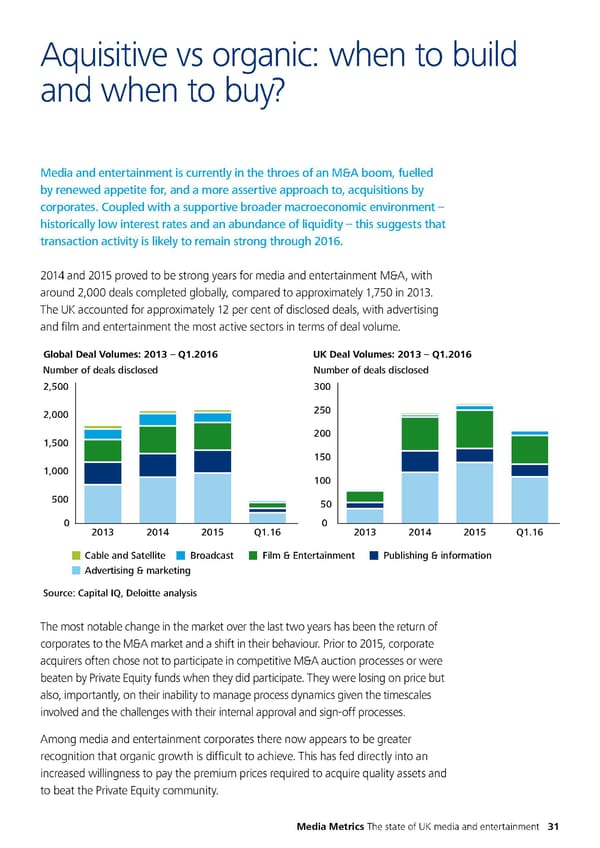

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. Aquisitive vs organic: when to build and when to buy? Media and entertainment is currently in the throes of an M&A boom, fuelled by renewed appetite for, and a more assertive approach to, acquisitions by corporates. Coupled with a supportive broader macroeconomic environment – historically low interest rates and an abundance of liquidity – this suggests that transaction activity is likely to remain strong through 2016. 2014 and 2015 proved to be strong years for media and entertainment M&A, with around 2,000 deals completed globally, compared to approximately 1,750 in 2013. The UK accounted for approximately 12 per cent of disclosed deals, with advertising and film and entertainment the most active sectors in terms of deal volume. Global Deal Volumes: 2013 – Q1.2016 UK Deal Volumes: 2013 – Q1.2016 Number of deals disclosed Number of deals disclosed 2,500 300 2,000 250 200 1,500 150 1,000 100 500 50 0 0 2013 2014 2015 Q1.16 2013 2014 2015 Q1.16 Cable and Satellite Broadcast Film & Entertainment Publishing & information Advertising & marketing Source: Capital IQ, Deloitte analysis The most notable change in the market over the last two years has been the return of corporates to the M&A market and a shift in their behaviour. Prior to 2015, corporate acquirers often chose not to participate in competitive M&A auction processes or were beaten by Private Equity funds when they did participate. They were losing on price but also, importantly, on their inability to manage process dynamics given the timescales involved and the challenges with their internal approval and sign-off processes. Among media and entertainment corporates there now appears to be greater recognition that organic growth is difficult to achieve. This has fed directly into an increased willingness to pay the premium prices required to acquire quality assets and to beat the Private Equity community. Media Metrics The state of UK media and entertainment 31

Media Metrics Page 41 Page 43

Media Metrics Page 41 Page 43