Blockchains: Enigma. Paradox. Opportunity.

Blockchain Enigma. Paradox. Opportunity

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. Contents Foreword 1 Introduction 2 What is a blockchain? 4 The Internet of Value-Exchange 8 Key challenges 10 From vision to reality 13 Endnotes 14 Contacts 18 Acknowledgements The authors would like to acknowledge the support they have received from a number of people in Deloitte while researching this publication, including Ross Laurie, Jemma Insall, Ankur Borthakur and Aleksandra Szwiling. We would also like to thank the authors of “Bitcoin: Fact. Fiction. Future”, published by Deloitte University Press, for permission to reuse figures and text from their report, and the authors of “Cleared for takeoff: Five megatrends that will change financial services”, researched and written in collaboration with the World Economic Forum, and “Beyond bitcoin: Blockchain is coming to disrupt your industry”, for their invaluable insights into blockchain technology. In this publication, references to Deloitte are references to Deloitte LLP, the UK member firm of DTTL.

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. Foreword You may have read about Bitcoin or heard about it at a ‘FinTech’ conference. You may have used Bitcoins to purchase pizza, coffee or even a spaceflight. Wherever the word has cropped up, fierce debates have often followed. Early adopters passionately claim that Bitcoin will remove dependencies on banks and governments. Hardened business tycoons advise that Bitcoin is just a ‘flash in the pan’. While the debate about Bitcoin rages on, researchers have been quietly examining the technology that underpins this and other digital currencies. This is the realm of the blockchain – a protocol for exchanging value over the internet without an intermediary – and there is a growing buzz about how it might transform not just banking but many other industry sectors, too. In a recent survey by the World Economic Forum (WEF), a majority of experts and executives in the information and communications technology sector expected at least ten per cent of global GDP to be stored on blockchain platforms by 2025. And while the WEF doesn’t expect the tipping point for the technology to occur until around 2027, we anticipate that adoption will occur much faster as a multitude of applications emerge in different sectors. But who can benefit from this technology? What are the key blockchain applications and how will they work? How do Vimi Grewal-Carr organisations create value from them? And what are the technical, cultural and commercial challenges they will face? This paper is part of a series of reports under the title of “Disrupt: Deliver” – Deloitte’s approach to developing understanding of and new points of view on disruptive technologies. And, in the following pages, we take a close look at the blockchain and tackle these questions. In our view, there are new and emerging opportunities for organisations in all sectors to create and deliver compelling services for their customers using the power of disruptive innovation. As they formulate their plans for the coming months, we also hope that this paper helps business and public sector leaders understand the cultural and organisational challenges that are inevitably brought by the use of blockchain technologies, and provides them with the insights they need to overcome them. We hope that you find this paper useful and we look forward to your feedback. Stephen Marshall Vimi Grewal-Carr Stephen Marshall Managing Partner for Innovation Partner Deloitte LLP Deloitte LLP Blockchain Enigma. Paradox. Opportunity 1

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. Introduction “ Obviously a closed platform is a serious brake on innovation.” Sir Tim Berners-Lee, inventor of the World Wide Web Throughout history, many items have been used as The concept is approaching a tipping point in its 5 a store of value, from cowrie shells and clay tablets adoption, according to the World Economic Forum. to coins and today’s ubiquitous paper money. Even VentureScanner.com estimates that there are distributed payment networks have existed for now over 800 new ventures in the global Bitcoin millennia: thousands of years before the advent of ‘ecosystem’, which have collectively raised over $1 6 Bitcoin, the people of South Asia, Africa and the billion in funding. These companies include specialist Persian Gulf were using hawala for peer-to-peer money Bitcoin exchanges, such as Coinbase and Itbit; Bitcoin 1 transfer. ‘miners’, such as Petamine and 21e6, which provide specialist computer hardware for validating Bitcoin As our understanding of money has matured, so transactions; Bitcoin wallet and payments companies, have the methods and modes for exchanging it. The such as EasyWallet.org and CryptoPay; and many other 7 Bitcoin ‘experiment’, which was started by Satoshi infrastructure, news and related services companies. Nakamoto (presumed to be a pseudonym) in 2008, has demonstrated that there can be a viable digital In the FinTech space, the New York-based financial alternative to cash and other mediums of exchange innovation start-up R3CEV has announced that it is 2 in modern society. And although Bitcoin has had a working with over 40 banks to conduct research chequered history, with its association with the dark and experiments with the aim of creating a new net and websites like Silk Road, it has also triggered industry-wide blockchain.8 Separately, Visa Europe, debates about the opportunities that come from the Westpac, the Commonwealth Bank of Australia, blockchain – the technology ‘backbone’ and protocols RBS and many of the UK’s high street banks have all that Bitcoin and other digital currencies use.3 announced that they are working on their own 9,10,11,12 proof-of-concepts using blockchain. Citi According to the Bank of England, a blockchain is claims to have built three blockchains and its own 13 “a technology that allows people who don’t know cryptocurrency, ‘Citicoin’, to test them. And the each other to trust a shared record of events”.4 first patent for a securities settlement system using This shared record, or ledger, is distributed to all cryptocurrencies has been filed by an investment 14 participants in a network who use their computers to bank. validate transactions and thus remove the need for a third party to intermediate. 2

