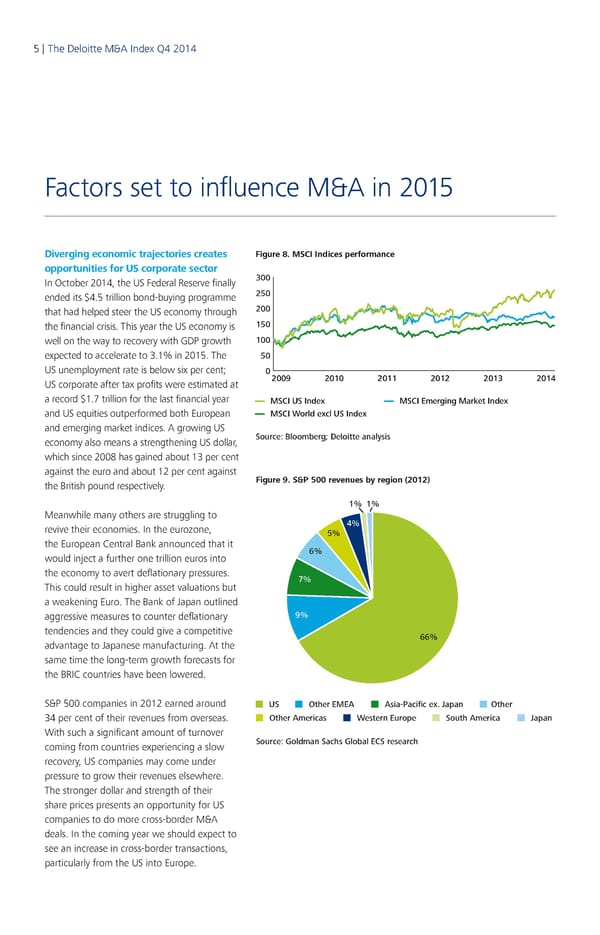

5 | The Deloitte M&A Index Q4 2014 Factors set to influence M&A in 2015 Diverging economic trajectories creates Figure 8. MSCI Indices performance opportunities for US corporate sector In October 2014, the US Federal Reserve finally 300 ended its $4.5 trillion bond-buying programme 250 that had helped steer the US economy through 200 the financial crisis. This year the US economy is 150 well on the way to recovery with GDP growth 100 expected to accelerate to 3.1% in 2015. The 50 US unemployment rate is below six per cent; 0 US corporate after tax profits were estimated at 2009 2010 2011 2012 2013 2014 a record $1.7 trillion for the last financial year MSCI US Index MSCI Emerging Market Index and US equities outperformed both European MSCI World excl US Index and emerging market indices. A growing US economy also means a strengthening US dollar, Source: Bloomberg; Deloitte analysis which since 2008 has gained about 13 per cent against the euro and about 12 per cent against the British pound respectively. Figure 9. S&P 500 revenues by region (2012) 1% 1% Meanwhile many others are struggling to revive their economies. In the eurozone, 4% 5% the European Central Bank announced that it 6% would inject a further one trillion euros into the economy to avert deflationary pressures. 7% This could result in higher asset valuations but a weakening Euro. The Bank of Japan outlined aggressive measures to counter deflationary 9% tendencies and they could give a competitive 66% advantage to Japanese manufacturing. At the same time the long-term growth forecasts for the BRIC countries have been lowered. S&P 500 companies in 2012 earned around US Other EMEA Asia-Pacific ex. Japan Other 34 per cent of their revenues from overseas. Other Americas Western Europe South America Japan With such a significant amount of turnover coming from countries experiencing a slow Source: Goldman Sachs Global ECS research recovery, US companies may come under pressure to grow their revenues elsewhere. The stronger dollar and strength of their share prices presents an opportunity for US companies to do more cross-border M&A deals. In the coming year we should expect to see an increase in cross-border transactions, particularly from the US into Europe.

Q4 2014 The Deloitte M&A Index Page 4 Page 6

Q4 2014 The Deloitte M&A Index Page 4 Page 6