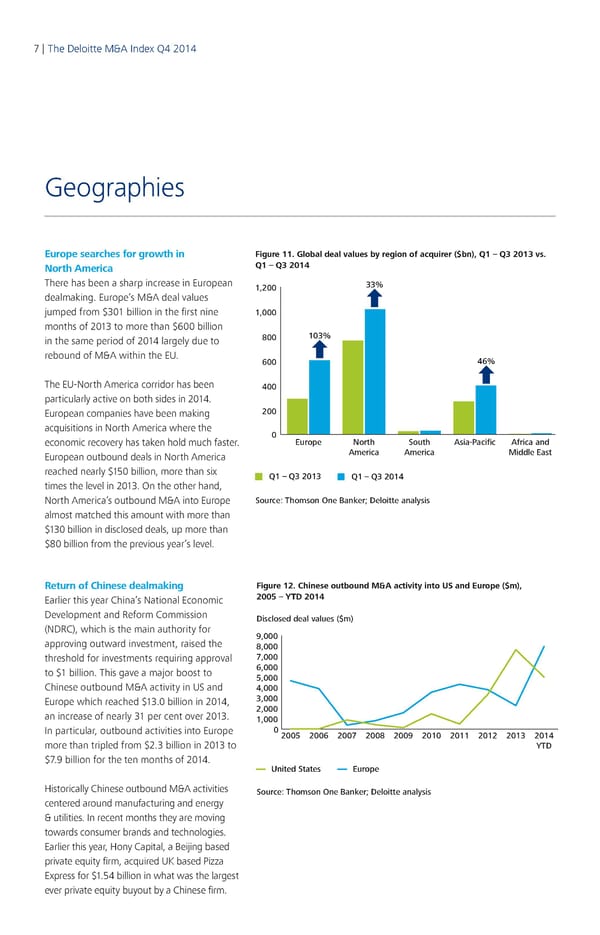

7 | The Deloitte M&A Index Q4 2014 Geographies Europe searches for growth in Figure 11. Global deal values by region of acquirer ($bn), Q1 – Q3 2013 vs. North America Q1 – Q3 2014 There has been a sharp increase in European 1,200 33% dealmaking. Europe’s M&A deal values jumped from $301 billion in the first nine 1,000 months of 2013 to more than $600 billion in the same period of 2014 largely due to 800 103% rebound of M&A within the EU. 600 46% The EU-North America corridor has been 400 particularly active on both sides in 2014. European companies have been making 200 acquisitions in North America where the 0 economic recovery has taken hold much faster. Europe North South Asia-Pacific Africa and European outbound deals in North America America America Middle East reached nearly $150 billion, more than six Q1 – Q3 2013 Q1 – Q3 2014 times the level in 2013. On the other hand, North America’s outbound M&A into Europe Source: Thomson One Banker; Deloitte analysis almost matched this amount with more than $130 billion in disclosed deals, up more than $80 billion from the previous year’s level. Return of Chinese dealmaking Figure 12. Chinese outbound M&A activity into US and Europe ($m), Earlier this year China’s National Economic 2005 – YTD 2014 Development and Reform Commission Disclosed deal values ($m) (NDRC), which is the main authority for 9,000 approving outward investment, raised the 8,000 threshold for investments requiring approval 7,000 to $1 billion. This gave a major boost to 6,000 5,000 Chinese outbound M&A activity in US and 4,000 Europe which reached $13.0 billion in 2014, 3,000 an increase of nearly 31 per cent over 2013. 2,000 1,000 In particular, outbound activities into Europe 0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 more than tripled from $2.3 billion in 2013 to YTD $7.9 billion for the ten months of 2014. United States Europe Historically Chinese outbound M&A activities Source: Thomson One Banker; Deloitte analysis centered around manufacturing and energy & utilities. In recent months they are moving towards consumer brands and technologies. Earlier this year, Hony Capital, a Beijing based private equity firm, acquired UK based Pizza Express for $1.54 billion in what was the largest ever private equity buyout by a Chinese firm.

Q4 2014 The Deloitte M&A Index Page 6 Page 8

Q4 2014 The Deloitte M&A Index Page 6 Page 8