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. For consumers, a growing number of mainstream merchants accept Bitcoin as payment for their goods or A blockchain is “a technology that services. Overstock.com, one of the first major online retailers to accept Bitcoins, made more than $124,000 in allows people who don’t know Bitcoin sales on January 10, 2014, its first day of accepting 15 each other to trust a shared record the currency. Recently, Overstock.com became the first company to receive approval from the US Securities and 4 Exchange Commission to issue shares using the Bitcoin of events”. This shared record, 16 blockchain. or ledger, is distributed to all Understandably, the focus on digital currencies like Bitcoin participants in a network who has created a common misconception that blockchains use their computers to validate are relevant only to the banking sector. “There has long been significant interest in the many different uses transactions and thus remove for blockchain technology,” says one commentator, the need for a third party to “However, the ‘non-currency’ use-cases … have until recently, generally commanded less total mindshare than intermediate. 17 ‘currency’ use-cases.” So who else can benefit from a blockchain? How does it generate value? And, perhaps more importantly, how can the technology be applied to existing organisations and their current business models? This paper aims to address these questions and help leaders in different sectors navigate the emerging opportunities offered by blockchain technology. Blockchain’s impact is illustrated in four domains: banking, insurance, the public sector and the media industry. We also discuss some of the challenges as organisations start planning to adopt this technology. Blockchain Enigma. Paradox. Opportunity 3

