A Tale of 44 Cities

Connecting Global FinTech: Interim Hub Review 2017

“ We want to encourage global engagement, best practices, and knowledge sharing, as well as build bridges between all FinTech hubs for entrepreneurs and investors to connect.” Global FinTech Hubs Federation

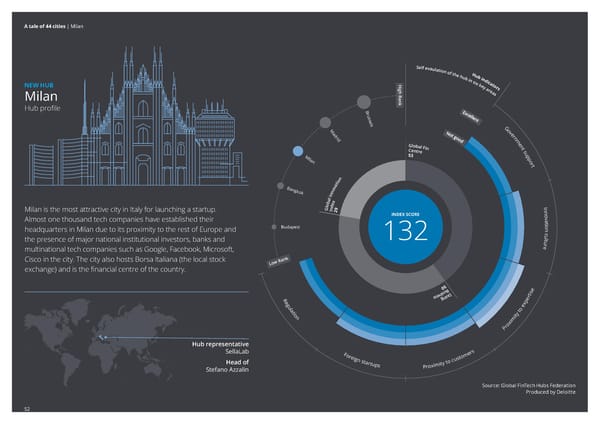

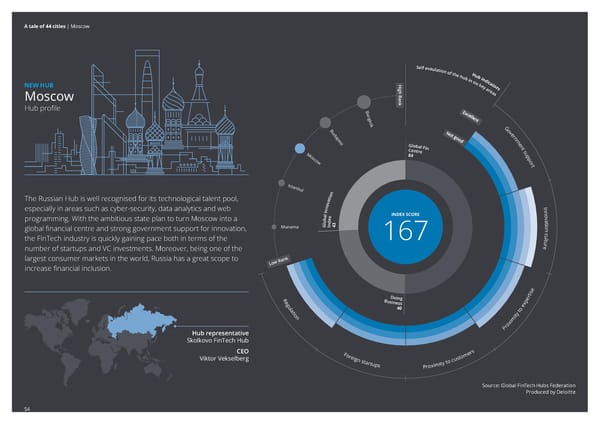

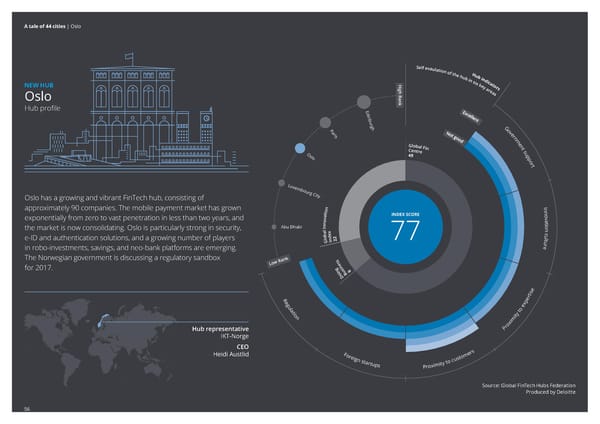

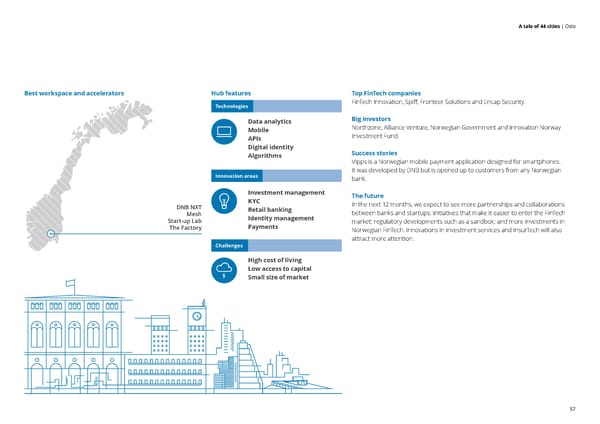

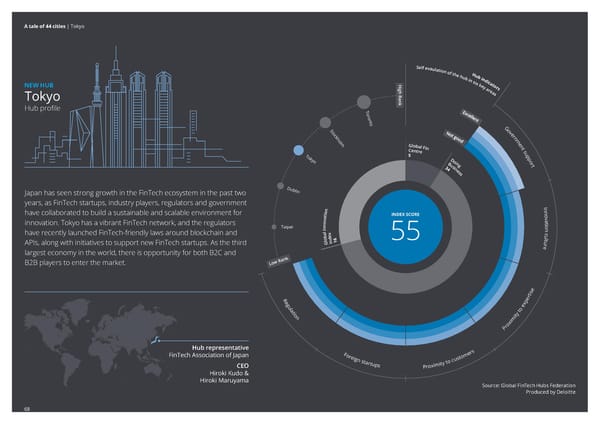

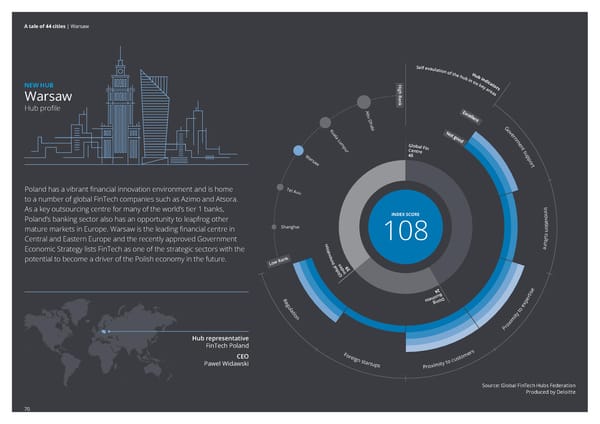

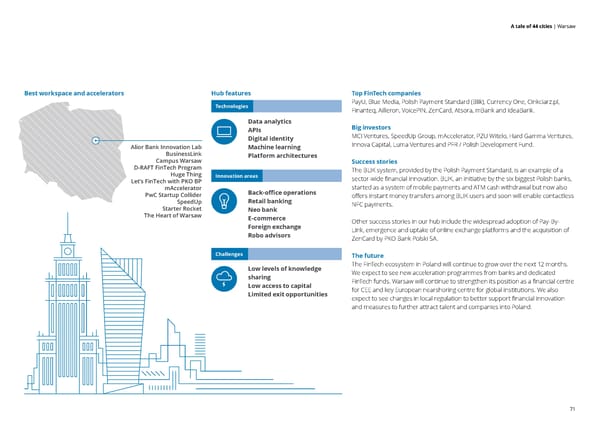

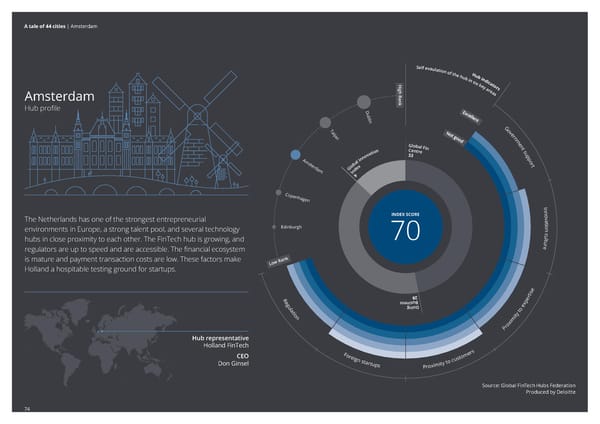

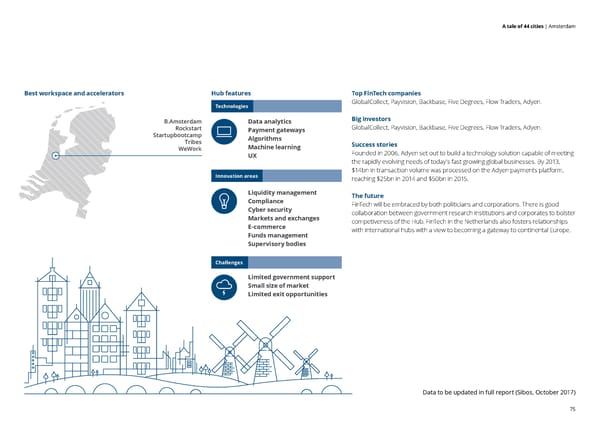

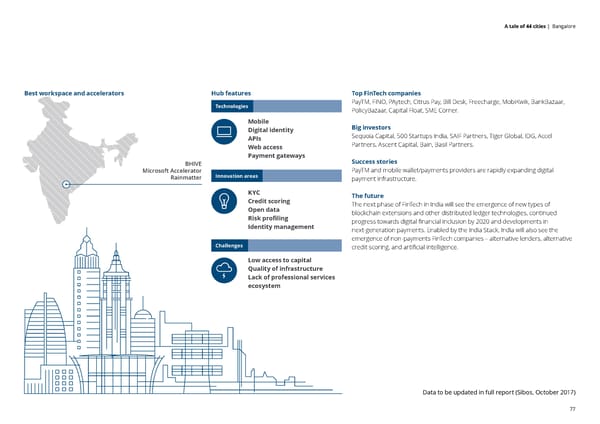

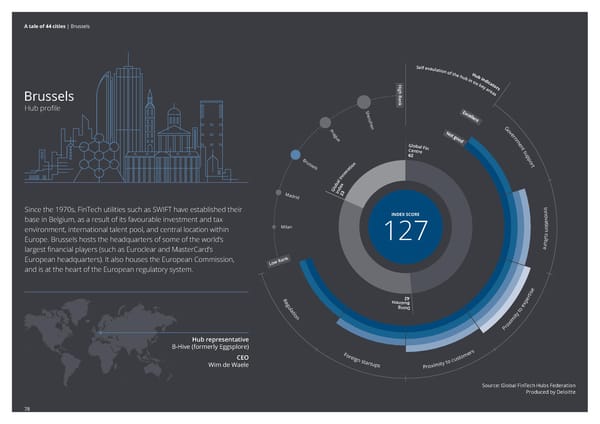

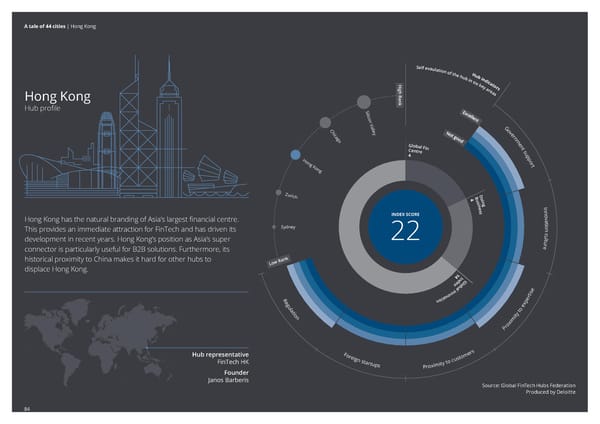

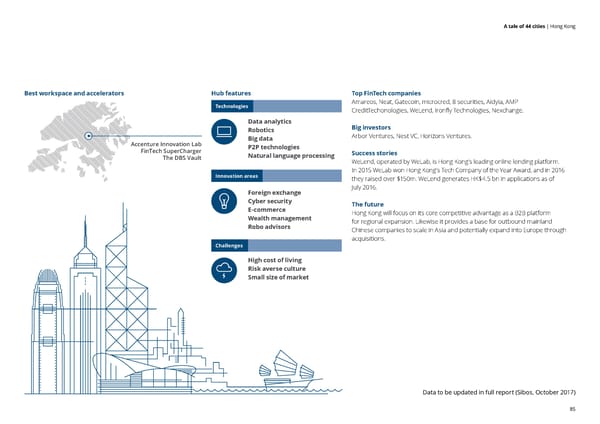

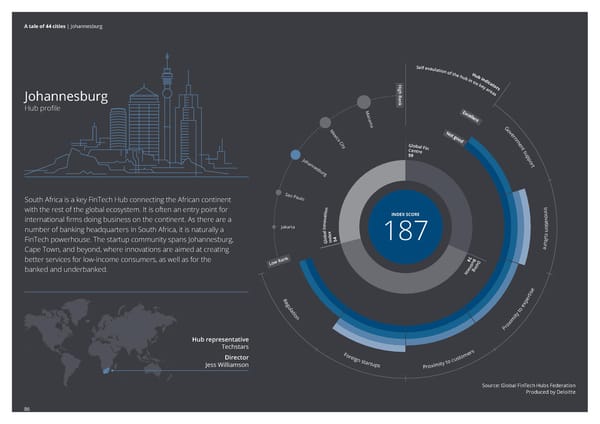

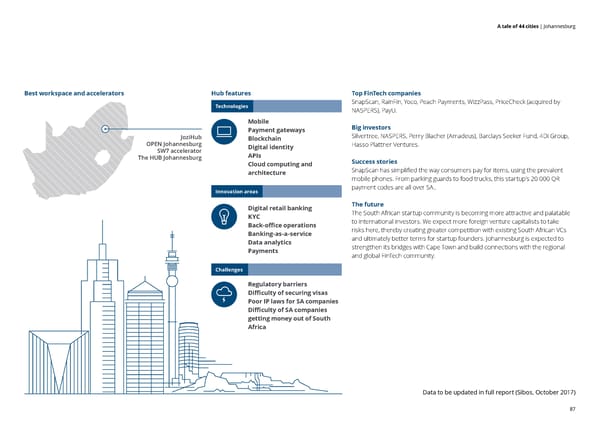

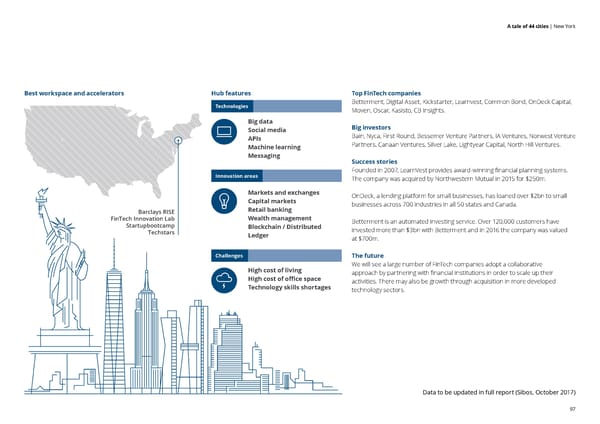

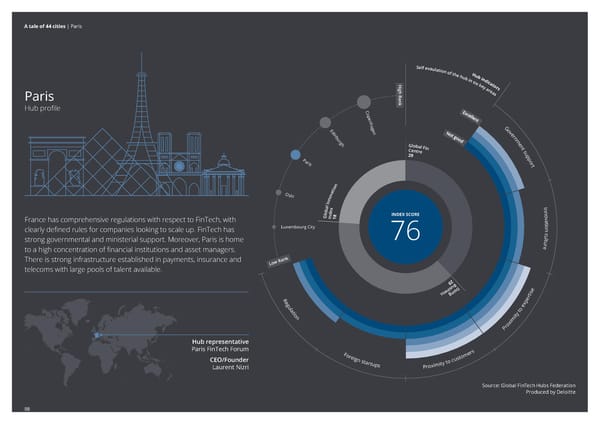

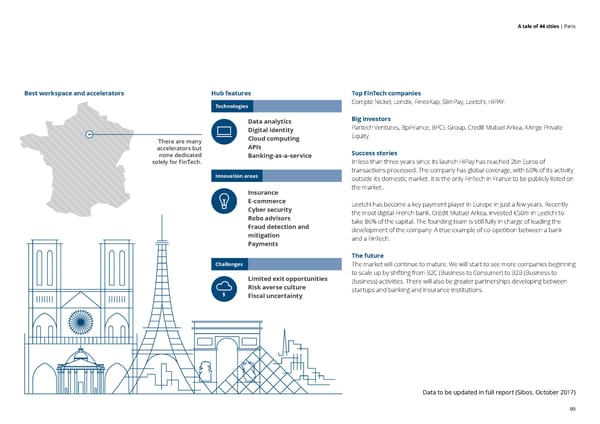

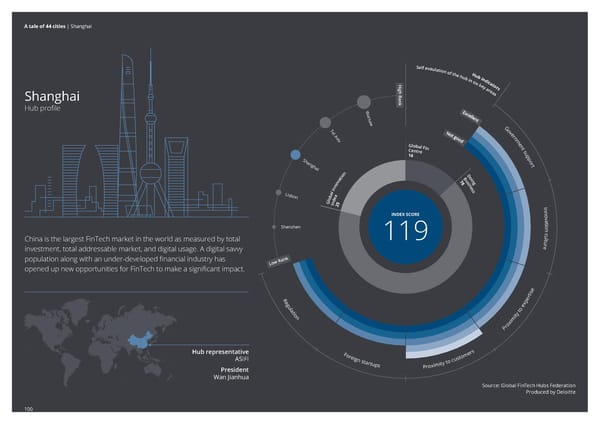

A tale of 44 cities | Contents Contents Connecting the global – Copenhagen 34 – Bangalore 76 FinTech community 04 – Edinburgh 36 – Brussels 78 Readers’ note 06 – Istanbul 38 – Dublin 80 Methodology 07 – Jakarta 40 – Frankfurt 82 Reading guide 13 – Kuala Lumpur 42 – Hong Kong 84 Research findings 14 – Lagos 44 – Johannesburg 86 – Lisbon 46 – London 88 Overview – Index – Madrid 48 – Luxembourg City 90 Performance Scores 17 – Manama 50 – Mexico City 92 Overview – Hub Indicators 18 – Milan 52 – Nairobi 94 Global FinTech VC deal – Moscow 54 – New York 96 value 2016 19 – Oslo 56 – Paris 98 Map of regulatory sandboxes 20 – Prague 58 – Shanghai 100 Map of regulatory – Sao Paulo 60 – Silicon Valley 102 collaboration 21 – Shenzhen 62 – Singapore 104 New Hubs 22 – Stockholm 64 – Sydney 106 – Abu Dhabi 24 – Taipei 66 – Tel Aviv 108 – Auckland 26 – Tokyo 68 – Toronto 110 – Bangkok 28 – Warsaw 70 – Zurich 112 – Budapest 30 Old Hubs 72 Acknowledgements 114 – Chicago 32 – Amsterdam 74 3

