Q3 2014 The Deloitte M&A Index

Rising ‘animal spirits’ continue to stoke M&A activity

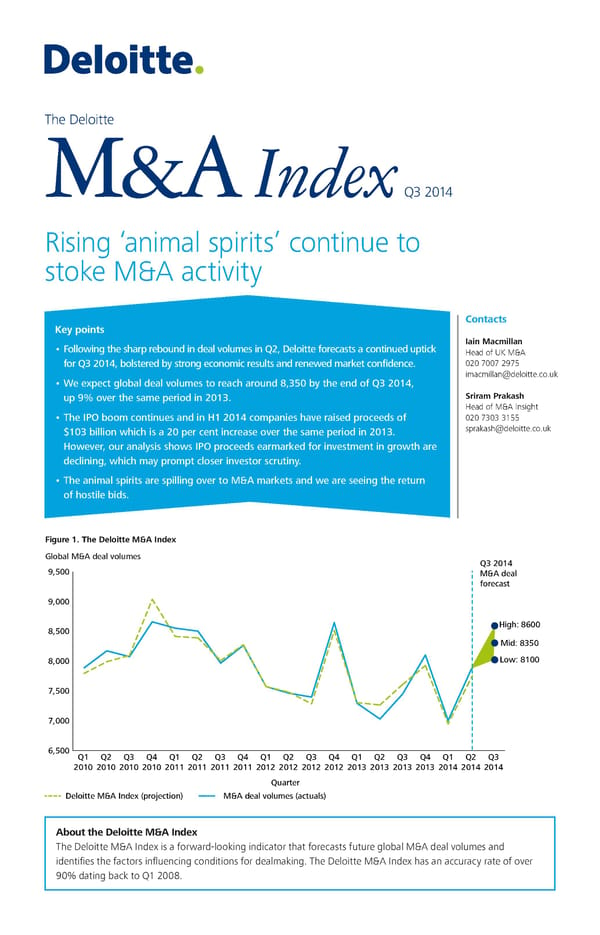

The Deloitte M&A Index Q3 2014 Rising ‘animal spirits’ continue to stoke M&A activity Contacts Key points • Following the sharp rebound in deal volumes in Q2, Deloitte forecasts a continued uptick Iain Macmillan Head of UK M&A for Q3 2014, bolstered by strong economic results and renewed market confidence. 020 7007 2975 imacmillan@deloitte.co.uk • We expect global deal volumes to reach around 8,350 by the end of Q3 2014, up 9% over the same period in 2013. Sriram Prakash Head of M&A Insight • The IPO boom continues and in H1 2014 companies have raised proceeds of 020 7303 3155 $103 billion which is a 20 per cent increase over the same period in 2013. sprakash@deloitte.co.uk However, our analysis shows IPO proceeds earmarked for investment in growth are declining, which may prompt closer investor scrutiny. • The animal spirits are spilling over to M&A markets and we are seeing the return of hostile bids. Figure 1. The Deloitte M&A Index Global M&A deal volumes Q3 2014 9,500 M&A deal forecast 9,000 8,500 High: 8600 Mid: 8350 8,000 Low: 8100 7,500 7,000 6,500 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2010 2010 2010 2010 2011 2011 2011 2011 2012 2012 2012 2012 2013 2013 2013 2013 2014 2014 2014 Quarter Deloitte M&A Index (projection) M&A deal volumes (actuals) About the Deloitte M&A Index The Deloitte M&A Index is a forward‑looking indicator that forecasts future global M&A deal volumes and identifies the factors influencing conditions for dealmaking. The Deloitte M&A Index has an accuracy rate of over 90% dating back to Q1 2008.

Q3 2014 The Deloitte M&A Index Page 2

Q3 2014 The Deloitte M&A Index Page 2