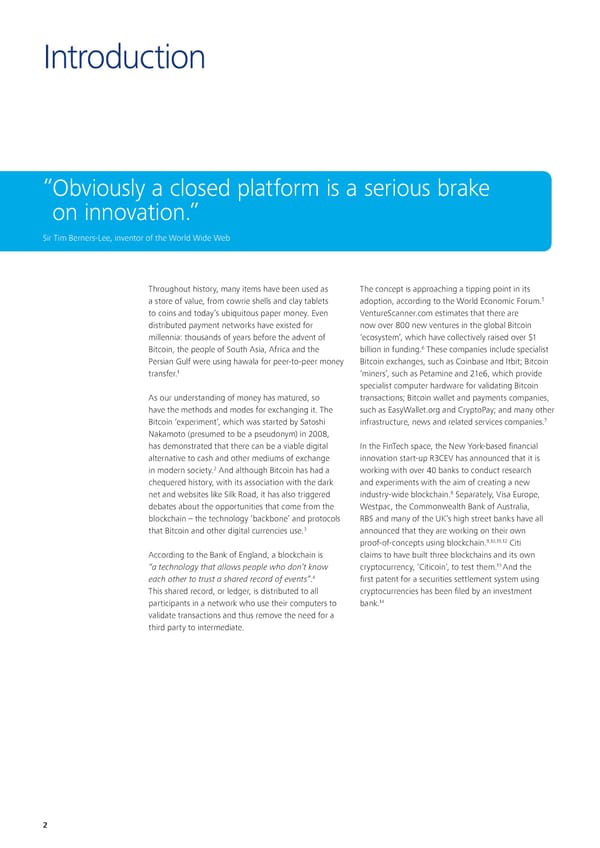

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. What is a blockchain? “ The network is robust in its unstructured simplicity. 18 Nodes work all at once with little coordination.” Satoshi Nakamoto How does a blockchain work? We can illustrate how a blockchain works by using Bitcoin In his original Bitcoin white paper, Satoshi Nakamoto as an example, as shown in Figure 1. Bitcoin, like other defined an electronic coin – the Bitcoin – as “a chain blockchains, uses cryptography to validate transactions, 19 of digital signatures” known as the ‘blockchain’. The which is why digital currencies are often referred to blockchain enables each coin owner to transfer an amount as ‘cryptocurrencies’. Bitcoin users gain access to their of currency directly to any other party connected to the balance through a password known as a private key. same network without the need for a financial institution Transactions are validated by a network of users called to mediate the exchange. ‘miners’, who donate their computer power in exchange for the chance to gain additional bitcoins using a shared database and distributed processing. Figure 1. How the Bitcoin blockchain works Bob owes Alice To pay her, he Bob gets Alice’s The app alerts The miners verify any transactions The new block is put …hen a miner solves The algorithm …ithin ten minutes All the transactions money for lunch. needs two pieces public key by Bitcoin ‘miners’ that Bob has occur in the network in the network so the cryptographic rewards the of Bob initiating in the block are now He installs an app of information: scanning a code around the world of enough bitcoins to at any time. All the that miners can problem, the winning miner with the transaction, fulfilled and Alice on his smartphone his private key and from her phone, or the impending make the payment. pending transactions verify if its discovery is †‡ bitcoins, and the he and Alice each gets paid. to create a new her public key. by having her email transaction. ‘iners’ in a given timeframe transactions are announced to the new block is added receive the first Bitcoin wallet. him the payment provide transaction are grouped in legitimate. rest of the network. to the front of confirmation that A wallet app is like a address, a string of verification services. a block for ƒerification is the blockchain. the bitcoin was mobile banking app seemingly random verification. €ach accomplished by €ach block ˆoins signed over to her. and a wallet is like a numbers and block has a uni‚ue completing comple„ the prior block so bank account. letters. identifying number, cryptographic a chain is made – creation time and computations. the blockchain. reference to the previous block. Anyone who has a public key can send money to a Bitcoin address, but only a signature generated by the private key can release money from it. †’ Šraphic: ‹eloitte Œniversity Žress. ‘ource: American Banker 4

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. What is in a blockchain? Given the latest block, it is possible to access all previous Despite its apparent complexity, a blockchain is just blocks linked together in the chain, so a blockchain another type of database for recording transactions – database retains the complete history of all assets and one that is copied to all of the computers in a participating instructions executed since the very first one – making network.21 A blockchain is thus sometimes referred to as its data verifiable and independently auditable. As the a ‘distributed ledger’. Data in a blockchain is stored in number of participants grows, it becomes harder for fixed structures called ‘blocks’. The important parts of malicious actors to overcome the verification activities of a block are: the majority. Therefore the network becomes increasingly robust and secure. Indeed, blockchain solutions are being • its header, which includes metadata, such as a unique planned to protect data from the UK’s nuclear power block reference number, the time the block was created stations, flood-defence mechanisms and other critical and a link back to the previous block infrastructure.23 • its content, usually a validated list of digital assets and instruction statements, such as transactions made, their amounts and the addresses of the parties to those transactions.22 Figure 1. How the Bitcoin blockchain works Bob owes Alice To pay her, he Bob gets Alice’s The app alerts The miners verify any transactions The new block is put …hen a miner solves The algorithm …ithin ten minutes All the transactions money for lunch.needs two piecespublic key by Bitcoin ‘miners’ that Bob has occur in the network in the network so the cryptographic rewards theof Bob initiatingin the block are now He installs an appof information: scanning a code around the world of enough bitcoins to at any time. All the that miners can problem, the winning miner with the transaction,fulfilled and Alice on his smartphone his private key and from her phone, or the impending make the payment.pending transactions verify if its discovery is †‡ bitcoins, and the he and Alice each gets paid. to create a new her public key.by having her email transaction. ‘iners’ in a given timeframe transactions are announced to the new block is added receive the first Bitcoin wallet.him the payment provide transaction are grouped inlegitimate. rest of the network.to the front ofconfirmation that A wallet app is like a address, a string of verification services.a block for ƒerification is the blockchain.the bitcoin was mobile banking app seemingly random verification. €ach accomplished by €ach block ˆoins signed over to her. and a wallet is like a numbers and block has a uni‚ue completing comple„ the prior block so bank account.letters.identifying number, cryptographic a chain is made – creation time and computations. the blockchain. reference to the previous block. Anyone who has a public key can send money to a Bitcoin address, but only a signature generated by the private key can release money from it. †’ Šraphic: ‹eloitte Œniversity Žress. ‘ource: American Banker Blockchain Enigma. Paradox. Opportunity 5