A tale of 44 cities | Connecting the global FinTech community Connecting the global FinTech community An update to the report Connecting Global FinTech: Hub Review 2016 where 21 emerging and established global FinTech Hubs were profiled. This interim report updates 20 of the Hubs profiled in September 2016 and introduces an additional 24 Hubs that have joined the Federation, bringing the number total number of Hubs profiled to 44. We have been overwhelmed by the response of the global FinTech community and their desire to Fabian Vandenreydt Lawrence Wintermeyer collaborate and connect with each other to share best practices and knowledge through the Global Global Head of Securities Markets, CEO, Innovate Finance FinTech Hubs Federation. Innotribe & The SWIFT Institute, SWIFT We welcome members of the Federation to the Innovate Finance Global Summit at London’s Guildhall on 10 and 11 April 2017. The next full report will be published in the autumn and be presented at Sibos 2017 where we will welcome all of the members of the Federation to Toronto. We would like to thank Deloitte for their continuing support and contribution to making this report the global FinTech hub report. We look forward to meeting and working with all of the hubs in the Federation in 2017. Fabian Vandenreydt, Global Head of Securities Markets, Innotribe & The SWIFT Institute Lawrence Wintermeyer, CEO, Innovate Finance 4

A tale of 44 cities | Connecting the global FinTech community GLOBAL FINTECH HUBS FEDERATION The Global FinTech Hubs Federation (GFHF) is an independent and inclusive network of emerging Launched in 2009, Innotribe was created to identify the emerging technologies and innovative and established FinTech hubs. As the FinTech sector develops globally, it is creating a growing trends surrounding the financial services industry and generate discussions on their potential international community helping to foster innovation across the world’s financial services industry. impact moving forward. Benefiting from SWIFT’s central position, Innotribe provides a platform to The Global FinTech Hubs Federation is bringing together FinTech hubs to provide a neutral, cross- the global financial community to understand the dynamics behind technology changes and to help border platform to encourage greater collaboration, engagement and knowledge sharing in this focus on the opportunities for transformation rather than the threats to current market practices. growing global community. Deloitte is the largest privately held professional services organization in the world based on Innovate Finance is an independent, not-for profit membership association that represents the headcount and breadth of capability, delivering audit, enterprise risk, tax, finance, strategy and UK’s global FinTech community. Founded in 2014 with support from the City of London and Canary operations, human capital, and technology services. Wharf Group and with over 250 members, Innovate Finance aims to accelerate the country’s leading position in the global financial services sector by directly supporting the next era of technology-led FinTech innovators. The goal is to create a single point of access across sectors to help foster enabling policies, regulation, and investment. 5

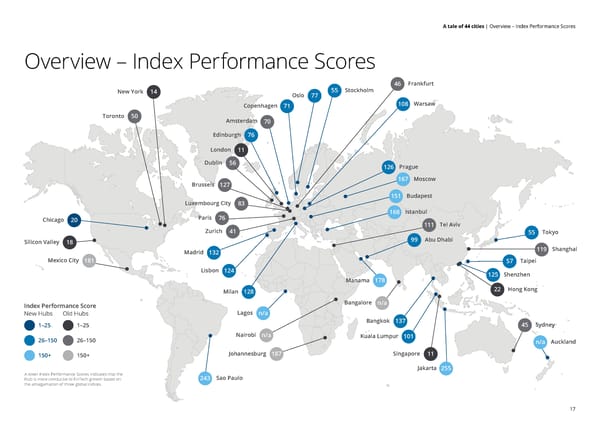

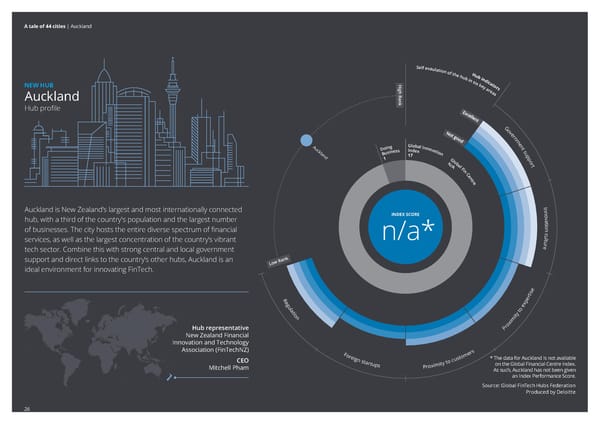

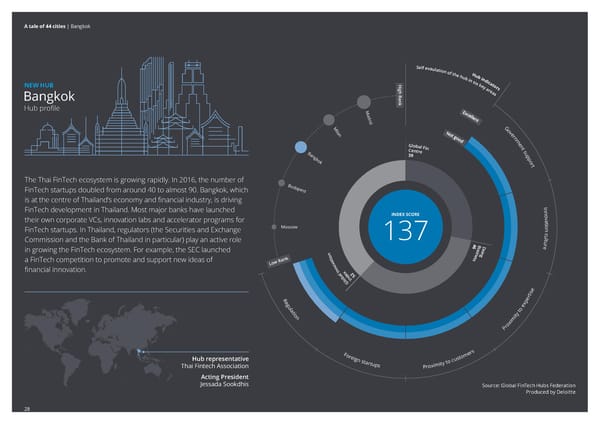

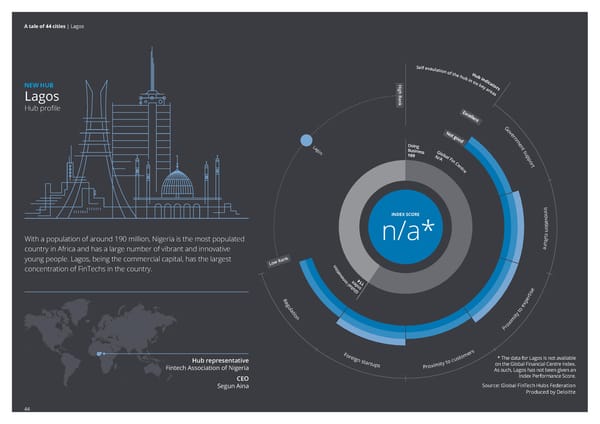

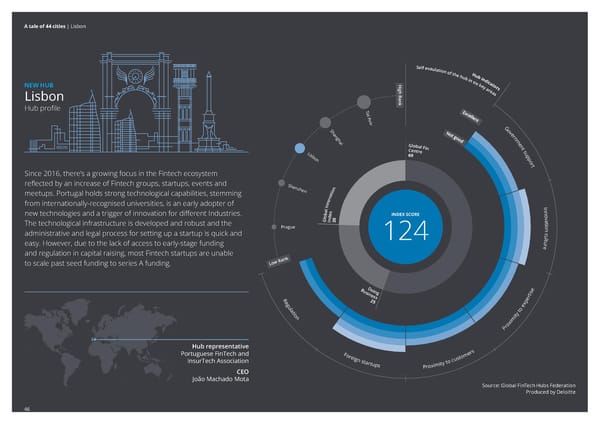

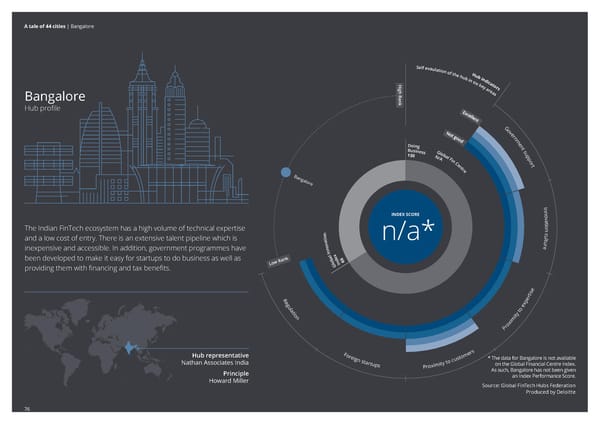

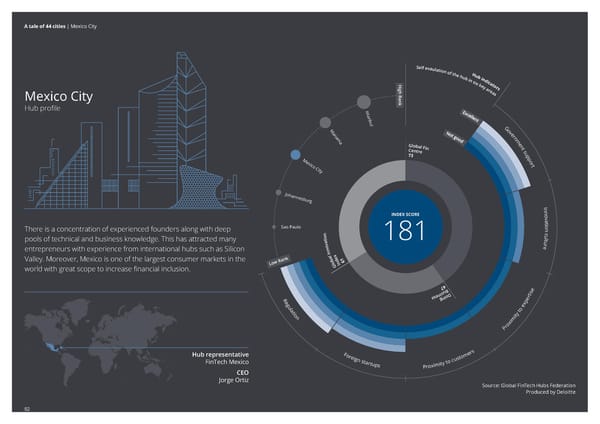

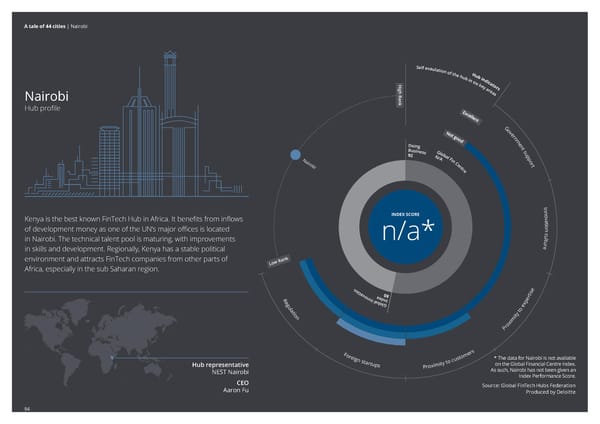

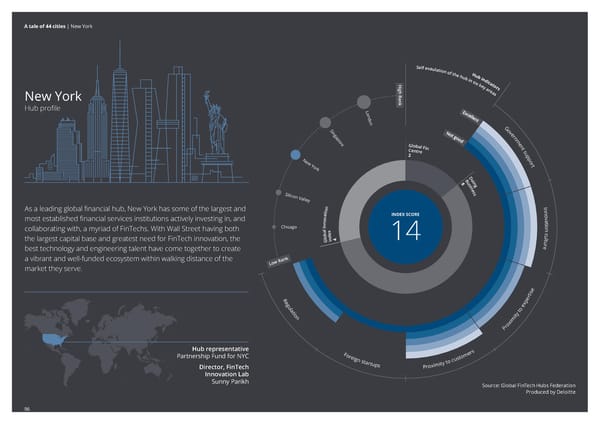

A tale of 44 cities | Readers’ note Readers’ note Interim report : new Hubs, same methodology This report uses the same research methodology as the Connecting Global FinTech: Hub Review Since our inaugural report was launched at Sibos 2016, the number of participants in the Global 2016 report. Full details of this, including how Hubs and Hub Representatives were selected, can FinTech Hubs Federation has more than doubled. This is a great success for the Federation and to be found in the Methodology on pages 7-12. recognise this significant growth, the Federation has asked Deloitte to help them create a one-off Interim report to showcase the 24 New Hubs. For the 24 New Hubs that are the focus of this Interim report, we have completed the full research approach set out in our methodology. However, for Hubs previously profiled in the 2016 report, In reading this report, readers should note that the analysis is split into two parts: we have limited the updates to Index Performance Scores and corrections which did not make it into the previous report. i. Index Performance Scores: We took the combined scores of each Hub from three prominent business indices (the World Our ambition for future reports Bank Doing Business Index, the Global Innovation Index and the Global Financial Centres Index) In FinTech, a lot changes over six months. When we launched our Connecting Global FinTech: to provide a consolidated “Index Performance Score” in order to assess the Hubs on a quantitative Hub Review 2016 at Sibos last year, it was the first report globally that attempted to score basis. A lower Index Performance Score is expected to be more conducive to the growth of FinTech. 21 international FinTech Hubs. At the time, and arguably still, there were no comprehensive FinTech measures that could be used to objectively benchmark global Hubs and track progress over time. However, readers should note that Index Performance Scores are not rankings. There are limitations of using Index Scores, and these are set out in the Methodology section. For example, As the industry continues to mature, and national governments, regulatory and FinTech bodies four Hubs (Auckland, Bangalore, Lagos and Nairobi) are not currently included in the Global start to publish more data regarding its impact, our ability to better measure and track progress Financial Centres Index and therefore have an Index Performance Score marked “n/a”. across Hubs has the potential to become more sophisticated and this can then be reflected in our analysis. ii. Hub Indicators: Hub Representatives were asked to provide a self-assessment of their Hub based on six categories Deloitte are excited to support the Global FinTech Hubs Federation in creating a set of qualitative and provide a broad overview of their Hub, including the top innovation areas and challenges, and quantitative measures that will underpin future reports and better capture the intricacies top FinTech companies, investors and others. Readers should note that while not all Hub and complexities of each Hub. We have gathered the lessons learnt from our 2016 report and Representatives in the 2016 report were GFHF participants, all Hub Representatives in the 24 New are already assimilating a list of refinements that we look forward to sharing with you in the next Hubs are GFHF participants and this is reflective of the ambition for future reports. Sibos report. The 2016 Hub profiles have been included at the end of this report. These have been included for reference only as the self-assessment and narrative data may now be out of date. We will conduct a comprehensive refresh of all Hubs as part of the full report being published at Sibos in October 2017. 6

A tale of 44 cities | Methodology Methodology The Connecting Global FinTech: Hub Interim Review 2017 The methodology for the FinTech Hub comparison is comprised of three sections: Hub and Hub is published by Deloitte in collaboration with the Global FinTech Representative Selection Index Performance Score and Hub Indicators. Hubs Federation and builds on the initial analysis and research For the Hubs featured in the original Connecting Global FinTech: Hub Review 2016 report, we undertaken for the Connecting Global FinTech: Hub Review updated the Index Performance Scores with recent data. However, the self-evaluation and narrative data remain largely unchanged, except where Hub Representatives have changed. 2016. The report takes into account both hard and soft data to For the 24 New Hubs, the full research was completed based on the methodology below. compare the status of 44 global hubs (“Hubs”) on the basis of the FinTech sector development in that location. Future reports will include a refresh of the full dataset. Section 1. Hub and Hub Representative Selection 1.1. Hub Selection Hubs (locations) profiled in this report were selected by the GFHF and are based on cities where GFHF participants are located. (Example: Copenhagen FinTech is a Copenhagen-based GFHF participant, and therefore Copenhagen is included as a Hub in this report.) Note that since the research cut-off date for this Interim report, the locations covered by GFHF participants have expanded to include Dubai and Charlotte (North Carolina). These Hubs will be included in the October 2017 edition of the report. 1.2. Representatives Selection Hub Representatives were selected by the GFHF to provide insights and knowledge on local FinTech markets and trends. These parties are all heavily integrated in their local FinTech ecosystems and play an important role in developing FinTech in their Hub. As contributors to the Connecting Global FinTech: Hub Review report, Hub Representatives have a responsibility to provide a balanced and unbiased overview of FinTech developments, strengths and challenges within their Hub. 7

