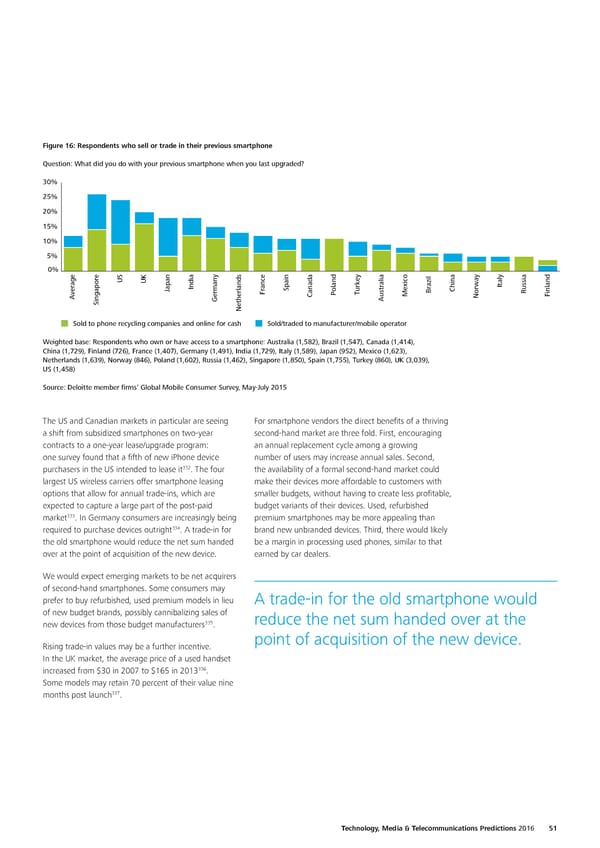

Figure 16: Respondents who sell or trade in their previous smartphone Question: What did you do with your previous smartphone when you last upgraded? 30% 25% 20% 15% 10% 5% 0% y a d a y a US UK India Ital Japan France Spain Canad Polan Turkey Mexico Brazil Chin Norway Russi Finland AverageSingapore German Australia Netherlands Sold to phone recycling companies and online for cash Sold/traded to manufacturer/mobile operator Weighted base: Respondents who own or have access to a smartphone: Australia (1,582), Brazil (1,547), Canada (1,414), China (1,729), Finland (726), France (1,407), Germany (1,491), India (1,729), Italy (1,589), Japan (952), Mexico (1,623), Netherlands (1,639), Norway (846), Poland (1,602), Russia (1,462), Singapore (1,850), Spain (1,755), Turkey (860), UK (3,039), US (1,458) Source: Deloitte member firms’ Global Mobile Consumer Survey, May-July 2015 The US and Canadian markets in particular are seeing For smartphone vendors the direct benefits of a thriving a shift from subsidized smartphones on two-year second-hand market are three fold. First, encouraging contracts to a one-year lease/upgrade program: an annual replacement cycle among a growing one survey found that a fifth of new iPhone device number of users may increase annual sales. Second, 332 purchasers in the US intended to lease it . The four the availability of a formal second-hand market could largest US wireless carriers offer smartphone leasing make their devices more affordable to customers with options that allow for annual trade-ins, which are smaller budgets, without having to create less profitable, expected to capture a large part of the post-paid budget variants of their devices. Used, refurbished 333 market . In Germany consumers are increasingly being premium smartphones may be more appealing than 334 required to purchase devices outright . A trade-in for brand new unbranded devices. Third, there would likely the old smartphone would reduce the net sum handed be a margin in processing used phones, similar to that over at the point of acquisition of the new device. earned by car dealers. We would expect emerging markets to be net acquirers of second-hand smartphones. Some consumers may prefer to buy refurbished, used premium models in lieu A trade-in for the old smartphone would of new budget brands, possibly cannibalizing sales of 335 reduce the net sum handed over at the new devices from those budget manufacturers . Rising trade-in values may be a further incentive. point of acquisition of the new device. In the UK market, the average price of a used handset 336 increased from $30 in 2007 to $165 in 2013 . Some models may retain 70 percent of their value nine 337 months post launch . Technology, Media & Telecommunications Predictions 2016 51

Technology, Media & Telecommunications Predictions Page 59 Page 61

Technology, Media & Telecommunications Predictions Page 59 Page 61