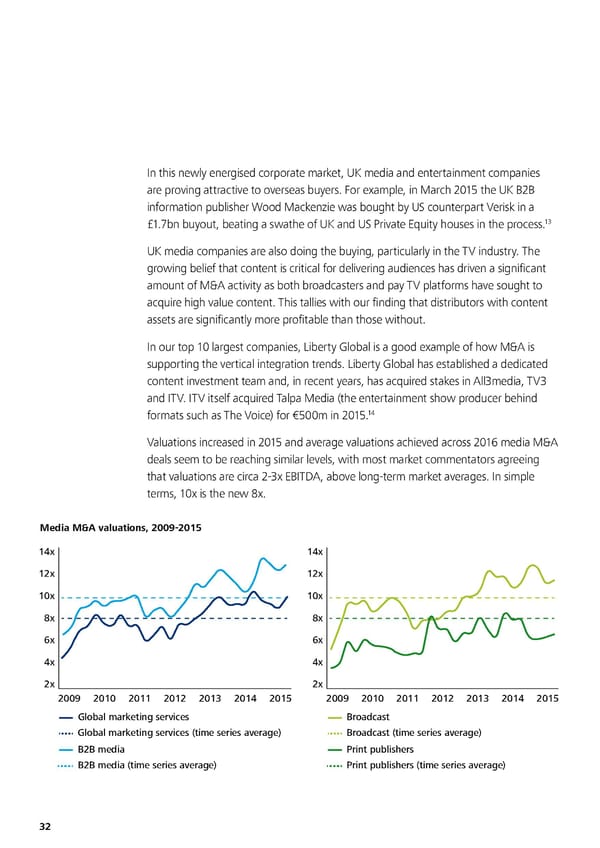

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. In this newly energised corporate market, UK media and entertainment companies are proving attractive to overseas buyers. For example, in March 2015 the UK B2B information publisher Wood Mackenzie was bought by US counterpart Verisk in a 13 £1.7bn buyout, beating a swathe of UK and US Private Equity houses in the process. UK media companies are also doing the buying, particularly in the TV industry. The growing belief that content is critical for delivering audiences has driven a significant amount of M&A activity as both broadcasters and pay TV platforms have sought to acquire high value content. This tallies with our finding that distributors with content assets are significantly more profitable than those without. In our top 10 largest companies, Liberty Global is a good example of how M&A is supporting the vertical integration trends. Liberty Global has established a dedicated content investment team and, in recent years, has acquired stakes in All3media, TV3 and ITV. ITV itself acquired Talpa Media (the entertainment show producer behind 14 formats such as The Voice) for €500m in 2015. Valuations increased in 2015 and average valuations achieved across 2016 media M&A deals seem to be reaching similar levels, with most market commentators agreeing that valuations are circa 2-3x EBITDA, above long-term market averages. In simple terms, 10x is the new 8x. Media M&A valuations, 2009-2015 14x 14x 12x 12x 10x 10x 8x 8x 6x 6x 4x 4x 2x 2x 2009 2010 2011 2012 201320142015 2009 2010 2011 2012 2013 2014 2015 Global marketing services Broadcast Global marketing services (time series average) Broadcast (time series average) B2B media Print publishers B2B media (time series average) Print publishers (time series average) Source: Capital IQ, Deloitte analysis 32

Media Metrics Page 42 Page 44

Media Metrics Page 42 Page 44