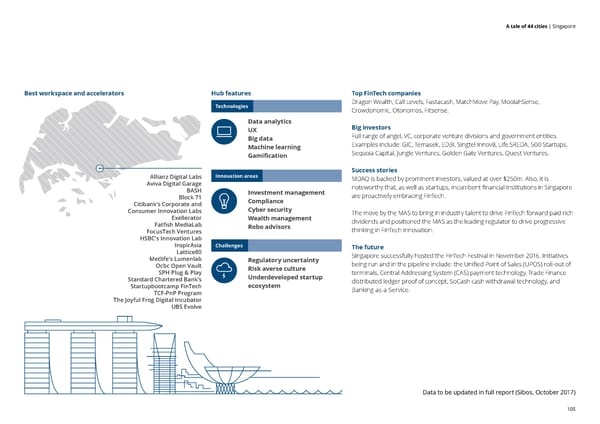

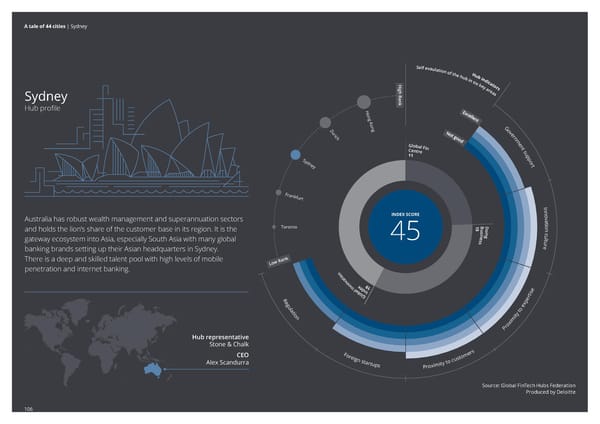

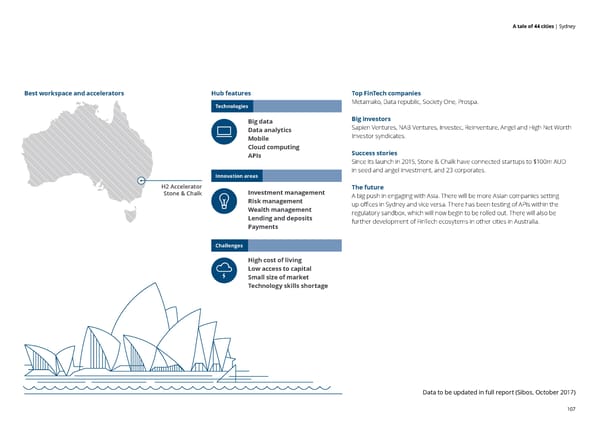

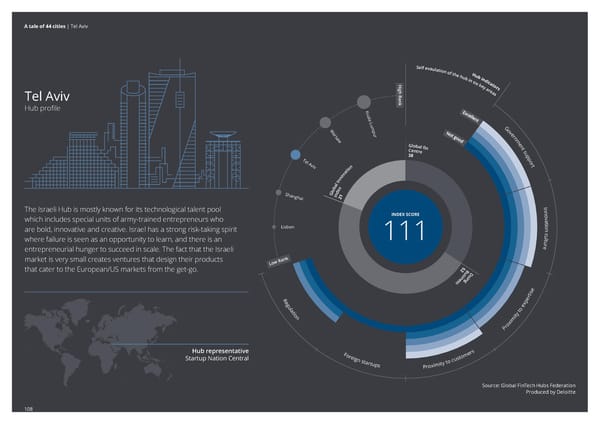

A tale of 44 cities | Methodology As the GFHF was still in its infancy when the inaugural report was launched, a broad spectrum 1.4. List of Selected Hubs and Hub Representatives of ecosystem participants, ranging from industry bodies to regulators and professional services 2016 Hubs (“Existing Hubs”) firms, were invited to contribute to the Connecting Global FinTech: Hub Review 2016 as Hub Hub Hub Representative Representatives. (Example: Deloitte Ireland is not a participant of the GFHF but was asked to contribute Amsterdam Holland FinTech towards the inaugural report as the Hub Representative. In the next full version of the report, a GFHF [NOTE 2] participant will replace Deloitte as the Hub Representative for Ireland.) Bangalore Nathan Associates India Brussels B-Hive (formerly Eggsplore) [NOTE 2] However, as the GFHF develops and its network of participants expands, the intention is to shift Dublin Deloitte Ireland the roles and responsibilities of Hub Representatives to GFHF participants. For example, Hub [NOTE 1] Frankfurt Frankfurt Main Finance Representatives selected for the “New Hubs” in this Interim report are FinTech associations and Hong Kong FinTech HK bodies who are also participants of the GFHF. [NOTE 2] Johannesburg Techstars Deloitte has no influence over the selection of the Hub Representatives. London Innovate Finance Luxembourg City Luxembourg for Finance 1.3. GFHF Participants Mexico City FinTech Mexico Under current guidelines, independent FinTech ecosystem facilitators such as associations, industry Nairobi NEST Nairobi bodies and organisations who play a role in connecting FinTech startups, investors, institutions, New York Partnership Fund for New York City policymakers and regulators are open to join the GFHF and become participants. Paris Paris FinTech Forum [NOTE 3] The current list of participants, and criteria for joining the Federation, can be found on the Seoul Deloitte South Korea [NOTE 1] GFHF’s website at: thegfhf.org Shanghai Association of Shanghai Internet Financial Industry (ASIFI) [NOTE 2] Silicon Valley 500 Startups [NOTE 2] Singapore Monetary Authority of Singapore Sydney Stone & Chalk Tel Aviv Startup Nation Central [NOTE 1] Toronto MaRS Discovery District Zurich Swiss Finance + Technology Association Note 1: Hub Representatives changed since 2016 report Note 2: Proxy representative until a GFHF participant is selected to be the Hub Representative Note 3: Seoul (South Korea) has been excluded from this Interim report as there is currently no GFHF participant in this location. 8

A tale of 44 cities | Methodology Interim 2017 Hubs (“New Hubs”) Section 2. Index Performance Score Hub Hub Representative For each Hub, we calculated an aggregate Index Performance Score which is predicated upon three Abu Dhabi Abu Dhabi Global Market business indices (“Business Indices”). Equal weighting has been given to these indices. Auckland FinTech NZ 1 • Global Financial Centre Index 2016 (GFCI) Bangkok Thai FinTech Association • Doing Business 20172 Budapest CEE FinTech (DB) Chicago FinTEx • Global Innovation Index 20163 (GII) Copenhagen Copenhagen FinTech Edinburgh FinTech Scotland (steering committee) A lower Index Performance Score suggests that the Hub is more conducive to the growth of FinTech. Istanbul FinTech Istanbul Note 1: The Doing Business and Global Innovation Indices score and rank countries as a whole and Jakarta FinTech Association of Indonesia do not provide further breakdowns at the city-level. As a result, the same DB or GII rankings were Kuala Lumpur FinTech Association of Malaysia used for all cities in the same country. (Example: New York, Silicon Valley and Chicago use the same Lagos FinTech Association of Nigeria DB (8) and GII (4) scores.) Lisbon Associação FinTech e InsurTech Portugal Madrid Asociación Española de FinTech e InsurTech Note 2: We are aware that at the point of going to press an updated Global Financial Centre Index Manama Economic Development Board of Bahrain 21 was published. Our research is based on the GFCI 20, published in September 2016. Milan SellaLab Note 3: Four Hubs (Auckland, Bangalore, Lagos and Nairobi) are not currently included in the Global Moscow Skolkovo FinTech Hub Financial Centre Index and therefore have an Index Performance Score marked “n/a”. We seek to Oslo IKT-Norge address this as part of the next full report. Prague Czech FinTech Association Sao Paulo Fintech Committee at ABStartups 1. World Bank. 2017. Doing Business 2017: Equal Opportunity for All. Washington, DC: World Bank. DOI: Shenzhen Silk Ventures 10.1596/978-1-4648-0948-4. License: Creative Commons Attribution CC BY 3.0 IGO. Available here: Stockholm Stockholm FinTech Hub http://www.doingbusiness.org/rankings Taipei FinTechBase 2. Z/Yen. 2016. The Global Financial Centres Index 20, September 2016. Yeandle, Z/Yen London. Available here: Tokyo FinTech Association of Japan http://www.longfinance.net/images/gfci/20/GFCI20_26Sep2016.pdf Warsaw FinTech Poland 3. Cornell University, INSEAD, and WIPO (2016): The Global Innovation Index 2016: Winning with Global Innovation, Ithaca, Fontainebleau, and Geneva. License: Creative Commons Attribution CC BY 3.0 IGO. Available here: https:// www.globalinnovationindex.org 9

A tale of 44 cities | Methodology Global Financial Centre Index (GFCI) As the FinTech sector is characterised by early and growth stage companies, the ease of doing Research indicates that many factors combine to make a financial centre competitive. The Global business is a crucial measure of the viability of a particular Hub. It should be noted that many Financial Centre Index (GFCI) was created in 2005 and was first published by Z/Yen Group in March governments in countries which have poor DB scores can and do get around this by creating 2007. The GFCI provides profiles, ratings and rankings for financial centres, drawing on two separate enterprise- / free- / technology-zones that remove many of the regular business restrictions. sources of data: Therefore a lower DB score does not necessarily equate to a poor FinTech ecosystem. • Instrumental Factors: Business Environment, Financial Sector Development, Infrastructure, Global Innovation Index (GII) Human Capital and Reputational and General Factors First published in 2007, the Global Innovation Index is the result of a collaboration between Cornell University, INSEAD, and the World Intellectual Property Organization (WIPO) and their Knowledge • Financial Centre Assessments: in the form of responses to an online survey Partners. GII aims to capture the multi-dimensional facets of innovation by providing a rich database of detailed metrics for 128 economies that represent 92.8% of the world’s population and The GFCI is important for the comparison of FinTech hubs, as it relates directly to the 97.9% of global GDP. Since FinTech is inherently disruptive, innovation is a key factor in determining competitiveness of that particular location as a financial centre. While the Instrumental Factors set whether a particular Hub can foster a successful FinTech sector. In particular, the wide variety of out above are typically the types of factors that would also go towards determining the strength measures used in the GII would be expected to capture the various innovation components for a of a Hub in supporting a FinTech ecosystem, strong global financial competitiveness does not technology-related sector. It should be noted that innovation is broader than solely technological necessarily equate to a strong environment for FinTech. A measure such as GFCI may also be innovation. For example, mobile payments via SMS have been a staple of the African payments representative of existing entrenched interests backed by an infrastructure and regulatory system system for many years (predating mobile payments in developed markets) – the “innovation” there that tend towards supporting the status quo. A truly disruptive economic micro-climate also needs was not technical, it was deployment of the right technology in the right context. that elusive x-factor that enables innovation to naturally occur. Doing Business (DB) Doing Business 2017 is the 14th in a series of annual reports on the regulations that enhance business activity and those that constrain it. DB presents quantitative indicators on business regulation and the protection of property rights across 190 economies. DB measures the legal and regulatory environment in which companies operate. This is crucial for FinTech companies. Long delays in setting up a company can stifle new ideas. Likewise a non-transparent legal system deters investors and customers from entering into relationships with anyone other than known counterparties, making the development of a knowledge-sharing ecosystem much harder. 10

A tale of 44 cities | Methodology Section 3. Hub Indicators Questionnaire We have created a series of qualitative indicators that enable comparison of the FinTech sector The following is a breakdown and explanation of each question in the Hub Indicator Questionnaire. in each Hub across a set of subjective and objective criteria. These “Hub Indicators” fulfil a number of roles: Self Rated Questions Hub Representatives were asked to provide a self-evaluation of six key areas in their FinTech Hub, 01. T hey help identify current strengths and core competences within each Hub. This is important rating each of these on a scale of 1 (Not Good) to 5 (Excellent). because it provides startups with an indication of which locations their particular niche would thrive in, and global investors with information to identify opportunities that fit their investment Scale: criteria. 01. Not Good: It is an issue that we are aware of 02. Average: We do no better or worse than other Hubs 02. They provide a “state of the nation” overview which covers some of the major players 03. Better than average: We do better than other Hubs (companies, investors or accelerators) in each market. 04. Good: We are happy with the current state 05. Excellent: This is something that defines our Hub 03. They highlight the local strengths and challenges for FinTech through a scoring system. This quantitative measure enables us to compare data across the 44 Hubs and track progress Self-assessment elements: in future GFHF reports. • Regulation: extent to which regulator(s) and the regulatory environment are conducive to FinTech growth. For example, is it challenging to obtain a banking license? Does the regulator support sandbox The Hub Indicators were collated through direct contact with the Hub Representatives. concepts or host surgeries to support startups? Does the regulator engage in the FinTech ecosystem? A questionnaire was sent to each Hub representative with the questions that form the basis of the research. Additional guidelines were provided and an interview took place with each Hub • Foreign startups: extent to which companies from other countries locate to the Hub to launch Representative to allow them to substantiate and clarify their responses. The responses received their FinTech business. For example, are there any initiatives or agreements in place with other Hubs to were then sense-checked by the research team through desktop research of publicly available help FinTechs land and expand? information and with a Deloitte FinTech subject matter expert (“SME”). Where any queries or discrepancies arose, we went back to the Hub Representative for clarification. • Proximity to customers: size of the market and the extent to which consumers and businesses within the Hubs are adopting FinTech solutions. For example, how quickly do customers and The final responses reflect the perspectives of the local Hub Representatives based on their businesses adopt new technologies? How large is the domestic market? knowledge and experience and are not the views of the GFHF or Deloitte. 11

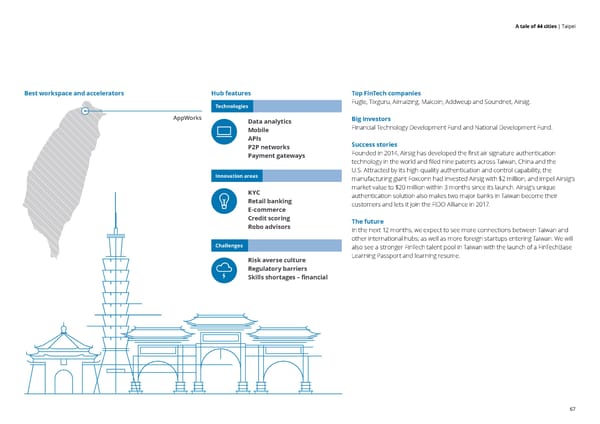

A tale of 44 cities | Methodology • Proximity to expertise: availability and level of talent (financial services, technological and Dropdown Questions entrepreneurial talent) within the Hubs. For example, is there a vibrant financial services or tech sector 01. What are the top five innovation areas in your Hub? in the Hub? Is there a balanced mix of skills? Is there a strong STEM education pipeline? If there isn’t 02. What are the top five underlying technologies to make those innovations happen? strong homegrown talent, are there initiatives to attract talent from other Hubs? 03. What are the top three challenges of doing business there? • Innovation culture: Hubs’ attitudes to innovation. For example, how many entrepreneurs and Narrative Questions startups are in the Hub? What is the attitude towards risks and failure? Is there a history 01. What sets you apart from other regional Hubs? of collaborating to develop new ideas? 02. Who are the big investors? • Government support: extent to which the Hubs’ government (local and state) supports FinTech. 03. What are the top accelerators and work spaces? For example, is FinTech on the government’s agenda? Has the government enacted or supported policies 04. What are the top FinTech companies in your Hub? that promote FinTech growth? Does the government provide funding for FinTech companies, events or 05. What is the biggest success story to come out of your ecosystem? co-working spaces? 06. What does the next 12 months look like? Dropdown and Narrative Questions Deloitte reviews These questions were comparatively subjective. Nevertheless, they constituted an important part To provide an additional layer of depth and challenge to the self-evaluations for the 24 New Hubs, of the development of the Connecting Global FinTech: Hub Review. The narratives enabled the we also reviewed Hub Representatives’ responses with Deloitte’s global network of FinTech SMEs. creation of “Hub Profiles” for the Hubs, which can be expanded upon in future editions in order to Challenges and changes proposed by SMEs were presented back to Hub Representatives further develop Hub comparisons. This could include, for example, developing the criteria (such as for them to accept or reject. market value, or value of investments) for selecting the “Top” companies, investors or accelerators. Hub Representatives were asked to select the most significant technologies, innovation areas Responses for Hubs profiled in the Connecting Global FinTech: Hub Review 2016 were reviewed and challenges in their local FinTech market from a dropdown list provided by the GFHF. Here, with Deloitte SMEs at the time of research and have not been reviewed again in the current innovation areas refer to the financial services sectors being disrupted by FinTech. Interim report. Individual Hubs have been the subject of extensive research and data collection, and the relevant The final opinions published are that of the Hub Representatives’ and not the opinions of the Hub Representatives have reported both subjectively and objectively derived responses. The future GFHF or Deloitte. objective will be to increase the standardisation of reporting across global Hubs. 12