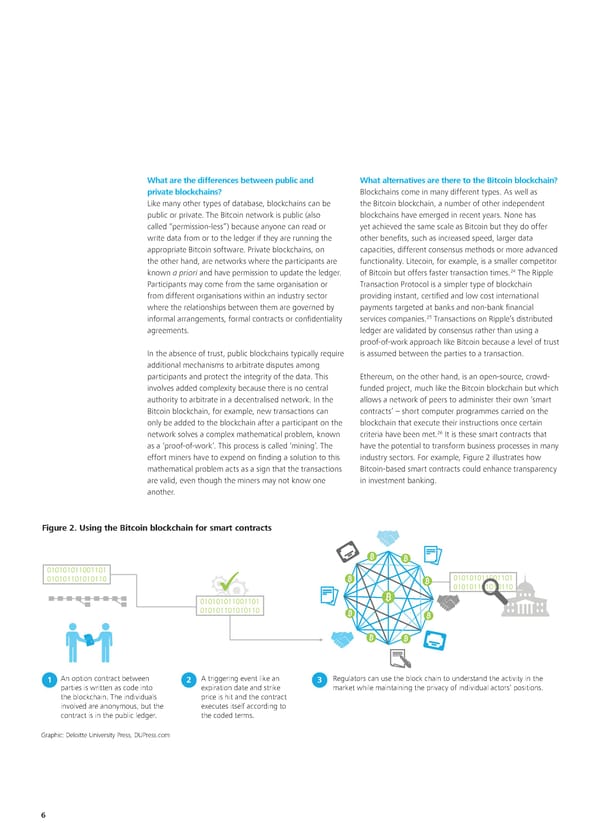

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. What are the differences between public and What alternatives are there to the Bitcoin blockchain? private blockchains? Blockchains come in many different types. As well as Like many other types of database, blockchains can be the Bitcoin blockchain, a number of other independent public or private. The Bitcoin network is public (also blockchains have emerged in recent years. None has called “permission-less”) because anyone can read or yet achieved the same scale as Bitcoin but they do offer write data from or to the ledger if they are running the other benefits, such as increased speed, larger data appropriate Bitcoin software. Private blockchains, on capacities, different consensus methods or more advanced the other hand, are networks where the participants are functionality. Litecoin, for example, is a smaller competitor known a priori and have permission to update the ledger. of Bitcoin but offers faster transaction times.24 The Ripple Participants may come from the same organisation or Transaction Protocol is a simpler type of blockchain from different organisations within an industry sector providing instant, certified and low cost international where the relationships between them are governed by payments targeted at banks and non-bank financial 25 informal arrangements, formal contracts or confidentiality services companies. Transactions on Ripple’s distributed agreements. ledger are validated by consensus rather than using a proof-of-work approach like Bitcoin because a level of trust In the absence of trust, public blockchains typically require is assumed between the parties to a transaction. additional mechanisms to arbitrate disputes among participants and protect the integrity of the data. This Ethereum, on the other hand, is an open-source, crowd- involves added complexity because there is no central funded project, much like the Bitcoin blockchain but which authority to arbitrate in a decentralised network. In the allows a network of peers to administer their own ‘smart Bitcoin blockchain, for example, new transactions can contracts’ – short computer programmes carried on the only be added to the blockchain after a participant on the blockchain that execute their instructions once certain network solves a complex mathematical problem, known criteria have been met.26 It is these smart contracts that as a ‘proof-of-work’. This process is called ‘mining’. The have the potential to transform business processes in many effort miners have to expend on finding a solution to this industry sectors. For example, Figure 2 illustrates how mathematical problem acts as a sign that the transactions Bitcoin-based smart contracts could enhance transparency are valid, even though the miners may not know one in investment banking. another. Figure 2. Using the Bitcoin blockchain for smart contracts 1 An option contract between 2 A triggering event like an 3 egulators can use the block chain to understand the activity in the parties is written as code into epiration date and strike market while maintaining the privacy o individual actors’ positions. the blockchain. The individuals price is hit and the contract involved are anonymous, but the eecutes itsel according to contract is in the public ledger. the coded terms. Graphic: Deloitte University Press, DUPress.com 6

