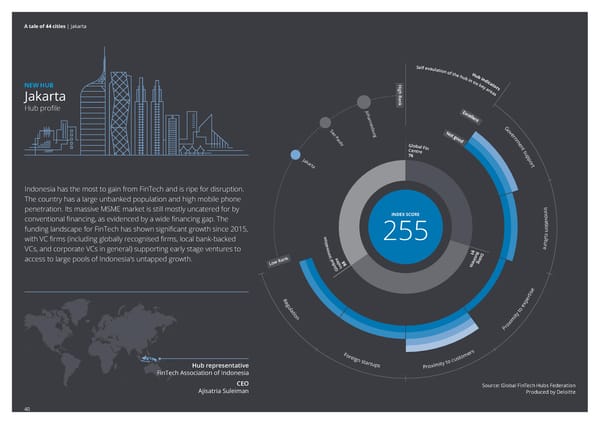

A tale of 44 cities | Jakarta S e l f e v a u l a t i o n o f t H h e u h b u b i i n n d i s c High Rank ix a t k o NEW HUB e y r s a r e a Jakarta s Hub profile Jo ha nne s G S b o a u v o rg e r P n aul m o e G n l o b a l F i t C n e s n t r e u 7 p Ja 6 p k o a r r t ta Indonesia has the most to gain from FinTech and is ripe for disruption. Conclave The country has a large unbanked population and high mobile phone D-LAB by SMDV Kejora penetration. Its massive MSME market is still mostly uncatered for by In Mandiri Digital Incubator n INDEX SCORE o Plug & Play Indonesia v conventional financing, as evidenced by a wide financing gap. The a t i o funding landscape for FinTech has shown significant growth since 2015, c n with VC firms (including globally recognised firms, local bank-backed noi 255 utlu VCs, and corporate VCs in general) supporting early stage ventures to tav 9 er onnI 1suBoD access to large pools of Indonesia's untapped growth. labxed8 senigni Low Rank olGnI8 s tise Re per gula o ex tion ty t imi rox P For mers eign st o custo Hub representative artups Proximity t FinTech Association of Indonesia CEO Source: Global FinTech Hubs Federation Ajisatria Suleiman Produced by Deloitte 40

A Tale of 44 Cities Page 39 Page 41

A Tale of 44 Cities Page 39 Page 41