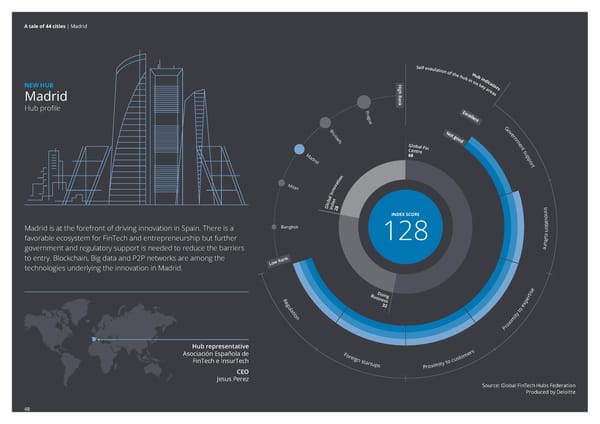

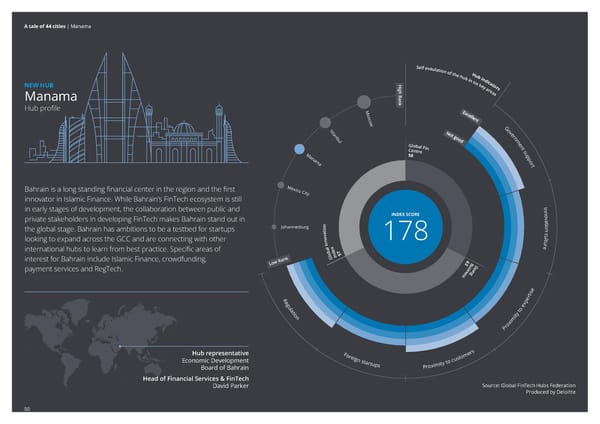

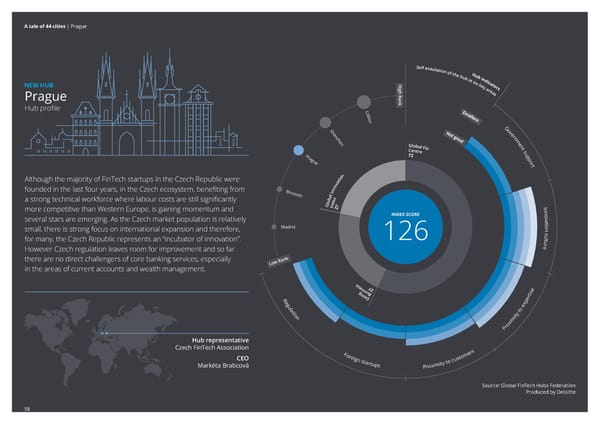

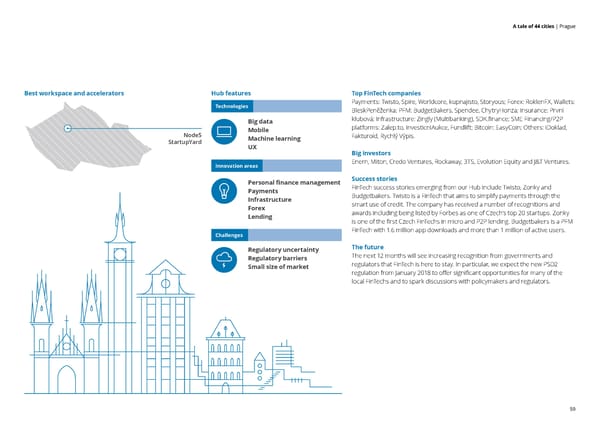

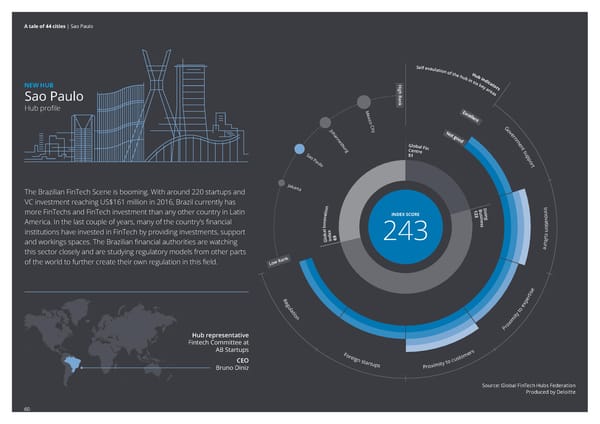

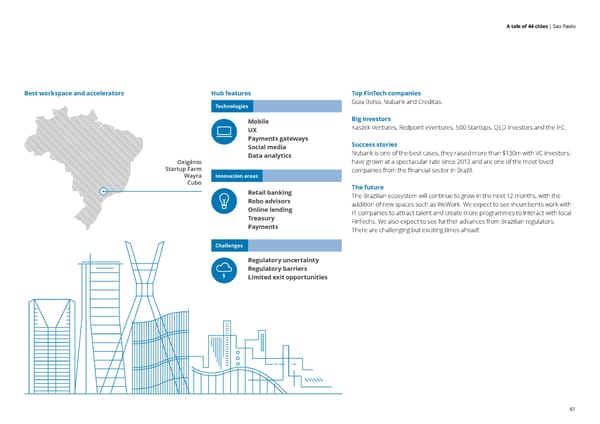

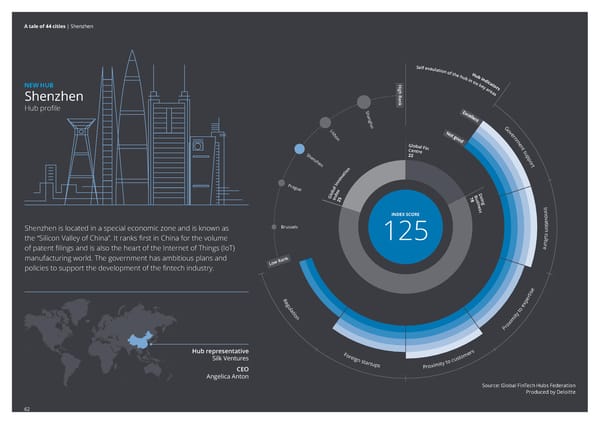

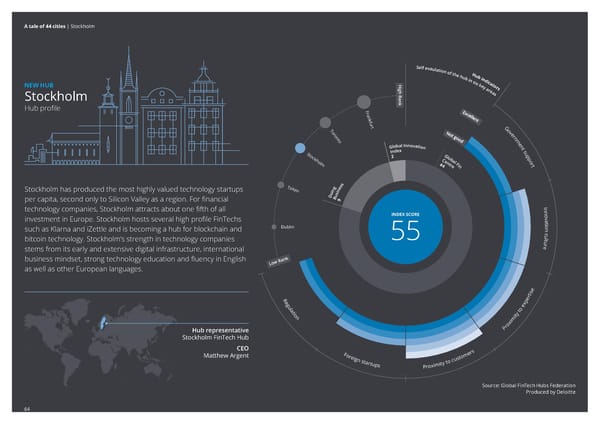

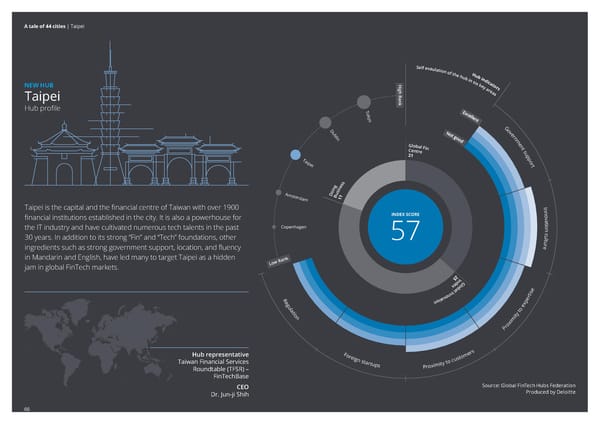

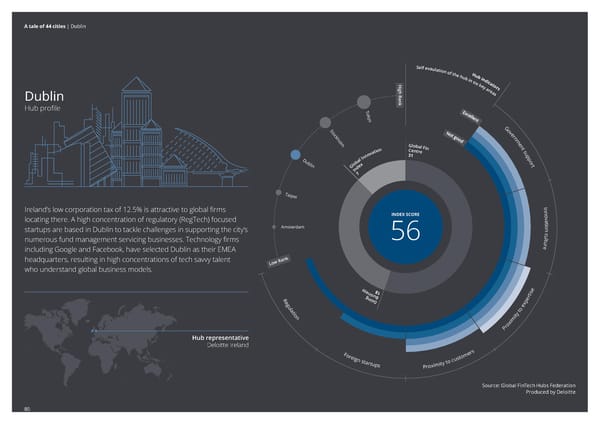

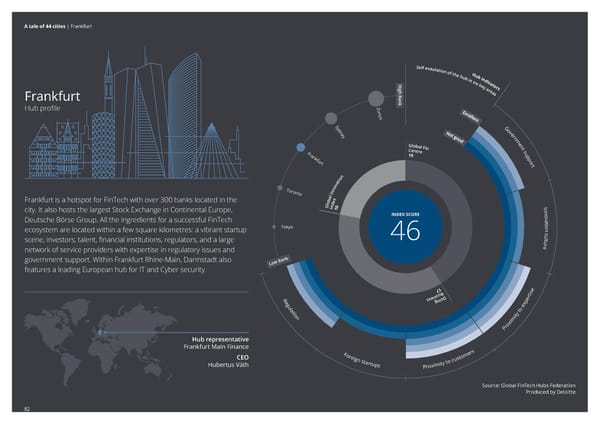

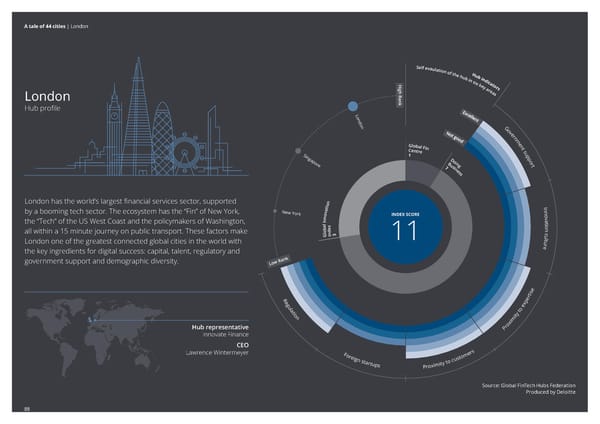

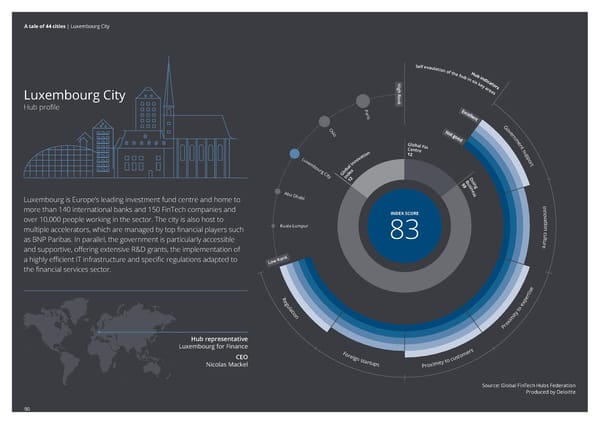

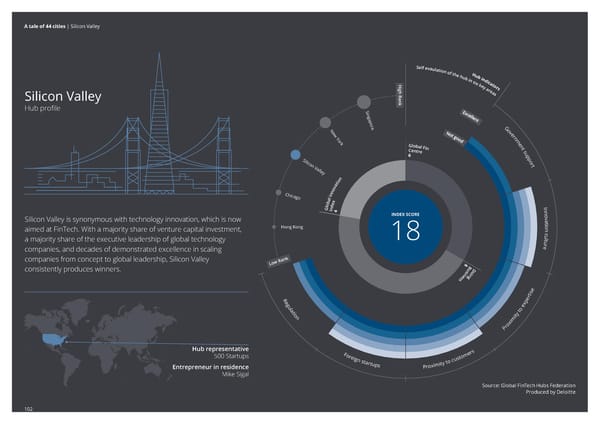

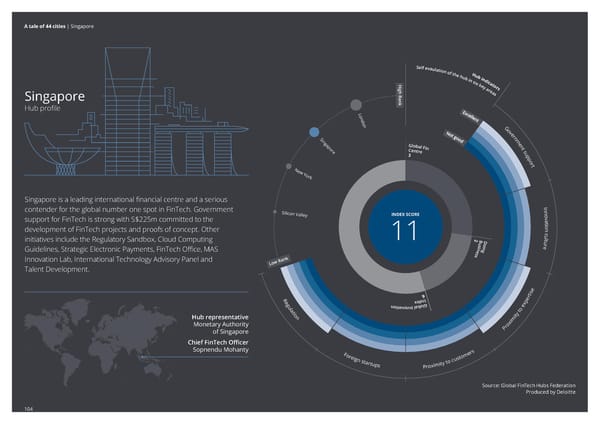

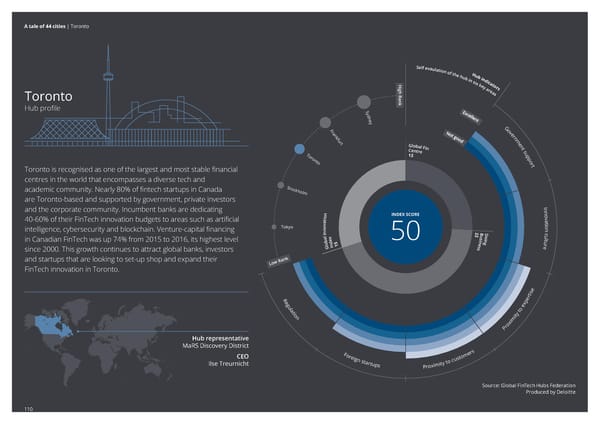

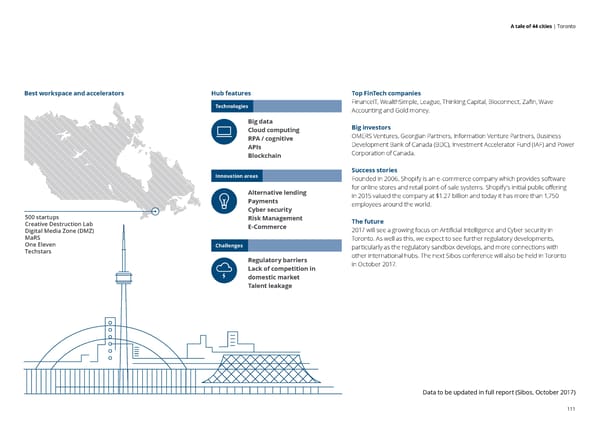

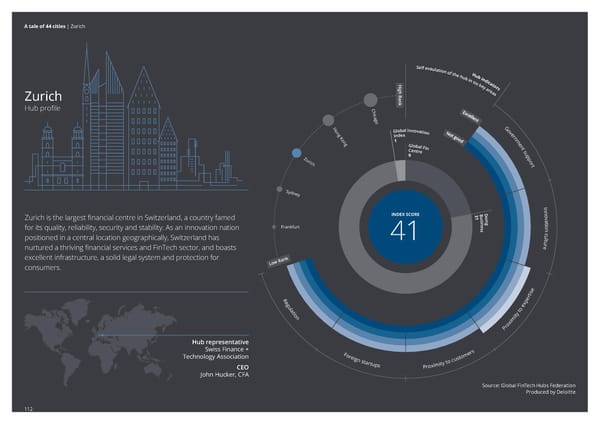

Reading guide S e l f e va u l a t i o n o f t H h e u h b u b i i n n d i s c i High Rank x a k t e o y r s a r e a Index Performance Scores s Hub Indicators The Index Score is the aggregated total of the S These Hub indicators are based on self- ili c three indices on the outer circle: on assessments from Hub Representatives and V a G H ll o indicate the strength of each component part o ey v n e g r • Global Fin Centre K n of their FinTech ecosystem on a scale of Not on m G e l g o b n a l F i n t C Good to Excellent. e n t s r e u p • Doing Business S p e o ou r l t • Global Innovation Index Z u ri ch INDEX SCORE In n o v a t Frankfurt i o c n n utlu oitav XX er onnI Low Rank labxed The High Rank and Low Rank scale shows the two olGnI Hubs with higher and lower Index Scores compared e with the current Hub. rtis Regu ssenisuB xpe lat gnioD to e ion ity xim Pro For mers eign st o custo artups Proximity t 13

A tale of 44 cities | Research findings Research findings 14

A tale of 44 cities | Research findings Research Findings Where is all the activity? interesting developments from emergent Hubs across Eastern Europe, South America and Africa FinTech is a truly global phenomenon. This that have not yet been represented in our report. As the network of GFHF participants expands, the interim report is driven by the exciting growth scope of our report will become increasingly comprehensive. of FinTech hubs globally who have become members of the Federation and sets the stage Emergent themes from the regions for our full GFHF Report being launched at When we analysed the data from the 24 New Hubs we profiled and coupled it with additional desk Sibos later this year. research, a number of interesting regional themes emerged across the globe: Although level of investment is by no means • On the whole, our research found that new European Hubs (particularly those within the the only factor contributing to the strength of European Union) tended to agree that there is good access to talent in their Hubs. On the Louise Brett FinTech Hubs, it is a good indicator of activity. other hand, most of these 12 European New Hubs rated regulation in their Hub negatively and UK FinTech Lead Partner, Deloitte Therefore, a look at the investment landscape regulatory barriers were cited as a common challenge. on page 19 gives us an idea of where FinTech activity is at its hottest across the globe. Consistent with this, our research on regulatory sandboxes and regulator collaboration showed that in Europe, only the UK, Netherlands, Russia, Switzerland and Norway (5 of the total 20 GFHF Our report now covers 20 Hubs in Europe, 12 in Asia Pacific and 12 from other regions around European Fintech hubs) have committed to a regulatory sandbox and only the UK, French and Swiss the world and offers a broadly representative overview of the global FinTech landscape. With that regulators have signed FinTech co-operation agreements with other regulators across the globe. said, there are still a few notable Hubs that have not yet joined the GFHF and therefore have not been featured in the current report. (For example, Beijing). In addition, we are aware that there are • In Asia Pacific, Hub Representatives were more positive about regulation in their Hubs compared to their European counterparts and with good reason too. Over the last year, we have seen very GFHF Hubs New Hubs Old Hubs Total positive developments from regulators across Asia and the pace of change has been extremely Africa 1 2 3 encouraging. For example, of the 16 regulators who have either set up or have committed to Asia Pacific 7 5 12 setting up regulatory sandboxes, seven are in Asia. Moreover, Asian regulators have also Central and South America 1 1 2 been proactive in cooperating with other regulatory bodies outside of their region. For example, as shown on the regulatory collaboration map on page 21, China, South Korea, Hong Kong, Japan, Europe 12 8 20 Singapore, Australia and India have all signed international cooperation agreements with other Middle East 2 1 3 regulators; and Singapore’s MAS has signed more FinTech cooperation agreements than other North America 1 3 4 regulatory bodies in the world. Although the tangible outcomes of these agreements largely Grand Total 24 20 44 remain to be seen, cooperation between regulators globally has undeniably become a trend. 15

