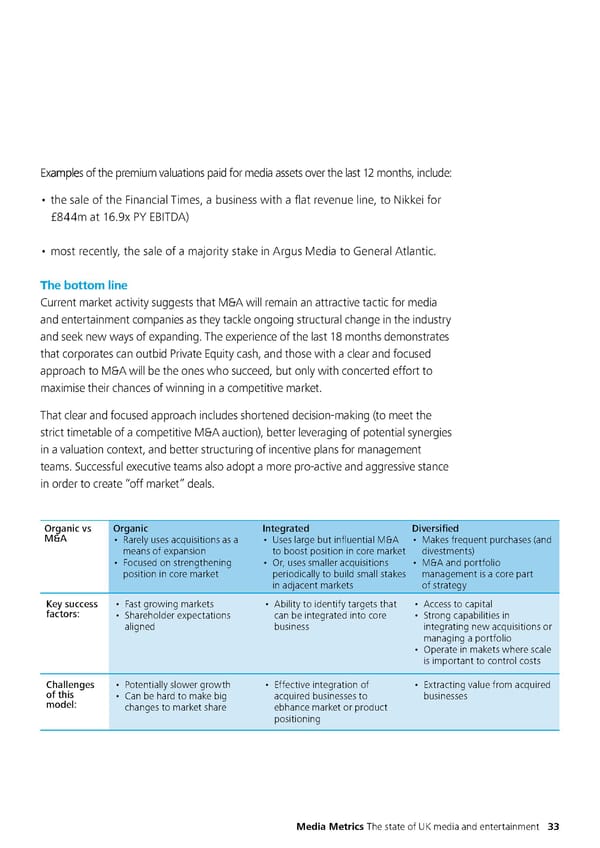

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. Examples of the premium valuations paid for media assets over the last 12 months, include: • the sale of the Financial Times, a business with a flat revenue line, to Nikkei for £844m at 16.9x PY EBITDA) • most recently, the sale of a majority stake in Argus Media to General Atlantic. The bottom line Current market activity suggests that M&A will remain an attractive tactic for media and entertainment companies as they tackle ongoing structural change in the industry and seek new ways of expanding. The experience of the last 18 months demonstrates that corporates can outbid Private Equity cash, and those with a clear and focused approach to M&A will be the ones who succeed, but only with concerted effort to maximise their chances of winning in a competitive market. That clear and focused approach includes shortened decision-making (to meet the strict timetable of a competitive M&A auction), better leveraging of potential synergies in a valuation context, and better structuring of incentive plans for management teams. Successful executive teams also adopt a more pro-active and aggressive stance in order to create “off market” deals. Organic vs Organic Integrated Diversified M&A • Rarely uses acquisitions as a • Uses large but influential M&A • Makes frequent purchases (and means of expansion to boost position in core market divestments) • Focused on strengthening • Or, uses smaller acquisitions • M&A and portfolio position in core market periodically to build small stakes management is a core part in adjacent markets of strategy Key success • Fast growing markets • Ability to identify targets that • Access to capital factors: • Shareholder expectations can be integrated into core • Strong capabilities in aligned business integrating new acquisitions or managing a portfolio • Operate in makets where scale is important to control costs Challenges • Potentially slower growth • Effective integration of • Extracting value from acquired of this • Can be hard to make big acquired businesses to businesses model: changes to market share ebhance market or product positioning Media Metrics The state of UK media and entertainment 33

Media Metrics Page 43 Page 45

Media Metrics Page 43 Page 45