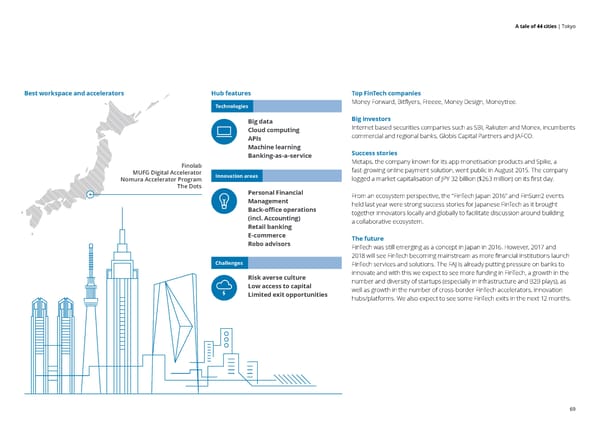

A tale of 44 cities | Tokyo S e l f e v a u l a t i o n o f tH h eu hb u bi in nd i sc High Rankixa t ko e yr s a r e a Tokyo s Best workspace and accelerators Hub features Top FinTech companies Hub profile Technologies Money Forward, Bitflyers, Freeee, Money Design, Moneytree. T o r o n Big investors toG Big data Internet based securities companies such as SBI, Rakuten and Monex, incumbents Sto Cloud computing ov ce kr commercial and regional banks, Globis Capital Partners and JAFCO. hn APIs olm me Gn l o b a l F Machine learning it Cn es n t r eu Success stories T5p Banking-as-a-service okDp yooo Metaps, the company known for its app monetisation products and Spike, a Bir u nt 3sg Finolab i 4n e fast-growing online payment solution, went public in August 2015. The company s MUFG Digital Accelerator s Nomura Accelerator Program Innovation areas logged a market capitalisation of JPY 32 billion ($263 million) on its first day. Dubl The Dots Japan has seen strong growth in the FinTech ecosystem in the past two in Personal Financial From an ecosystem perspective, the “FinTech Japan 2016” and FinSum2 events years, as FinTech startups, industry players, regulators and government Management held last year were strong success stories for Japanese FinTech as it brought nIn Back-office operations on have collaborated to build a sustainable and scalable environment for iINDEX SCOREo together innovators locally and globally to facilitate discussion around building tv aa (incl. Accounting) vt a collaborative ecosystem. innovation. Tokyo has a vibrant FinTech network, and the regulators oi o Taipeinn Retail banking nI l have recently launched FinTech-friendly laws around blockchain and aboxed655tluc E-commerce The future APIs, along with initiatives to support new FinTech startups. As the third lGnI1eru Robo advisors FinTech was still emerging as a concept in Japan in 2016. However, 2017 and largest economy in the world, there is opportunity for both B2C and 2018 will see FinTech becoming mainstream as more financial institutions launch B2B players to enter the market.Low Rank Challenges FinTech services and solutions. The FAJ is already putting pressure on banks to Risk averse culture innovate and with this we expect to see more funding in FinTech, a growth in the Low access to capital number and diversity of startups (especially in infrastructure and B2B plays), as tise Limited exit opportunities well as growth in the number of cross-border FinTech accelerators, innovation Reper hubs/platforms. We also expect to see some FinTech exits in the next 12 months. gulao ex tionty t imi rox P Hub representative FinTech Association of JapanFormers eign sto custo CEOartupsProximity t Hiroki Kudo & Hiroki Maruyama 69

A Tale of 44 Cities Page 68 Page 70

A Tale of 44 Cities Page 68 Page 70