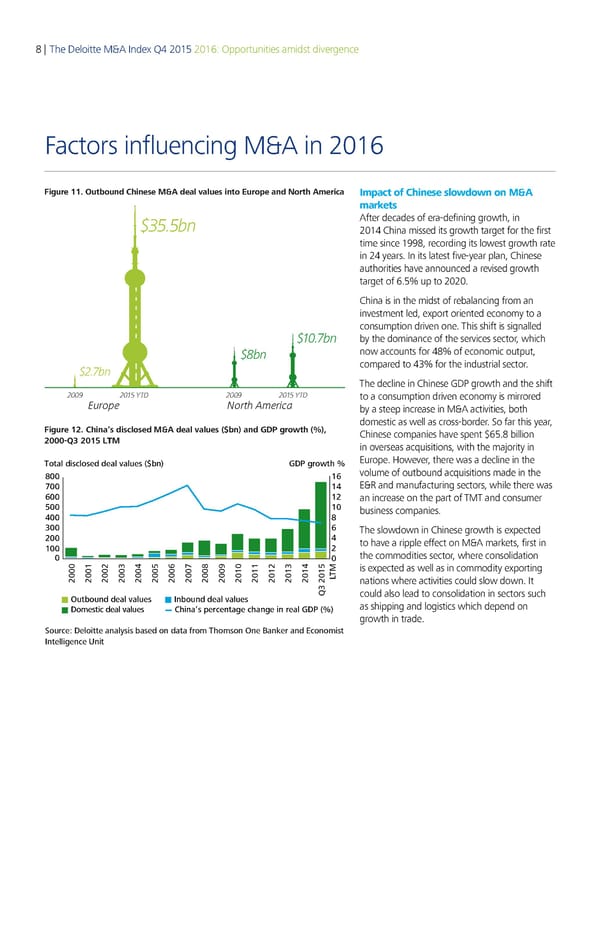

8 | The Deloitte M&A Index Q4 2015 2016: Opportunities amidst divergence Factors influencing M&A in 2016 Figure 11. „ubound Chinese M&A deal values ino …uro†e and ‡orh Aˆerica Impact of Chinese slowdown on M&A markets $35.5bn After decades of era-defining growth, in 2014 China missed its growth target for the first time since 1998, recording its lowest growth rate in 24 years. In its latest five-year plan, Chinese authorities have announced a revised growth target of 6.5% up to 2020. China is in the midst of rebalancing from an investment led, export oriented economy to a consumption driven one. This shift is signalled $10.7bn by the dominance of the services sector, which $8bn now accounts for 48% of economic output, $2.7bn compared to 43% for the industrial sector. The decline in Chinese GDP growth and the shift 2009 2015 YTD 2009 2015 YTD to a consumption driven economy is mirrored Europe North America by a steep increase in M&A activities, both domestic as well as cross-border. So far this year, Figure 12. China’s disclosed M&A deal values ($bn) and GDP groh () Chinese companies have spent $65.8 billion 2 21€ ‚ƒM in overseas acquisitions, with the majority in Total disclosed deal values ($bn) GDP growth % Europe. However, there was a decline in the ‡ … volume of outbound acquisitions made in the † ƒ E&R and manufacturing sectors, while there was … € an increase on the part of TMT and consumer „ business companies. ƒ ‡ ‚ … The slowdown in Chinese growth is expected € ƒ to have a ripple effect on M&A markets, first in € the commodities sector, where consolidation Š is expected as well as in commodity exporting € € € €€ ‚€ ƒ€ „€ …€ †€ ‡ € ‹€ € € €€ ‚€ ƒ ‰T nations where activities could slow down. It utbound deal values nbound deal values ˆ‚ € „ could also lead to consolidation in sectors such Domestic deal values Œhina’s ‘ercentage change in real GDP (%) as shipping and logistics which depend on growth in trade. Source: Deloitte analysis based on data from Thomson ne aner and conomist ntelligence nit

Deloitte M&A Index | Report Page 8 Page 10

Deloitte M&A Index | Report Page 8 Page 10