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. In addition, technology companies like Microsoft are now providing ‘Blockchain-as-a-Service’ (BaaS) on their existing Blockchains come in many cloud platforms.27 BaaS enables developers from any organisation to deploy private or semi-public blockchains different types. As well as the using Bitcoin, Ripple, Ethereum and other protocols, Bitcoin blockchain, a number of and experiment with decentralised applications without incurring the capital costs associated with setting up their other independent blockchains have own networks. emerged in recent years. None What elements are common to all blockchains? has yet achieved the same scale • A blockchain is digitally distributed across a number of computers in almost real-time: the as Bitcoin but they do offer other blockchain is decentralised, and a copy of the entire record is available to all users and participants of a benefits, such as increased speed, peer-to-peer network. This eliminates the need for larger data capacities, different central authorities, such as banks, as well as trusted intermediaries, such as brokerage firms. consensus methods or more • A blockchain uses many participants in the network advanced functionality. to reach consensus: the participants use their computers to authenticate and verify each new block – for example, to ensure that the same transaction does not occur more than once. New blocks are only adopted by the network once a majority of its participants agree that they are valid. • A blockchain uses cryptography and digital signatures to prove identity: transactions can be traced back to cryptographic identities, which are theoretically anonymous, but can be tied back to real- life identities with some reverse engineering. • A blockchain has mechanisms to make it hard (but not impossible) to change historical records: even though all data can be read and new data can be written, data that exists earlier in a blockchain cannot in theory be altered except where the rules embedded within the protocol allow such changes – for instance, by requiring more than 50 per cent of the network to agree on a change. • A blockchain is time-stamped: transactions on the blockchain are time-stamped, making it useful for tracking and verifying information. • A blockchain is programmable: instructions embedded within blocks, such as “if” this “then” do that “else” do this, allow transactions or other actions to be carried out only if certain conditions are met, and can be accompanied by additional digital data. Blockchain Enigma. Paradox. Opportunity 7

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. The Internet of Value-Exchange “ [The] Bitcoin protocol and network today is that foundational layer. It is [a] value transfer network. Beyond that, it is a core, backbone security service securing contracts, physical and digital property, equities, bonds, robot AI and an enormous wave of 28 applications which have not yet been conceived.” Jeff Garzik, Bitcoin core developer and CEO, Dunvegan Space Systems How does a blockchain deliver value? The problem for many organisations at the centre of The way in which many established transaction processing traditional value-exchange processes, especially banks, or systems work is very different from the decentralised and credit card and other types of payment company, is that distributed nature of a blockchain. For certain applications, blockchain technology is a double-edged sword. the current model of value creation is likely to be bettered by faster, cheaper, more reliable and transparent processes Public blockchains, like Bitcoin, Litecoin and others, enabled by the blockchain. This is illustrated in Figure 3. threaten disintermediation as they empower peer-to- However, Jeff Garzik, one of Bitcoin’s core developers, peer networks. The value they create is taken away from cautions against trying to do too much with a blockchain: central institutions and returned mainly to consumers. “Do not try to stuff every feature into the Bitcoin protocol. However, early predictions of the demise of our global Let it do what it does best. Build systems on top of Bitcoin banking system or national governments seem hasty which use its strengths…. Putting all the world’s coffee and premature in the cold light of day. The reality is that transactions, and all the world’s stock trades, and all the while many transactions will benefit from a decentralised world’s Internet of Things device samplings, on the Bitcoin approach, many others will still need to be handled via an 29 blockchain seems misguided”. intermediary, which can, despite additional complexities and regulation, veto suspect transactions, provide There are clearly both practical and philosophical limits guarantees and indemnities, and deliver a range of to the scope of applications amenable to blockchain associated products and services that consumers cannot approaches. But with a little careful thought, linking users yet access on the blockchain. and organisations directly together through a shared ledger and distributing processing across a network, we should be able to remove the friction that makes existing transactions slow and expensive. And because a blockchain breaks many of the rules and conventions that traditional business processes are built upon, it forces organisations to think differently about how they create value. 8

