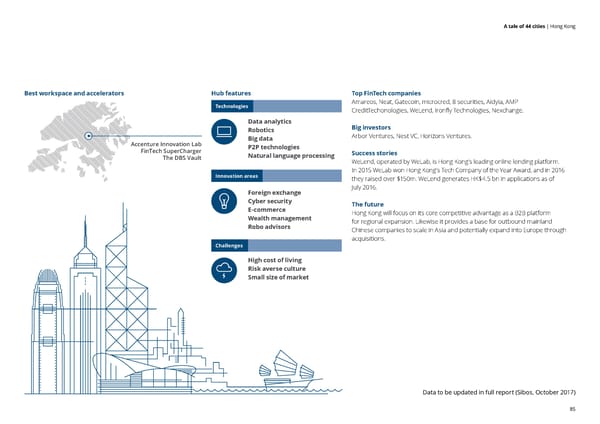

A tale of 44 cities | Hong Kong S e l f e v a u l a t i o n o f tH h eu hb u bi in nd i sc High Rankixa t ko e yr s a r e a Hong Kongs Best workspace and accelerators Hub features Top FinTech companies Hub profile Technologies Amareos, Neat, Gatecoin, microcred, 8 securities, Aidyia, AMP Si CreditTechonologies, WeLend, Ironfly Technologies, Nexchange. l i c on Data analytics VaG Cllo Big investors hev Robotics icye ar Arbor Ventures, Nest VC, Horizons Ventures. gn Big data om e Accenture Innovation Lab Gn l o b a l F P2P technologies it Cn es n t r FinTech SuperCharger eu Success stories 4p Natural language processing Hp The DBS Vault ono WeLend, operated by WeLab, is Hong Kong’s leading online lending platform. gr t Kong In 2015 WeLab won Hong Kong’s Tech Company of the Year Award, and in 2016 Innovation areas they raised over $150m. WeLend generates HK$4.5 bn in applications as of Foreign exchange July 2016. ZD u r icB h4uo i sn Cyber security ig nI The future en sn E-commerce INDEX SCOREso Hong Kong will focus on its core competitive advantage as a B2B platform Hong Kong has the natural branding of Asia’s largest financial centre. va Wealth management t for regional expansion. Likewise it provides a base for outbound mainland Sydneyi o Robo advisors This provides an immediate attraction for FinTech and has driven its c n Chinese companies to scale in Asia and potentially expand into Europe through development in recent years. Hong Kong’s position as Asia’s super 22utlu acquisitions. connector is particularly useful for B2B solutions. Furthermore, its er Challenges historical proximity to China makes it hard for other hubs to High cost of living displace Hong Kong.Low Rank Risk averse culture 41nI Small size of market xedolG lab nnI se avoti Renoitper gulao ex tionty t imi rox P Hub representativeFormers FinTech HKeign sto custo artupsProximity t Founder Janos Barberis Data to be updated in full report (Sibos, October 2017) 85

A Tale of 44 Cities Page 84 Page 86

A Tale of 44 Cities Page 84 Page 86