At the start of the year, we highlighted that YTD conditions were favourable for dealmaking, however confidence remained low. The equity Volume of mega-deals (LHS) Value of mega-deals ($bn)(RHS) rallies in the first half of the year provided a Disclosed deal values ($bn)(RHS) much-needed boost to confidence, which Source: Thomson One Banker; Deloitte analysis did not get undermined in spite of some high-profile deal withdrawals. M&A financing: Shift from cash to stock Figure 3. M&A deals by type of financing as % of total value of deals While companies are sitting on record levels of (2012 – YTD 2014) cash reserves, they are less reluctant than in the 100% past to use their hard preserved cash in deal financing. In 2012 all-cash deals accounted for 80% 75 per cent of the total. However since that time, 15% points there has been a steady decline in cash only deals 60% which has made up just 60 per cent of the total to date in 2014. Instead there has been a steady 40% 13% points increase in deals involving stock as a means of 4% points finance, and in 2014 nearly one third of deals had stock as a component. 20% Many companies have been undertaking 0% Cash Cash & Stock Stock share repurchase programmes in the last few years, and with the value of equities in global 2012 2013 2014 YTD market hitting a record $65.6 trillion earlier this year, stock has been an attractive currency for Source: Bloomberg; Deloitte analysis acquisitions. We expect this trend to continue in 2015. 1 YTD 2014 refers to 14th of November 2014.

Q4 2014 The Deloitte M&A Index Page 1 Page 3

Q4 2014 The Deloitte M&A Index Page 1 Page 3