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. Figure 3. Value of a blockchain Single organisation Collaborating organisations Characteristic Consumer blockchain blockchain on a blockchain • Increases speed of exchange • Increases speed of exchange • Increases speed of exchange, and reduces time delays between departments/ which reduces baclog and Decentralised • Reduces price of exchange divisions, which reduces overall costs processing network (if a fee is charged) baclog and overall costs • Improves availability, reliability • Improves quality, reliability and • Improves availability, reliability and maintainability of services availability of services and maintainability of services • Increases transparency (in the • Increases efficiency by • Increases efficiency by case of public blocchains) standardising data formats standardising data formats • Increases confidence across departments/divisions across multiple organisations, and ensures process integrity enabling interoperability, and • Improves auditability because ensures process integrity Distributed ledger records are verified in near • Reduces ris of fraud, error realtime and invalid transactions across the group because records cannot be altered • Improves auditability because records are verified in near realtime • Reduces ris of fraud or theft • elps identify customers and • elps identify customers Digital signatures participating departments/ and participating organisations divisions • nables transaction criteria • nables new capabilities to be • nables new capabilities to be to be strictly enforced added to existing services and added to existing services and Programmable logic processes processes across the group • nables collaboration criteria to be strictly enforced • ublic blocchain enables • rivate blocchain restricts • rivate blocchain restricts anyone to participate in any processing to members or participation to members of Private vs. public capacity employees of the organisation the group of organisations but but opens up use to opens up use to consumers consumers ource €eloitte There are considerable opportunities for organisations that adopt blockchain technology internally, using bespoke blockchains or so-called ‘side-chains’, which provide some interoperability with public blockchains, like Bitcoin, while 30 adding new functionality. Perhaps the most significant opportunity, though, comes from blockchains that link currently disparate parts of one enterprise together or even many different organisations from within the same sector. Blockchain Enigma. Paradox. Opportunity 9

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. Key challenges “ There have been a few different start-ups trying to create basically their own blockchains with specific use-cases. In our view we feel that kind of defeats the purpose of having a network itself because it just 31 recreates silos.” Tim Swanson, head of research at R3CEV As the blockchain ecosystem evolves and different use- Organisation cases emerge, organisations in all industry sectors will face The blockchain creates most value for organisations a complex and potentially controversial array of issues, as when they work together on areas of shared pain or well as new dependencies. shared opportunity – especially problems particular to each industry sector. The problem with many current Awareness and understanding approaches, though, is that they remain stove-piped: The principal challenge associated with blockchain is a lack organisations are developing their own blockchains of awareness of the technology, especially in sectors other and applications to run on top of them. In any one than banking, and a widespread lack of understanding industry sector, many different chains are therefore being of how it works. This is hampering investment and the developed by many different organisations to many exploration of ideas. As George Howard, contributor different standards. This defeats the purpose of distributed to Forbes Media and Entertainment, says about the ledgers, fails to harness network effects and can be less music business, “Artists – visual, musical, or otherwise efficient than current approaches. – really must educate themselves about these emerging technologies, or suffer the fate of being exploited by those Key questions every leader should ask: 32 who do”. This is a message that applies to organisations, • What problems or opportunities does my organisation also. share with others in the sector? Key questions every leader should ask: • Will a blockchain approach still leave a marketplace in • Who is a thought leader in my industry in blockchain which we can compete? technology? • What are the bottlenecks that might prevent us from • To whom do I turn to in my organisation to explain working together? blockchains? • How can we take a lead in bringing the community • How do we increase our level of understanding – together? at all levels? • How many organisations would be needed to create a • Is a blockchain right for my organisation? And, if so, critical mass? how are we thinking about applying it and what would this mean organisationally and culturally? • What are the common standards we require? • With whom do I interact within my organisation to collaborate and deliver? • What are my competitors and peers saying about blockchain? 10