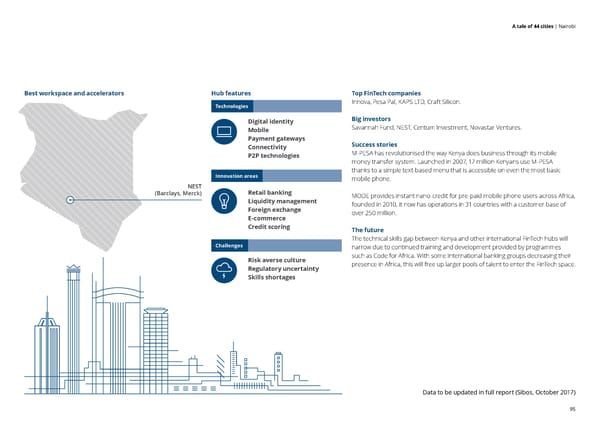

A tale of 44 cities | Research findings • Although our research only included two Hubs from the Gulf region, both Hub Representatives Closing remarks presented very similar self-assessments. For one, both Hubs claimed excellent government As we have seen, FinTech ecosystems continue to evolve at pace across the globe. and regulator support for FinTech and these are evidenced by the range of initiatives that the government and regulatory bodies are driving together. For example, the RegLab in Abu Dhabi, As these ecosystems evolve, so too will the report and its methodology for assessing and the FinTech Hive and 2020 blockchain ambition in Dubai and the FinTech work driven by the EDB presenting the FinTech developments in these Hubs. in Bahrain. As identified within the Readers’ Note section, we are pleased to be working with the Global • In Africa, FinTech developments continue to be concentrated around mobile and social payments. FinTech Hubs Federation to review and refine the methodology and improve the robustness of the Highly successful FinTechs are rare as low levels of government and regulatory support and lack assessments currently being completed by each Hub. of quality infrastructure continue to be barriers to scaling. Without giving away too much, we are very excited about the new Full Report that we will be • In the Central and South America region, Brazil leads the pack by way of investment and number releasing at Sibos in October and look forward to working closely with ecosystem participants of FinTechs and much of the activity is concentrated in Sao Paulo. Broadly, across the region, across all the GFHF Hubs over the coming months. corporates and investors are the ones proactively developing the local FinTech ecosystems. However, there are positive signals that government and regulator support for FinTech is increasing. For example, Mexico’s new financial inclusion strategy is expected to promote FinTech growth. • Finally, we complete the map with North America. While Silicon Valley and New York continue to be the indisputable top FinTech Hubs in the USA, and Toronto in Canada with 80% of the Canadian FinTech activity in this Hub, over the last year we have seen a number of other emerging Hubs: Chicago, which has been included in this Interim report; and Charlotte, North Carolina, which will feature in the next GFHF report. Another interesting development in the USA in recent months has been regulation, particularly in regards to the OCC’s FinTech charter. As the USA’s complex and fragmented regulatory environment has been cited as a challenge by US FinTech Hubs in our research, it will be interesting to review these developments again in our full Sibos report which will be launched in October. 16

A tale of 44 cities | Overview – Index Performance Scores Overview – Index Performance Scores 46 Frankfurt New York 14 Oslo 77 55 Stockholm Copenhagen 71 108 Warsaw Toronto 50 Amsterdam 70 Edinburgh 76 London 11 Dublin 56 126 Prague 167 Moscow Brussels 127 151 Budapest Luxembourg City 83 168 Istanbul Paris 76 Chicago 20 111 Tel Aviv Zurich 41 55 Tokyo Silicon Valley 18 99 Abu Dhabi Madrid 132 119 Shanghai Mexico City 181 57 Taipei Lisbon 124 125 Shenzhen Manama 178 Milan 128 22 Hong Kong Index Performance Score Bangalore n/a New Hubs Old Hubs Lagos n/a 1–25 1–25 Bangkok 137 45 Sydney 26–150 26–150 Nairobi n/a Kuala Lumpur 101 n/a Auckland 150+ 150+ Johannesburg 187 Singapore 11 Jakarta 255 178 Manama A lower Index Performance Scores indicates that the 243 Sao Paulo Hub is more conducive to FinTech growth based on the amalgamation of three global indices. 17

A tale of 44 cities | Overview - Hub Indicators B en B ud hC g B r a i a u p c h B a s e a n a n s s g e n h n g e t o p li g k l r g o s o b u Au alo k C Du b t A ck re din m la E ng Overview – Hub Indicators s n t d o e Frankfur K r d g A am n bu o l D H bu ha n bi a st I rta a g k r Ja t nesbu r an o oh p J r p e u u r p s u um t L t l la n u e a e c s i Ku n t m r n o e s i p r r t x e e a e v v m s os o o o o g n t t p La G n s u I y u t t r i c a n t o m o s i i t t x a o y n l bon t g u s r i i i P e g L m r e i o R x F o r n P do n Lo y t Ci g r u bo m xe u L adrid M M an am a M exi co C i ty M il an New Hubs Old Hubs M osc ow Excellent Excellent N ai r ob Good Good i Better than average Better than average New Y or Average Average O k s Not good Not good lo Pa ris h Pr This diagram lists the Hubs from ric ag u u Z w Sa e left to right in alphabetical order. a o S Pa The colours of the Hub Indicators o h ul Wars nt a o reflect the response given by the o Sh ng y S e ha Toro k v i n i o i S l z Hub Representative in relation T v ei S in ic h A t o l ip o g n Vall e to this category. e a ck ap n T T h o Sydney ol r e m e y 18

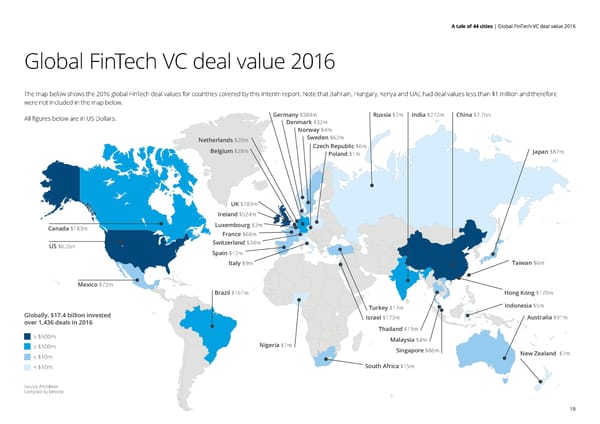

A tale of 44 cities | Global FinTech VC deal value 2016 Global FinTech VC deal value 2016 The map below shows the 2016 global FinTech deal values for countries covered by this Interim report. Note that Bahrain, Hungary, Kenya and UAE had deal values less than $1 million and therefore were not included in the map below. All figures below are in US Dollars. Germany $384m Russia $7m India $272m China $7.7bn Denmark $32m Norway $4m Netherlands $20m Sweden $62m Belgium $28m Czech Republic $6m Japan $87m Poland $1m UK $783m Ireland $524m Canada $183m Luxembourg $2m France $68m US $6.2bn Switzerland $34m Spain $12m Italy $9m Taiwan $6m Mexico $72m Brazil $161m Hong Kong $170m Turkey $17m Indonesia $5m Globally, $17.4 billion invested Israel $173m Australia $91m over 1,436 deals in 2016 Thailand $19m ≥ $500m Malaysia $4m ≥ $100m Nigeria $1m Singapore $86m ≥ $10m New Zealand $7m < $10m South Africa $15m Source: PitchBook Compiled by Deloitte 19

A tale of 44 cities | Map of regulatory sandboxes Map of regulatory sandboxes A regulatory sandbox is a regulator-driven initiative which allows businesses to test innovative products, services, business models and delivery mechanisms in a live environment. Typically, some regulatory requirements are amended to create a bespoke framework for the duration of an on-market trial. The map below shows all live and proposed regulatory sandboxes (and similar regulatory initiatives). Proposed sandboxes are ones on which a formal statement has been made by a regulatory or government body. Live sandboxes are ones which have already began accepting applications or conducting trials. As this is a dynamic space, the map is accurate as at time Norway Proposed of publication. Netherlands Live Financial Supervisory Authority (FSA) Dutch financial supervisors of Norway, ICT Norway the Authority for the Financial Market (AFM) and De Thailand Proposed Nederlandsche Bank (DNB) Bank of Thailand Russia Proposed Central Bank of Russia Canada Live Hong Kong Live Ontario Securities Hong Kong Monetary Authority Commission (OSC) / Applied Science and Technology Research Institute UK Live Taiwan Proposed USA Proposed Financial Conduct Financial Supervisory Federal Reserve Board / Treasury Authority (FCA) Commission (FSC) Department / Securities and Exchange Commission Singapore Live Monetary Authority of Singapore (MAS) Key Australia Live Australian Securities & Investments Commission (ASIC) Proposed Formal statement made by a regulatory or government body Malaysia Live Live Switzerland Proposed Bank Negara Malaysia Accepting applications or Financial Market Supervisory (Central Bank) Authority (FINMA) conducting trials Dubai Proposed Dubai Financial Services Authority Abu Dhabi Live Indonesia Proposed (DFSA) Dubai International Financial Abu Dhabi Global Market Bank Indonesia (Central Bank) Source: Innovate Finance Centre Authority (DIFCA) (ADGM) Compiled by Deloitte 20

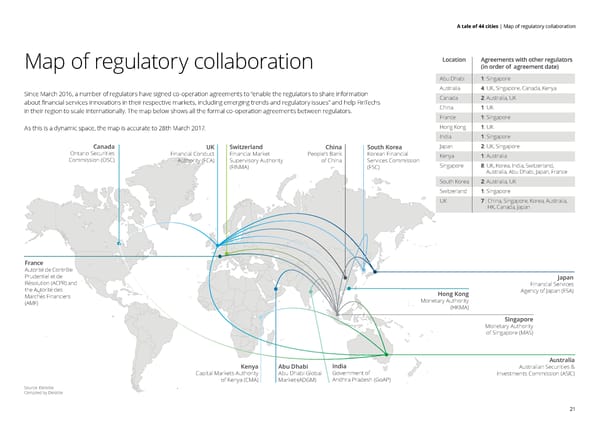

A tale of 44 cities | Map of regulatory collaboration Location Agreements with other regulators Map of regulatory collaboration (in order of agreement date) Abu Dhabi 1: Singapore Since March 2016, a number of regulators have signed co-operation agreements to “enable the regulators to share information Australia 4: UK, Singapore, Canada, Kenya about financial services innovations in their respective markets, including emerging trends and regulatory issues” and help FinTechs Canada 2: Australia, UK in their region to scale internationally. The map below shows all the formal co-operation agreements between regulators. China 1: UK France 1: Singapore As this is a dynamic space, the map is accurate to 28th March 2017. Hong Kong 1: UK India 1: Singapore Canada UK Switzerland China South Korea Japan 2: UK, Singapore Ontario Securities Financial Conduct Financial Market People’s Bank Korean Financial Kenya 1: Australia Commission (OSC) Authority (FCA) Supervisory Authority of China Services Commission Singapore 8: UK, Korea, India, Switzerland, (FINMA) (FSC) Australia, Abu Dhabi, Japan, France South Korea 2: Australia, UK Switzerland 1: Singapore UK 7 : China, Singapore, Korea, Australia, HK, Canada, Japan France Autorité de Contrôle Prudentiel et de Japan Résolution (ACPR) and Financial Services the Autorité des Hong Kong Agency of Japan (FSA) Marchés Financiers Monetary Authority (AMF) (HKMA) Singapore Monetary Authority of Singapore (MAS) Australia Kenya Abu Dhabi India Australian Securities & Capital Markets Authority Abu Dhabi Global Government of Investments Commission (ASIC) of Kenya (CMA) Market (ADGM) Andhra Pradesh (GoAP) Source: Deloitte Compiled by Deloitte 21

A tale of 44 cities | New Hubs Abu Dhabi Auckland Bangkok Budapest Chicago Copenhagen Edinburgh Istanbul Jakarta Kuala Lumpur Lagos Lisbon New Hubs... Madrid Manama Milan Moscow Oslo Prague Sao Paulo Shenzhen Stockholm Taipei Tokyo Warsaw 22

A tale of 44 cities |New Hubs New Hubs The following section contains an analysis of the 24 FinTech Hubs that are new additions to the Index Performance Scores Hub Indicators Connecting Global FinTech : Hub Review report. The analysis captures the following insights: The Index Score is the aggregated total of the These Hub indicators are based on three indices on the outer circle: self-assessments from Hub 1. An Index Performance Score that combines these key indices: • Global Fin Centre Representatives and indicate the • Global Innovation Index (released 15 August 2016) strength of each component part of • Doing Business their FinTech ecosystem on a scale S of Not Good to Excellent. e lf e va u l a t i o n • Global Financial Centre Index (released September 2016) o f t H h e u h b u b i i n n d i s c • Global Innovation Index i High Rank x a k t e o y r s a r e a • Doing Business Index (released October 2016) s S il i c on V The Index Performance Score can be found in the centre of each Hub’s dedicated diagram. H all G e o o y v n e g r K n The topleft quadrant shows how the Index Performance Score compares to other Hubs. on m G e l g o b n a l F i n t C e n t s r e u p S p e o ou r If a Hub receives a lower Index Performance Score, it can be said that the Hub is more conducive l t to FinTech growth. However, the analysis is not designed to rank each of these Hubs, as a more Z uri rigorous examination across multiple categories is required for in-depth benchmarking. Future ch In n iterations of this analysis will aim to incorporate more holistic factors outside the global indices o va t Frankfurt i o included in the Index Performance Score. c n n utlu oitav er 2. A qualitative analysis of the Hub Indicators and further details on key Hub features, onnI Low Rank labxed based on interviews conducted with local Hub Representatives. The High Rank olGnI The remaining circumference of the diagram captures the qualitative analysis on Hub Indicators. and Low Rank tise Re er gu ssenisuB exp scale shows the latio gnioD to Further details on key Hub features, such as workspaces and accelerators, top FinTech investors n ity xim and the future of the FinTech Hub, are presented thereafter. The insights provided by the Hub two Hubs with Pro Representatives are subjective and based on their experiences within the local Hub. These opinions higher and lower Index Scores For mers eign st o custo are designed to add to the understanding of local FinTech activity and are not opinions of the GFHF compared with artups Proximity t or Deloitte. the current Hub. 23

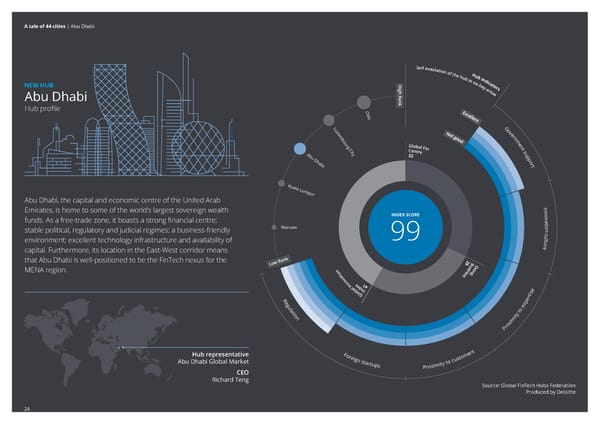

A tale of 44 cities | Abu Dhabi S e l f e v a u l a t i o n o f t H h e u h b u b i i n n d i s c i High Rank x a t NEW HUB k o e y r s a r e a Abu Dhabi s Hub profile O sl o Flat6Labs Lu G x o GlassQube Co-working e v m e r b n ou m r e g G n l o b a l F i t C C n i e s n t t r A y e u b 3 p u 2 p D o hab r i t K uala L umpu Abu Dhabi, the capital and economic centre of the United Arab r In Emirates, is home to some of the world’s largest sovereign wealth n INDEX SCORE o v funds. As a free-trade zone, it boasts a strong financial centre; a t Warsaw i o stable political, regulatory and judicial regimes; a business-friendly c n environment; excellent technology infrastructure and availability of 99 utlu capital. Furthermore, its location in the East-West corridor means er that Abu Dhabi is well-positioned to be the FinTech nexus for the Low Rank 62uBD MENA region. n enisnio oita ssg vonnIx1 laboeldnI4 se R G erti egula exp tio y to n mit oxi Pr Hub representative For mers Abu Dhabi Global Market eign st o custo artups Proximity t CEO Richard Teng Source: Global FinTech Hubs Federation Produced by Deloitte 24

