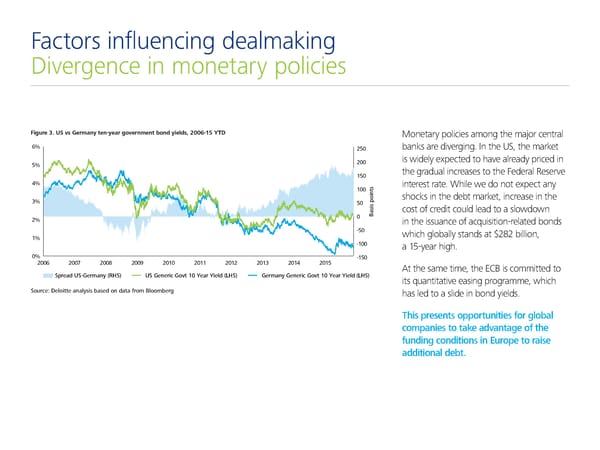

Factors influencing dealmaking Divergence in monetary policies Figure 3. US vs Germany ten-year government bond yields, 2006-15 Y Monetary policies among the major central ‚ 250 banks are diverging. In the US, the market 5 200 is widely expected to have already priced in 150 the gradual increases to the Federal Reserve € interest rate. While we do not expect any 100 shocks in the debt market, increase in the 50 cost of credit could lead to a slowdown 0 Basis points 2 in the issuance of acquisition-related bonds -50 which globally stands at $282 billion, 1 -100 a 15-year high. 0 -150 200‚ 200… 200„ 200ƒ 2010 2011 2012 201 201€ 2015 At the same time, the ECB is committed to Spread US-Germany (S US Generic Got 10 ear ield (S Germany Generic Got 10 ear ield (S its quantitative easing programme, which Source: Deloitte analysis based on data from Bloomberg has led to a slide in bond yields. This presents opportunities for global companies to take advantage of the funding conditions in Europe to raise additional debt.

Deloitte M&A Index | Presentation Page 3 Page 5

Deloitte M&A Index | Presentation Page 3 Page 5