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. Culture Cost and efficiency A blockchain represents a total shift away from the The speed and effectiveness with which blockchain traditional ways of doing things – even for industries networks can execute peer-to-peer transactions comes that have already seen significant transformation from at a high aggregate cost, which is greater for some types digital technologies. It places trust and authority in a of blockchain than others. This inefficiency arises because decentralised network rather than in a powerful central each node performs the same tasks as every other node institution. And for most, this loss of control can be deeply on its own copy of the data in an attempt to be the first unsettling. to find a solution. For the Bitcoin network, for example, which uses a proof-of-work approach in lieu of trusting It has been estimated that a blockchain is about 80 per participants in the network, the total running costs cent business process change and 20 per cent technology associated with validating and sharing transactions on the 33 implementation. This means that a more imaginative public ledger are estimated to be as much as $600 million 34 approach is needed to understand opportunities and also a year and rising. This total does not include the capital how things will change. costs associated with acquiring specialist mining hardware. Key questions every leader should ask: Blockchains are something of a productivity paradox, • W here can we pilot new blockchain approaches on the therefore. At the scale of the entire network the process is edges of our business? significantly productivity enhancing, but requires a certain ‘critical mass’ of nodes. Yet, even so, individual nodes can • W ho will be most affected by blockchain work extremely hard and may not contribute very much to implementations and are they supportive? the network overall. • W hich areas of our business are likely to be most Therefore, decisions about implementing blockchain disrupted? applications need to be carefully thought through. The returns to individual processing nodes – either individuals • H ave we thought about impacts on our strategy, in a public blockchain or organisations in a sector-wide organisational structure, business processes, blockchain – may diminish as the network grows in size. governance, talent and legacy systems? This means that blockchain applications must harness network effects to deliver value to consumers or to sectors at large. Key questions every leader should ask: • What is the business case for implementing a blockchain? How do we make it pay? • What are the bottlenecks in the processes we are replacing with the blockchain? • What are the main drivers of cost in our implementation of the blockchain? • How can the cost and processing load be shared among participating organisations? Blockchain Enigma. Paradox. Opportunity 11

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. Regulation and governance Security and privacy Regulations have always struggled to keep up with While cryptocurrencies like Bitcoin offer pseudonymity advances in technology. Indeed, some technologies like (Bitcoin transactions are tied to ‘wallets’ rather than to the Bitcoin blockchain bypass regulation completely to individuals), many potential applications of the blockchain tackle inefficiencies in conventional intermediated payment require smart transactions and contracts to be indisputably networks. One of the other challenges of the blockchain linked to known identities, and thus raise important approach, which was also one of its original motivations, is questions about privacy and the security of the data stored that it reduces oversight. and accessible on the shared ledger. Centralised systems, particularly in financial services, also Some argue that while no technology is completely secure, “act as shock absorbers in times of crisis” despite their no one has yet managed to break the encryption and 35 36 challenges and bottlenecks. Decentralised networks decentralised architecture of a blockchain. Identities can be much less resilient to shocks, which can impact created within a blockchain would be unique and offer participants directly, unless careful thought is given to their a higher level of assurance that the party was who they design. claim to be. But these claims do not take away from the need for every organisation adopting the technology to There is thus a strong argument for blockchain applications consider how privacy and security can inform the design. to work within existing regulatory structures not outside In particular, driving public acceptance of blockchain of them, but this means that regulators in all industries applications will likely mean proactively framing the have to understand the technology and its impact on the discussion of privacy around concepts of value, security businesses and consumers in their sector. and trust. Key questions every leader should ask: Key questions every leader should ask: • How do current regulations impact our application of • How are we applying security to our application and is blockchain? privacy a priority? • Where are current regulations lacking? • Who has access to the ledger and how is access controlled? • What will a regulator want to know about our application? • How are updates to the software or application agreed and made? • How do we work with the regulator to bring our application to market? • Have we thought about what our customers think about our application beforehand? • What else might we have to do alongside the existing rules to keep regulators happy? • How are we engaging with our customers? 12

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. From vision to reality “ We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. Don’t let yourself be lulled into inaction.” Bill Gates, technologist and philanthropist Today, performing an online transaction – such as paying For start-ups and entrepreneurs, interest in the blockchain for goods or services – is almost impossible without space is growing rapidly. For legacy organisations, involving a third party, such as a bank or credit card particularly large multinationals, the situation is more company. When these transactions work, they are taken challenging. These types of organisation can be stirred for granted. When they fail, the complexities, fragmented into action by identifying specific opportunities where nature and opacity of the systems used to handle the the existing modes of value exchange in the sector create exchange are often exposed. bottlenecks and then analysing how a distributed ledger might help address them. By solving concrete problems, Some bold predictions suggest that the institutions at the organisations can more effectively identify the technical, centre of current transaction systems will cease to exist in organisational, cultural and talent changes necessary to just a few years. Others are more conservative, positing realise new benefits – and then scale what works. a relatively low impact in the short term for blockchain applications other than payments. The reality is likely to be Beyond the tactical changes for organisations, it is somewhere between these two extremes. And different important to consider the potential magnitude of business markets will also move at different speeds, particularly and process change caused by a shift onto sector- where the role of central institutions is less dominant. wide blockchain platforms. Engaging with like-minded organisations to develop and foster these collaborations Jonathan Swift, author of Gulliver’s Travels, said, “Vision and prepare for change is vital. Understanding the risks is the art of seeing what is invisible to others” and this and level of disruption beforehand is also key to the design quote sums up what is needed from businesses today. As of effective systems. the blockchain ecosystem steadily builds, the prospects of more significant change occurring within the next decade Ultimately, the blockchain is not just about will increase. Organisations that fail to create a vision cryptocurrencies and faster peer-to-peer payments. It and adopt a ‘wait-and-see’ attitude towards blockchain is also part of an ecosystem of advanced but fledgling are unlikely to develop the expertise or break down technologies, including artificial intelligence, robotics and the organisational and cultural barriers needed to work crowdsourcing, that look set to play a fundamental role effectively with this new technology. Nor are they likely in the future of commerce and society. Blockchain will to engage their peers or stakeholders in discussions about affect the way that individuals and organisations interact, how the technology may affect their industry at large. the way that businesses collaborate with one another, the transparency of processes and data, and, ultimately, the productivity and sustainability of our economy. Blockchain Enigma. Paradox. Opportunity 13