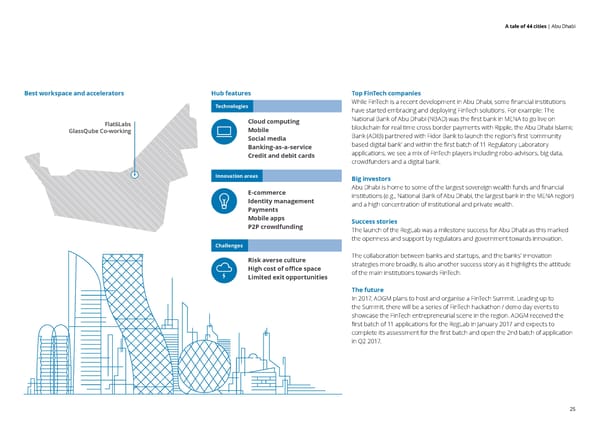

A tale of 44 cities | Abu Dhabi S e l f e v a u l a t i o n o f tH h eu hb u bi in nd i sc i High Rankxa t ko e yr s a r e a Abu Dhabis Best workspace and accelerators Hub features Top FinTech companies Hub profile Technologies While FinTech is a recent development in Abu Dhabi, some financial institutions Os have started embracing and deploying FinTech solutions. For example: The l o Flat6Labs Cloud computing National Bank of Abu Dhabi (NBAD) was the first bank in MENA to go live on LuG blockchain for real time cross border payments with Ripple, the Abu Dhabi Islamic xo GlassQube Co-working Mobile ev me r Bank (ADIB) partnered with Fidor Bank to launch the region’s first ‘community bn Social media oum re based digital bank’ and within the first batch of 11 Regulatory Laboratory gGn l o b a l F Banking-as-a-service it CCn ies n t tr Ayeu applications, we see a mix of FinTech players including robo-advisors, big data, b3p u2p Credit and debit cards Do habr crowdfunders and a digital bank. it Innovation areas Big investors K uala L Abu Dhabi is home to some of the largest sovereign wealth funds and financial umpu E-commerce Abu Dhabi, the capital and economic centre of the United Arab r institutions (e.g., National Bank of Abu Dhabi, the largest bank in the MENA region) Identity management and a high concentration of institutional and private wealth. In Payments Emirates, is home to some of the world’s largest sovereign wealth n INDEX SCOREo funds. As a free-trade zone, it boasts a strong financial centre;va Mobile apps t Success stories Warsawi o P2P crowdfunding stable political, regulatory and judicial regimes; a business-friendly c n The launch of the RegLab was a milestone success for Abu Dhabi as this marked environment; excellent technology infrastructure and availability of 99utlu the openness and support by regulators and government towards innovation. capital. Furthermore, its location in the East-West corridor meanser Challenges The collaboration between banks and startups, and the banks’ innovation that Abu Dhabi is well-positioned to be the FinTech nexus for theLow Rank62uBD Risk averse culture strategies more broadly, is also another success story as it highlights the attitude MENA region. nenisnio High cost of office space oitassg Limited exit opportunities of the main institutions towards FinTech. vonnIx1 laboeldnI4se The future RGerti In 2017, ADGM plans to host and organise a FinTech Summit. Leading up to egula exp the Summit, there will be a series of FinTech hackathon / demo day events to tioy to nmit showcase the FinTech entrepreneurial scene in the region. ADGM received the oxi first batch of 11 applications for the RegLab in January 2017 and expects to Pr complete its assessment for the first batch and open the 2nd batch of application in Q2 2017. Hub representativeFormers Abu Dhabi Global Marketeign sto custo artupsProximity t CEO Richard Teng 25

A tale of 44 cities | Auckland S e l f e v a u l a t i o n o f t H h e u h b u b i i n n d i s c High Rank ix a t k o NEW HUB e y r s a r e a Auckland s Hub profile G Astrolab o Creative HQ v e r n Kiwibank Lightning Lab FinTech Accelerator m e The Icehouse GG n ll oo A bb aa ll g II u n nn i nn t o oo c D I vv n aa s s d k s e e x tt n ii l i oo u a s u nn n B 1 p d 1 7 G p l o N o r b / a t A l F i n C e n t r e In Auckland is New Zealand’s largest and most internationally connected n INDEX SCORE o v hub, with a third of the country's population and the largest number a t i o of businesses. The city hosts the entire diverse spectrum of financial c n services, as well as the largest concentration of the country’s vibrant n/a* utlu tech sector. Combine this with strong central and local government er support and direct links to the country’s other hubs, Auckland is an ideal environment for innovating FinTech. Low Rank tise Re per gula o ex tion ty t imi Hub representative rox New Zealand Financial P Innovation and Technology Association (FinTechNZ) rs Foreig stome * The data for Auckland is not available CEO n startup ity to cu on the Global Financial Centre Index. Mitchell Pham s Proxim As such, Auckland has not been given an Index Performance Score. SSoouurrccee:: G Globlobaall F FiinnTTeecchh Hu Hubbss F Feeddereraattiionon PPrroodduucceed bd by Dy Deellooiittttee 26

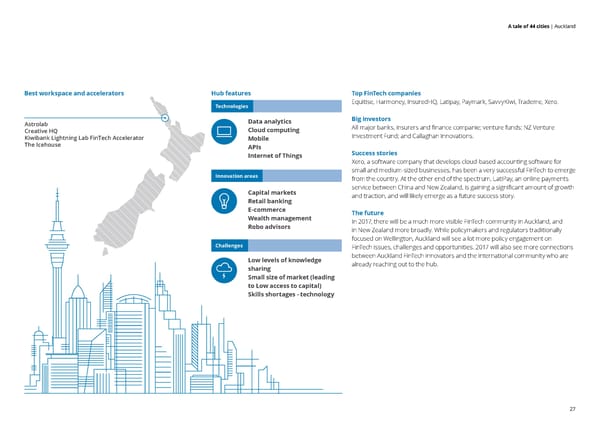

A tale of 44 cities | Auckland S e l f e v a u l a t i o n o f tH h eu hb u bi in nd i sc High Rankixa t ko e yr s a r e a AucklandsBest workspace and accelerators Hub features Top FinTech companies Hub profile Technologies Equitise, Harmoney, InsuredHQ, Latipay, Paymark, SavvyKiwi, Trademe, Xero. Astrolab Data analytics Big investors G All major banks, insurers and finance companie; venture funds; NZ Venture o Creative HQ Cloud computing v e r Investment Fund; and Callaghan Innovations. n Kiwibank Lightning Lab FinTech Accelerator Mobile m e The Icehouse GGn ll oo Abb aa ll g II unnn APIs innt ooo cDIvv naas sd kse extt nii lioou as unn Success stories nB1p d17Gp Internet of Things lo N or Xero, a software company that develops cloud-based accounting software for b /at Al F i n small and medium-sized businesses, has been a very successful FinTech to emerge C e Innovation areas n t from the country. At the other end of the spectrum, LatiPay, an online payments r e service between China and New Zealand, is gaining a significant amount of growth Capital markets and traction, and will likely emerge as a future success story. Retail banking In E-commerce Auckland is New Zealand’s largest and most internationally connected n INDEX SCOREo The future hub, with a third of the country's population and the largest number va Wealth management t In 2017, there will be a much more visible FinTech community in Auckland, and i o Robo advisors of businesses. The city hosts the entire diverse spectrum of financial c n in New Zealand more broadly. While policymakers and regulators traditionally services, as well as the largest concentration of the country’s vibrant n/a*utlu focused on Wellington, Auckland will see a lot more policy engagement on tech sector. Combine this with strong central and local government erChallenges FinTech issues, challenges and opportunities. 2017 will also see more connections support and direct links to the country’s other hubs, Auckland is an Low levels of knowledge between Auckland FinTech innovators and the international community who are ideal environment for innovating FinTech.Low Rank sharing already reaching out to the hub. Small size of market (leading e to Low access to capital) rtis Skills shortages - technology Reguxpe latto e ionity xim Hub representativePro New Zealand Financial Innovation and Technology Association (FinTechNZ) rs Foreigstome* The data for Auckland is not available CEOn startupity to cuon the Global Financial Centre Index. Mitchell PhamsProximAs such, Auckland has not been given an Index Performance Score. 27

A tale of 44 cities | Bangkok S e l f e v a u l a t i o n o f t H h e u h b u b i i n n d i s c i High Ran x a t k o NEW HUB e y r s a r e a Bangkok s Hub profile k M a dr i M d G il o a v n e r n m e G n l o b a l F i t C n e s Digital Ventures n t r B e u a 3 p n 9 gkok p Dream Office (C-Asean) o r Dtac Accelerate t Krungsri Rise The Thai FinTech ecosystem is growing rapidly. In 2016, the number of B FinTech startups doubled from around 40 to almost 90. Bangkok, which udapest is at the centre of Thailand’s economy and financial industry, is driving In FinTech development in Thailand. Most major banks have launched n INDEX SCORE o v their own corporate VCs, innovation labs and accelerator programs for a t Moscow i o FinTech startups. In Thailand, regulators (the Securities and Exchange c n Commission and the Bank of Thailand in particular) play an active role 137 utlu 64uBoD er in growing the FinTech ecosystem. For example, the SEC launched n enisgni a FinTech competition to promote and support new ideas of k oitav ss financial innovation. Low Ran onnI laboxednI25 lG tise Re per gula o ex tion ty t imi rox P For mers Hub representative eign st o custo Thai Fintech Association artups Proximity t Acting President Jessada Sookdhis Source: Global FinTech Hubs Federation Produced by Deloitte 28

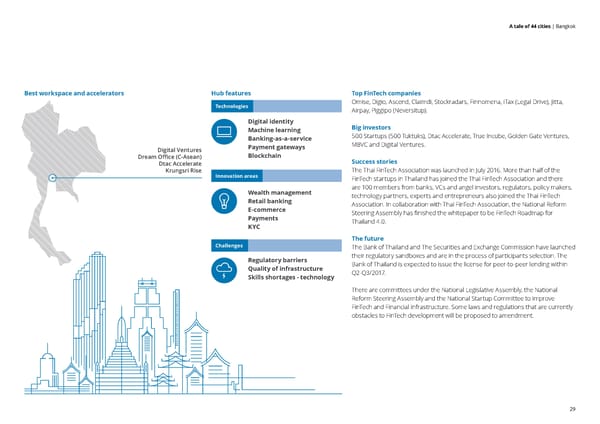

A tale of 44 cities | Bangkok S e l f e v a u l a t i o n o f tH h eu hb u bi in nd i sc i High Ranxa t ko e yr s a r e a BangkoksBest workspace and accelerators Hub features Top FinTech companies Hub profilek Technologies Omise, Digio, Ascend, Claimdi, Stockradars, Finnomena, iTax (Legal Drive), Jitta, M Airpay, Piggipo (Neversitup). a dr i Md G Digital identity Big investors ilo Machine learning av ne r 500 Startups (500 Tuktuks), Dtac Accelerate, True Incube, Golden Gate Ventures, n Banking-as-a-service m e M8VC and Digital Ventures. Gn l o b a l F Payment gateways it Cn es Digital Ventures n t r Beu a3p n9 Blockchain gkokp Dream Office (C-Asean) o Success stories r Dtac Accelerate t Krungsri Rise The Thai FinTech Association was launched in July 2016. More than half of the The Thai FinTech ecosystem is growing rapidly. In 2016, the number of Innovation areas FinTech startups in Thailand has joined the Thai FinTech Association and there B FinTech startups doubled from around 40 to almost 90. Bangkok, which udapest Wealth management are 100 members from banks, VCs and angel investors, regulators, policy makers, is at the centre of Thailand’s economy and financial industry, is driving Retail banking technology partners, experts and entrepreneurs also joined the Thai FinTech In E-commerce Association. In collaboration with Thai FinTech Association, the National Reform FinTech development in Thailand. Most major banks have launched n INDEX SCOREo Steering Assembly has finished the whitepaper to be FinTech Roadmap for their own corporate VCs, innovation labs and accelerator programs for va Payments t Thailand 4.0. Moscowi o KYC FinTech startups. In Thailand, regulators (the Securities and Exchange c n Commission and the Bank of Thailand in particular) play an active role 137utlu The future 64uBoDer Challenges The Bank of Thailand and The Securities and Exchange Commission have launched in growing the FinTech ecosystem. For example, the SEC launchednenisgni a FinTech competition to promote and support new ideas ofkoitavss Regulatory barriers their regulatory sandboxes and are in the process of participants selection. The financial innovation.Low RanonnI Quality of infrastructure Bank of Thailand is expected to issue the license for peer-to-peer lending within laboxednI25 Skills shortages - technology Q2-Q3/2017. lG tise There are committees under the National Legislative Assembly, the National Reper Reform Steering Assembly and the National Startup Committee to improve gulao ex FinTech and Financial infrastructure. Some laws and regulations that are currently tionty t obstacles to FinTech development will be proposed to amendment. imi rox P Formers Hub representativeeign sto custo Thai Fintech Association artupsProximity t Acting President Jessada Sookdhis 29

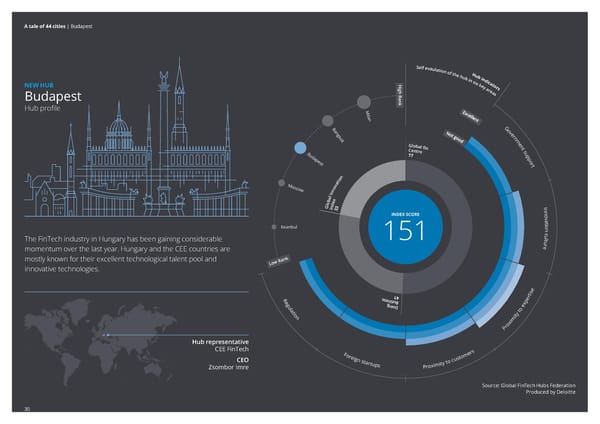

A tale of 44 cities | Budapest S e l f e v a u l a t i o n o f t H h e u h b u b i i n n d i s c High Rank ix a t k o NEW HUB e y r s a r e a Budapest s Hub profile M i l an B G a o n v g e k r o n k m e G n l o b a l fi n t C e s n t r B e u u 7 p da 7 p pes o t r t n o i t M a o v sc o ow n n I l a x b e o l d I G n 3 n I 3 n INDEX SCORE o v MKB Fintech Accelerator a t Istanbul i o Mosaik c n SparkLab by NN The FinTech industry in Hungary has been gaining considerable 151 utlu momentum over the last year. Hungary and the CEE countries are er mostly known for their excellent technological talent pool and innovative technologies. Low Rank tise R s s e ni s u1 4 er egu g ni o DB exp latio y to n mit oxi Pr Hub representative CEE FinTech rs Foreig stome CEO n startup ity to cu Zsombor Imre s Proxim Source: Global FinTech Hubs Federation Produced by Deloitte 30

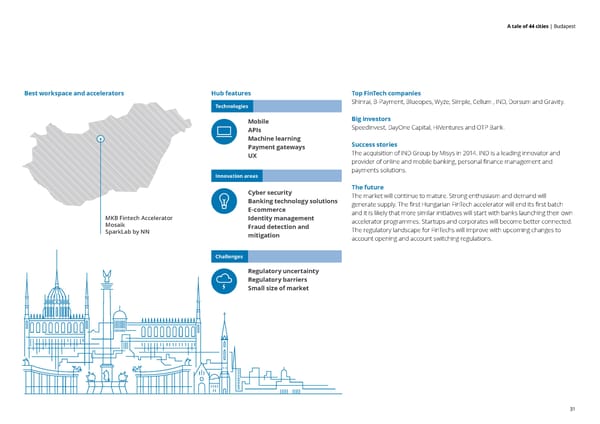

A tale of 44 cities | Budapest S e l f e v a u l a t i o n o f tH h eu hb u bi in nd i sc High Rankixa t ko e yr s a r e a Budapests Best workspace and accelerators Hub features Top FinTech companies Hub profile Technologies Shinrai, B-Payment, Blueopes, Wyze, Simple, Cellum , IND, Dorsum and Gravity. Mi l an Mobile Big investors BG Speedinvest, DayOne Capital, HiVentures and OTP Bank. ao APIs nv ge kr on Machine learning km e Success stories Gn l o b a l fi Payment gateways nt C es n t r Beu The acquisition of IND Group by Misys in 2014. IND is a leading innovator and u7p da7p UX peso provider of online and mobile banking, personal finance management and tr t payments solutions. n Innovation areas o i t Ma ov sco The future own n Cyber security I l The market will continue to mature. Strong enthusiasm and demand will ax be Banking technology solutions o ldI generate supply. The first Hungarian FinTech accelerator will end its first batch Gn3n I3n E-commerce INDEX SCOREo and it is likely that more similar initiatives will start with banks launching their own va MKB Fintech Accelerator Identity management t accelerator programmes. Startups and corporates will become better connected. Istanbuli o Mosaik Fraud detection and c n SparkLab by NN The regulatory landscape for FinTechs will improve with upcoming changes to The FinTech industry in Hungary has been gaining considerable 151utlu mitigation account opening and account switching regulations. momentum over the last year. Hungary and the CEE countries are er mostly known for their excellent technological talent pool and Challenges innovative technologies. Low Rank Regulatory uncertainty Regulatory barriers se Small size of market 14rti RessenisuBpe gulagnioDo ex tionty t imi rox P Hub representative CEE FinTechrs Foreigstome CEOn startupity to cu Zsombor ImresProxim 31

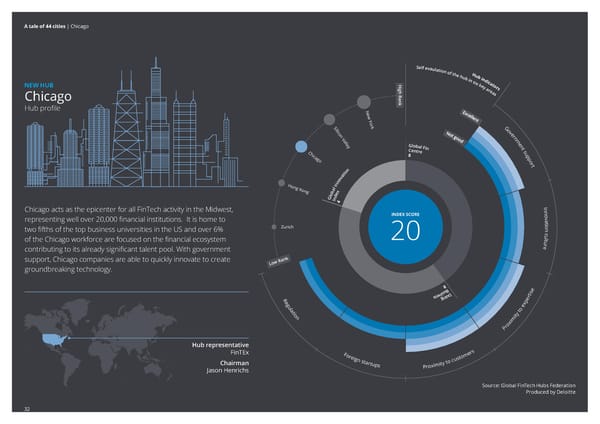

A tale of 44 cities | Chicago S e l f e v a u l a t i o n o f t H h e u h b u b i i n n d i s c High Rank ix a t k o NEW HUB e y r s a r e a Chicago s Hub profile N e w Yor Si k G lic o o v n e r V n a m l l e e G n y l o b a l F i t C n e s n t r C e u h p icag 8 p o o r n t o i t a v o n H n o I n g l K a on g b x o e l d G n I 4 Chicago acts as the epicenter for all FinTech activity in the Midwest, In 1871 n INDEX SCORE o Catapult Chicago v representing well over 20,000 financial institutions. It is home to a t Tech Nexus Zurich i o two fifths of the top business universities in the US and over 6% c n Techstars Chicago of the Chicago workforce are focused on the financial ecosystem 20 utlu contributing to its already significant talent pool. With government er support, Chicago companies are able to quickly innovate to create groundbreaking technology. Low Rank 8 s u B e ss e ni ni o D tis Re g per gula o ex tion ty t imi rox P Hub representative FinTEx For mers eign st o custo Chairman artups Proximity t Jason Henrichs Source: Global FinTech Hubs Federation Produced by Deloitte 32

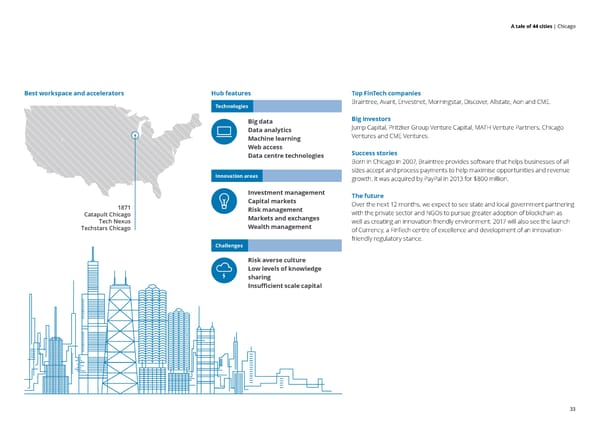

A tale of 44 cities | Chicago S e l f e v a u l a t i o n o f tH h eu hb u bi in nd i sc High Rankixa t ko e yr s a r e a Chicagos Best workspace and accelerators Hub features Top FinTech companies Hub profile Technologies Braintree, Avant, Envestnet, Morningstar, Discover, Allstate, Aon and CME. New Yor Big data Big investors SikG Jump Capital, Pritzker Group Venture Capital, MATH Venture Partners, Chicago lico Data analytics ov ne r Ventures and CME Ventures. Vn Machine learning am l le eGn yl o b a l F Web access it Cn es n t r Ceu hp Success stories icag8p Data centre technologies oo Born in Chicago in 2007, Braintree provides software that helps businesses of all r nt sizes accept and process payments to help maximise opportunities and revenue o i t Innovation areas a v growth. It was acquired by PayPal in 2013 for $800 million. o n Hn oI n gl Ka on gbx Investment management oe ld The future Gn I4 Capital markets Over the next 12 months, we expect to see state and local government partnering Chicago acts as the epicenter for all FinTech activity in the Midwest, In 1871 Risk management n INDEX SCOREo Catapult Chicago with the private sector and NGOs to pursue greater adoption of blockchain as representing well over 20,000 financial institutions. It is home tova Markets and exchanges t Tech Nexus well as creating an innovation friendly environment. 2017 will also see the launch Zurichi o Wealth management two fifths of the top business universities in the US and over 6%c n Techstars Chicago of Currency, a FinTech centre of excellence and development of an innovation- of the Chicago workforce are focused on the financial ecosystem 20utlu friendly regulatory stance. contributing to its already significant talent pool. With government er Challenges support, Chicago companies are able to quickly innovate to create Risk averse culture groundbreaking technology. Low Rank Low levels of knowledge sharing 8 Insufficient scale capital suBe sseninioDtis Regper gulao ex tionty t imi rox P Hub representative FinTExFormers eign sto custo ChairmanartupsProximity t Jason Henrichs 33

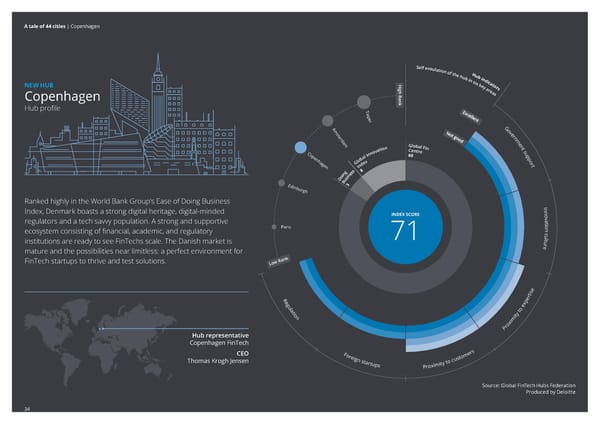

A tale of 44 cities | Copenhagen S e l f e v a u l a t i o n o f t H h e u h b u b i i n n d i s c High Rank ix a t k o NEW HUB e y r s a r e a Copenhagen s Hub profile Taip Accelerace Copenhagen Fintech Lab e A i G Founders House m o Rainmaking Loft s v t e Singularity U Copenhagen e r rd n a m Spar Nord Future Finance m e G n l o b a l F i t n n The Camp o i t C s a e n t v r C o e u o n n 6 p I 0 Venture Cup penh l p a b o o a l x r g G e e d t n n I s 8 g s n e i n o i D s u Edinb B 3 u r gh Ranked highly in the World Bank Group’s Ease of Doing Business In Index, Denmark boasts a strong digital heritage, digital-minded n INDEX SCORE o v a regulators and a tech savvy population. A strong and supportive t Paris i o ecosystem consisting of financial, academic, and regulatory c n institutions are ready to see FinTechs scale. The Danish market is 71 utlu mature and the possibilities near limitless: a perfect environment for er FinTech startups to thrive and test solutions. Low Rank tise Re per gula o ex tion ty t imi rox Hub representative P Copenhagen FinTech CEO For mers Thomas Krogh Jensen eign st o custo artups Proximity t Source: Global FinTech Hubs Federation Produced by Deloitte 34

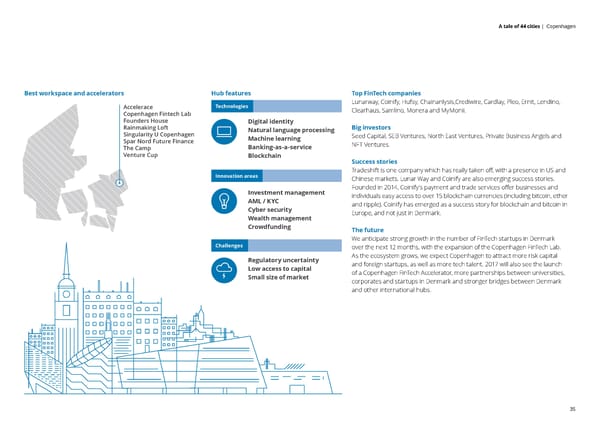

A tale of 44 cities | Copenhagen S e l f e v a u l a t i o n o f tH h eu hb u bi in nd i sc High Rankixa t ko e yr s a r e a Copenhagens Best workspace and accelerators Hub features Top FinTech companies Technologies Lunarway, Coinify, Hufsy, Chainanlysis,Crediwire, Cardlay, Pleo, Ernit, Lendino, Hub profileTaip Accelerace Clearhaus, Samlino, Monera and MyMonii. Copenhagen Fintech Lab ei Founders House Digital identity AG Rainmaking Loft Big investors mo Natural language processing sv te Singularity U Copenhagen er Seed Capital, SEB Ventures, North East Ventures, Private Business Angels and rdn Machine learning am Spar Nord Future Finance me NFT Ventures. Gn l o b a l F Banking-as-a-service it nn The Camp o i tCs ae n t vr Coeu on n6p I0 Venture Cup penh Blockchain lp a bo o alxr Success stories gGe edt nn I s8 Tradeshift is one company which has really taken off, with a presence in US and gs ne in Innovation areas oi Ds Chinese markets. Lunar Way and Coinify are also emerging success stories. u EdinbB 3 Founded in 2014, Coinify’s payment and trade services offer businesses and u r gh Investment management individuals easy access to over 15 blockchain currencies (including bitcoin, ether Ranked highly in the World Bank Group’s Ease of Doing Business AML / KYC and ripple). Coinify has emerged as a success story for blockchain and bitcoin in In Cyber security Index, Denmark boasts a strong digital heritage, digital-minded n INDEX SCOREo Europe, and not just in Denmark. va Wealth management regulators and a tech savvy population. A strong and supportive t Parisi o Crowdfunding ecosystem consisting of financial, academic, and regulatory c n The future institutions are ready to see FinTechs scale. The Danish market is 71utlu We anticipate strong growth in the number of FinTech startups in Denmark mature and the possibilities near limitless: a perfect environment for er Challenges over the next 12 months, with the expansion of the Copenhagen FinTech Lab. FinTech startups to thrive and test solutions. Regulatory uncertainty As the ecosystem grows, we expect Copenhagen to attract more risk capital Low Rank Low access to capital and foreign startups, as well as more tech talent. 2017 will also see the launch Small size of market of a Copenhagen FinTech Accelerator, more partnerships between universities, corporates and startups in Denmark and stronger bridges between Denmark tise and other international hubs. Reper gulao ex tionty t imi rox Hub representativeP Copenhagen FinTech CEOFormers Thomas Krogh Jenseneign sto custo artupsProximity t 35

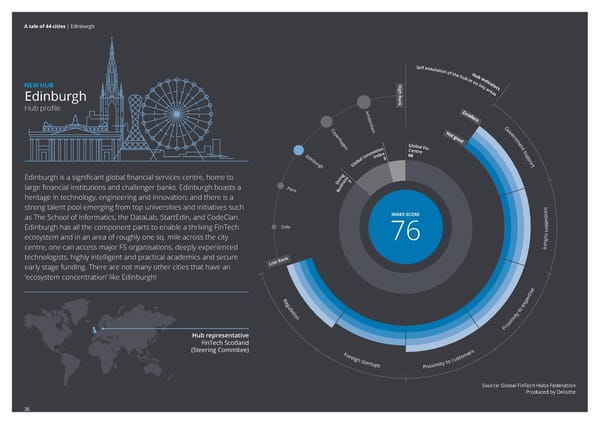

A tale of 44 cities | Edinburgh S e l f e v a u l a t i o n o f t H h e u h b u b i i n n d i s c High Rank ix a t k o NEW HUB e y r s a r e a Edinburgh s Hub profile A ms te rd C am G o o p v e e n r h n Codebase Technology Incubator ag m e e G n l o b E-Spark (HQ at RBS Gogarburn) n a l F i t n n o C s i e n t t r a e u v x o e 6 p E n d 6 d n n I I p i n l 3 b a o u b r o r g l t h G g Edinburgh is a significant global financial services centre, home to n s i s o e 7 D n i large financial institutions and challenger banks. Edinburgh boasts a Pari s s u heritage in technology, engineering and innovation; and there is a B strong talent pool emerging from top universities and initiatives such In n INDEX SCORE o as The School of Informatics, the DataLab, StartEdin, and CodeClan. v a t Oslo i o Edinburgh has all the component parts to enable a thriving FinTech c n ecosystem and in an area of roughly one sq. mile across the city 76 utlu centre, one can access major FS organisations, deeply experienced er technologists, highly intelligent and practical academics and secure early stage funding. There are not many other cities that have an Low Rank 'ecosystem concentration’ like Edinburgh! tise Re per gula o ex tion ty t imi rox Hub representative P FinTech Scotland (Steering Commitee) rs Foreig stome n startup ity to cu s Proxim Source: Global FinTech Hubs Federation Produced by Deloitte 36

A tale of 44 cities | Edinburgh S e l f e v a u l a t i o n o f tH h eu hb u bi in nd i sc High Rankixa t ko e yr s a r e a Edinburghs Best workspace and accelerators Hub features Top FinTech companies Hub profile Technologies The ID Co., Money Dashboard, Nucleus, Float, FreeAgent, Zonefox, Symphonic A Software, Wallet Services, The Lending Crowd and Payfont. ms te rd Big data CamG Big investors oo Data analytics pv ee nr Par Equity, Archangels, Scottish Enterprise and Scottish Equity Partners. hn Codebase Technology Incubator Digital identity agm ee Gn l o b E-Spark (HQ at RBS Gogarburn) na l F P2P networks it nn oCs ie n tt r aeu vx Success stories oe6p End6 Blockchain dnn IIp i nl3 bao ub Successful startups include Nucleus (won investment platform of the year for ror glt hG 2016), Zonefox (recently secured £3.6m Series A), Money Dashboard (awarded g Innovation areas Edinburgh is a significant global financial services centre, home to ns is Best Personal Finance App 2017 in the British Bank Awards), FreeAgent oe7 Dn i large financial institutions and challenger banks. Edinburgh boasts a Paris (first equity crowdfunded business to IPO, achieving a market capitalisation su heritage in technology, engineering and innovation; and there is a B Compliance of around £34.1m), Payfont (recently valued at up to £180 million). Cyber security strong talent pool emerging from top universities and initiatives such In Identity management n INDEX SCOREo The creation of a FinTech strategy for Scotland, sponsored and supported by the as The School of Informatics, the DataLab, StartEdin, and CodeClan. va Open data t government and industry is another success story for Edinburgh. This initiative Osloi o Payments Edinburgh has all the component parts to enable a thriving FinTech c n is already helping to accelerate growth and connection across the industry. ecosystem and in an area of roughly one sq. mile across the city 76utlu centre, one can access major FS organisations, deeply experienced er Challenges The future technologists, highly intelligent and practical academics and secure Risk averse culture The pace and scale of FinTech startups and scaleups is set to continue across early stage funding. There are not many other cities that have an Low Rank Low levels of knowledge Edinburgh. The jointly backed government and industry initiative to define and 'ecosystem concentration’ like Edinburgh! sharing drive a FinTech strategy for Scotland is already gathering huge momentum. Regulatory uncertainty The next 12 months will see the emergence of a connected FinTech ecosystem tise in Edinburgh, and Scotland more broadly. Reper gulao ex tionty t imi rox Hub representativeP FinTech Scotland (Steering Commitee)rs Foreigstome n startupity to cu sProxim 37

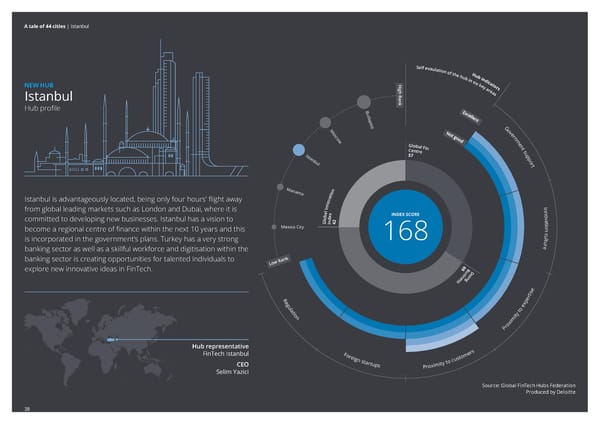

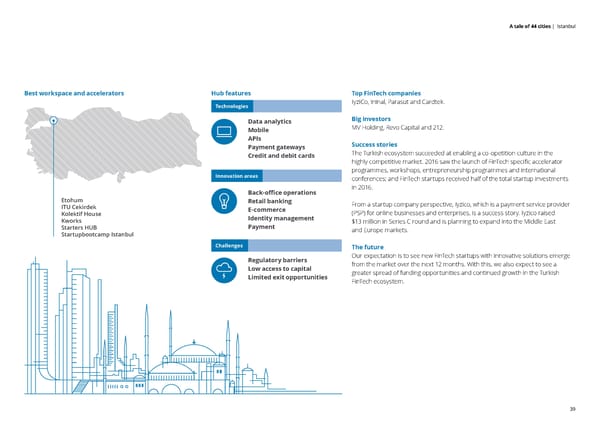

A tale of 44 cities | Istanbul S e l f e v a u l a t i o n o f t H h e u h b u b i i n n d i s c High Rank ix a t k o NEW HUB e y r s a r e a Istanbul s Hub profile B ud a pes M t G o o v s e c r o n w m e G n l o b a l F i t C n e s n t r e u I 5 p stan 7 p b o u r l t M a n n a m o a i t Istanbul is advantageously located, being only four hours’ flight away a v Etohum o n In ITU Cekirdek n I from global leading markets such as London and Dubai, where it is n al x INDEX SCORE o Kolektif House b e v o d a committed to developing new businesses. Istanbul has a vision to Gl n 2 t Kworks Mexico City I 4 i o become a regional centre of finance within the next 10 years and this c n Starters HUB is incorporated in the government’s plans. Turkey has a very strong 168 utlu Startupbootcamp Istanbul banking sector as well as a skillful workforce and digitisation within the er banking sector is creating opportunities for talented individuals to Low Rank 9 6 B explore new innovative ideas in FinTech. n i s u o D s e g n i s tise Re per gula o ex tion ty t imi rox P Hub representative FinTech Istanbul For mers eign st o custo CEO artups Proximity t Selim Yazici Source: Global FinTech Hubs Federation Produced by Deloitte 38

A tale of 44 cities | Istanbul S e l f e v a u l a t i o n o f tH h eu hb u bi in nd i sc High Rankixa t ko e yr s a r e a Istanbuls Best workspace and accelerators Hub features Top FinTech companies Hub profile Technologies IyziCo, Ininal, Parasut and Cardtek. B ud a Big investors pes Data analytics MtG MV Holding, Revo Capital and 212. o Mobile ov se cr on APIs wm e Success stories Gn l o b a l F Payment gateways it Cn es n t r eu The Turkish ecosystem succeeded at enabling a co-opetition culture in the I5p stan7p Credit and debit cards bo highly competitive market. 2016 saw the launch of FinTech specific accelerator ur lt programmes, workshops, entrepreneurship programmes and international Innovation areas conferences; and FinTech startups received half of the total startup investments M in 2016. an n a mo Back-office operations ai t Istanbul is advantageously located, being only four hours’ flight away a v Etohum Retail banking o nIn ITU Cekirdek From a startup company perspective, Iyzico, which is a payment service provider n I from global leading markets such as London and Dubai, where it is n E-commerce alxINDEX SCOREo Kolektif House (PSP) for online businesses and enterprises, is a success story. Iyzico raised bev oda Identity management committed to developing new businesses. Istanbul has a vision to Gln2t Kworks $13 million in Series C round and is planning to expand into the Middle East Mexico CityI4i o Payment become a regional centre of finance within the next 10 years and this c n Starters HUB and Europe markets. is incorporated in the government’s plans. Turkey has a very strong 168utlu Startupbootcamp Istanbul banking sector as well as a skillful workforce and digitisation within the er Challenges The future banking sector is creating opportunities for talented individuals to Regulatory barriers Our expectation is to see new FinTech startups with innovative solutions emerge Low Rank96B Low access to capital from the market over the next 12 months. With this, we also expect to see a explore new innovative ideas in FinTech. nisuoD greater spread of funding opportunities and continued growth in the Turkish segni Limited exit opportunities s FinTech ecosystem. tise Reper gulao ex tionty t imi rox P Hub representative FinTech IstanbulFormers eign sto custo CEOartupsProximity t Selim Yazici 39

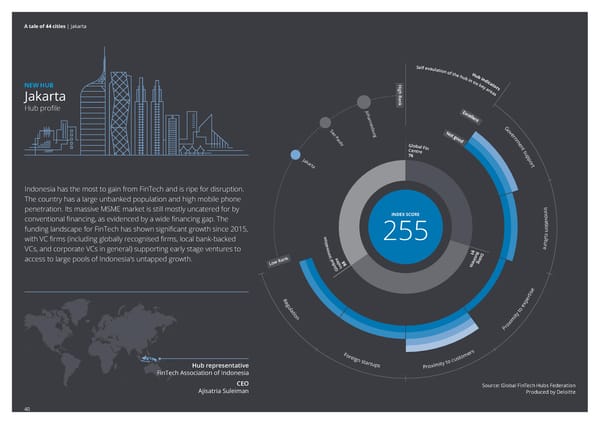

A tale of 44 cities | Jakarta S e l f e v a u l a t i o n o f t H h e u h b u b i i n n d i s c High Rank ix a t k o NEW HUB e y r s a r e a Jakarta s Hub profile Jo ha nne s G S b o a u v o rg e r P n aul m o e G n l o b a l F i t C n e s n t r e u 7 p Ja 6 p k o a r r t ta Indonesia has the most to gain from FinTech and is ripe for disruption. Conclave The country has a large unbanked population and high mobile phone D-LAB by SMDV Kejora penetration. Its massive MSME market is still mostly uncatered for by In Mandiri Digital Incubator n INDEX SCORE o Plug & Play Indonesia v conventional financing, as evidenced by a wide financing gap. The a t i o funding landscape for FinTech has shown significant growth since 2015, c n with VC firms (including globally recognised firms, local bank-backed noi 255 utlu VCs, and corporate VCs in general) supporting early stage ventures to tav 9 er onnI 1suBoD access to large pools of Indonesia's untapped growth. labxed8 senigni Low Rank olGnI8 s tise Re per gula o ex tion ty t imi rox P For mers eign st o custo Hub representative artups Proximity t FinTech Association of Indonesia CEO Source: Global FinTech Hubs Federation Ajisatria Suleiman Produced by Deloitte 40

A tale of 44 cities | Jakarta S e l f e v a u l a t i o n o f tH h eu hb u bi in nd i sc High Rankixa t ko e yr s a r e a JakartasBest workspace and accelerators Hub features Top FinTech companies Hub profile Technologies C88 FinTech Group (proprietor of Cekaja), Midtrans, Doku, Modalku, Investree Jo and Dimo. ha nne Mobile sG Sbo Big investors auv Location based services orge r Pn Sinar Mas Digital Ventures, MDI Ventures (subsidiary of Telkom, Indonesia’s largest aulm Web access oe telco operator), Lippo Group, Kejora Venture, Mandiri Capital Indonesia (subsidiary Gn l o b a l F Open Source it Cn es n t r eu of Mandiri, Indonesia’s largest bank), East Venture and Northstar (for later stage). 7p Ja6p UX ko ar rt ta Success stories Innovation areas C88 FinTech Group is the biggest FinTech companies in Indonesia, securing Series Indonesia has the most to gain from FinTech and is ripe for disruption. ConclaveRetail banking B round from major investor like Telstra. It was funded by Kejora Group since the The country has a large unbanked population and high mobile phone D-LAB by SMDV seed stage, and emerged as Indonesia’s FinTech powerhouse. Kejora E-commerce penetration. Its massive MSME market is still mostly uncatered for by InMandiri Digital IncubatorAggregators n INDEX SCOREoPlug & Play Indonesia In December 2016, new regulations on P2P lending, payment gateway, and conventional financing, as evidenced by a wide financing gap. The va Credit scoring t e-wallet demonstrated commitments by the regulator to support FinTech i o Underwriting funding landscape for FinTech has shown significant growth since 2015, c n development. with VC firms (including globally recognised firms, local bank-backed noi255utlu VCs, and corporate VCs in general) supporting early stage ventures to tav9erChallenges The future onnI1suBoD December 2016 was a milestone for Indonesia’s FinTech ecosystem as the Central access to large pools of Indonesia's untapped growth. labxed8senigni Regulatory uncertainty from Low RankolGnI8s new regulations Bank (BI) and the Financial Services Authority (OJK) each issued regulations Quality of infrastructure that paved the way forward for Indonesian FinTech. In 2017, we expect to see Skills shortages – technology companies secure licenses, more companies to flourish and an increase in foreign tise FinTech companies entering the Indonesian market. BI will also issue a regulatory Reper sandbox in mid 2017 and we hope to see investors gaining more confidence in gulao ex investing in Indonesian FinTech companies. tionty t imi rox P Formers eign sto custo Hub representativeartupsProximity t FinTech Association of Indonesia CEO Ajisatria Suleiman 41

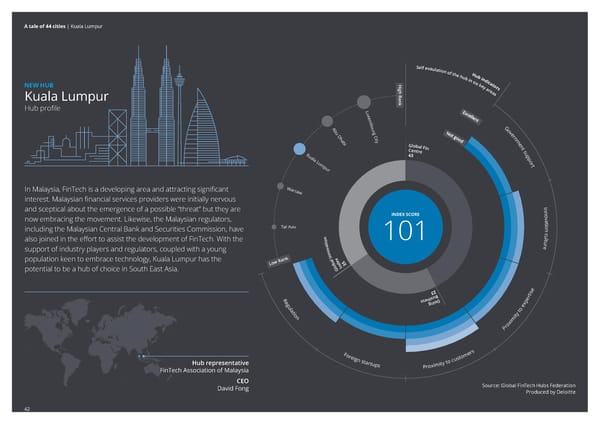

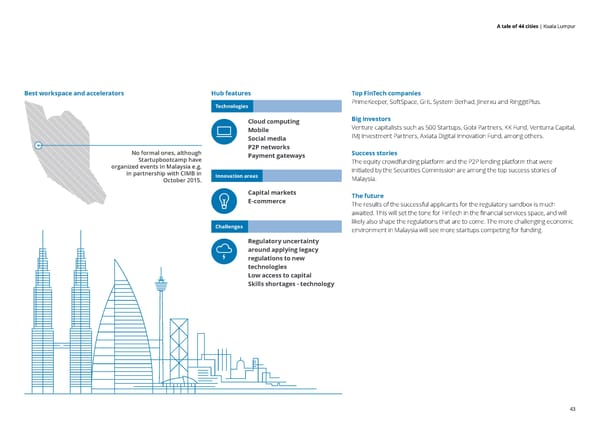

A tale of 44 cities | Kuala Lumpur S e l f e v a u l a t i o n o f t H h e u h b u b i i n n d i s c High Rank ix a t k o NEW HUB e y r s a r e a Kuala Lumpur s „ub profile Lu xem b A ou G b rg o u v e D C r h it n ab y m i e G n l o b a l F i t C n e s n t r e u K 4 p No formal ones, although ua 3 p la o Startupbootcamp have Lu r m t pur organized events in Malaysia e.g. in partnership with CIMB in October 2015. W In Malaysia, FinTech is a developing area and attracting significant arsaw interest. Malaysian financial services providers were initially nervous and sceptical about the emergence of a possible “threat” but they are In n INDEX SCORE o v now embracing the movement. iewise, the Malaysian regulators, a t Tel Aviv i o including the Malaysian entral an and ecurities ommission, have c n also oined in the effort to assist the development of FinTech. ith the noi 101 utlu support of industry players and regulators, coupled with a young tavo er population een to embrace technology, €uala umpur has the nnI lx Low Rank abolednI53 potential to be a hub of choice in outh ‚ast ƒsia. G 32 ise nisuB rt Reg ssegnioD xpe ulatio to e n ity xim Pro For mers eign st o custo Hub representative artups Proximity t FinTech Association of Malaysia CEO Source: Global FinTech Hubs Federation David Fong Produced by Deloitte 42

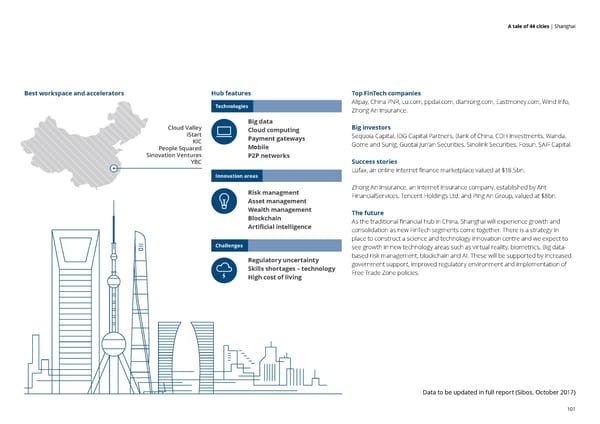

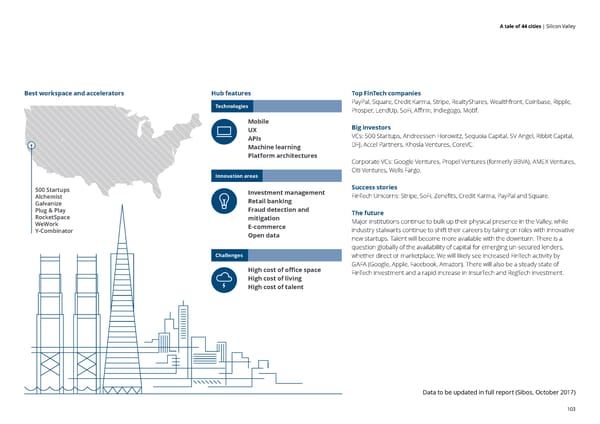

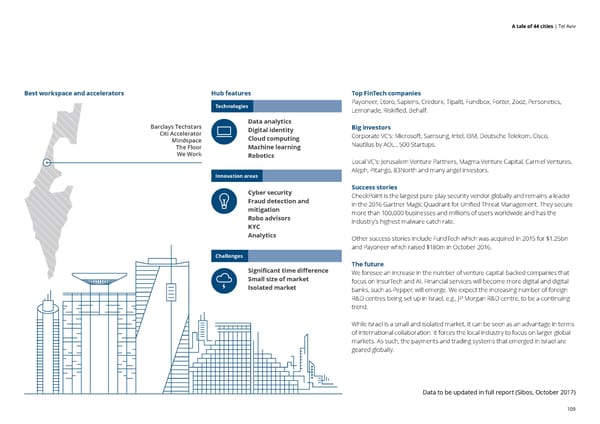

A tale of 44 cities | Kuala Lumpur S e l f e v a u l a t i o n o f tH h eu hb u bi in nd i sc High Rankixa t ko e yr s a r e a Kuala LumpursBest workspace and accelerators Hub features Top FinTech companies „ub profile Technologies PrimeKeeper, SoftSpace, GHL System Berhad, Jinerxu and RinggitPlus. Lu xem Cloud computing Big investors b AouG Venture capitalists such as 500 Startups, Gobi Partners, KK Fund, Venturra Capital, brgo Mobile uv e DCr IMJ Investment Partners, Axiata Digital Innovation Fund, among others. hitn Social media abym ie Gn l o b a l F P2P networks it Cn es n t r eu K4p No formal ones, although Success stories ua3p Payment gateways lao Startupbootcamp have Lur The equity crowdfunding platform and the P2P lending platform that were mt pur organized events in Malaysia e.g. initiated by the Securities Commission are among the top success stories of in partnership with CIMB in Innovation areas Malaysia. October 2015. W In Malaysia, FinTech is a developing area and attracting significant arsaw Capital markets The future interest. Malaysian financial services providers were initially nervous E-commerce The results of the successful applicants for the regulatory sandbox is much and sceptical about the emergence of a possible “threat” but they are In n INDEX SCOREo awaited. This will set the tone for FinTech in the financial services space, and will now embracing the movement. iewise, the Malaysian regulators, va t likely also shape the regulations that are to come. The more challenging economic Tel Avivi o Challenges including the Malaysian entral an and ecurities ommission, have c n environment in Malaysia will see more startups competing for funding. also oined in the effort to assist the development of FinTech. ith the noi101utlu Regulatory uncertainty support of industry players and regulators, coupled with a young tavoer around applying legacy population een to embrace technology, €uala umpur has the nnI lx regulations to new Low RankabolednI53 technologies potential to be a hub of choice in outh ‚ast ƒsia.G Low access to capital Skills shortages - technology 32ise nisuBrt RegssegnioDxpe ulatio to e nity xim Pro Formers eign sto custo Hub representativeartupsProximity t FinTech Association of Malaysia CEO David Fong 43