To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. Endnotes 1. Hawala relies on an extensive network of connected individuals (“Hawaladas”) to agree and validate transactions between parties. It offers many of the same benefits we would recognise in today’s digital networks, including cost-effectiveness, efficiency, reliability and lack of bureaucracy. Further information on Hawala can be found in “An Introduction to the Concept and Origins of Hawala”, Edwina A. Thompson, Journal of the History of International Law, Volume 10, 2008. 2. “Bitcoin: A Peer-to-Peer Electronic Cash System”, Satoshi Nakamoto, 2008. See also: https://Bitcoin.org/Bitcoin.pdf 3. “Digital Gold: The Untold Story of Bitcoin”, Nathanial Popper, May 2015. 4. See: http://blockchain.bankofenglandearlycareers.co.uk/ 5. “Deep shift: Technology tipping points and societal impact”, World Economic Forum, September 2015. See also: http://www3. weforum.org/docs/WEF_GAC15_Technological_Tipping_Points_report_2015.pdf 6. Information valid for December 2015. See: https://www.venturescanner.com/ 7. See: https://www.venturescanner.com/files/sector/Bitcoin.pdf 8. “R3’s distributed ledger initiative grows to 42 bank members and looks to extend reach to the broader financial services community”, Jo Lang, R3CEV, December 2015. See also: http://r3cev.com/press/2015/12/17/r3s-distributed-ledger-initiative-grows- to-42-bank-members-and-looks-to-extend-reach-to-the-broader-financial-services-community 9. See: http://www.coindesk.com/visa-europe-announces-blockchain-remittance-proof-of-concept/ 10. “RBS Trials Ripple as Part of £3.5 Billion Tech Revamp”, Grace Caffyn, CoinDesk, June 2015. See also: http://www.coindesk.com/ rbs-trials-ripple-part-3-5-billion-tech-revamp/ 11. See: http://siliconangle.com/blog/2015/06/09/westpac-anz-trial-ripples-blockchain-ledger-system-but-say-no-to-Bitcoin-for-now/ 12. See: http://www.ibtimes.co.uk/cryptocurrency-round-blockchain-bug-commonwealth-bank-australia-embraces-Bitcoin-1503832 13. See: http://cointelegraph.com/news/114717/citi-develops-3-blockchains-with-own-citicoin-token 14. “ Cryptographic Currency For Securities Settlement”, Paul Walker and Phil Venables (Goldman Sachs), US Patent Application 20150332395, November 2015. See also: http://appft.uspto.gov/netacgi/nph-Parser?Sect1=PTO2&Sect2=HITOFF&p=1&u=%2Fneta html%2FPTO%2Fsearch-bool.html&r=1&f=G&l=50&co1=AND&d=PG01&s1=20150332395&OS=20150332395&RS=20150332395 15. “Overstock CEO Patrick Byrn to keynote Bitcoin 2014 conference,” John Southurst, CoinDesk, March 25, 2014. See also: http:// www.coindesk.com/overstock-ceo-patrick-byrne-keynote-Bitcoin-2014-conference/ 16. “SEC Approves Overstock.com S-3 Filing to Issue Shares Using Bitcoin Blockchain”, Jacob Donnelly, Bitcoin Magazine, December 2015. See also: https://Bitcoinmagazine.com/articles/sec-approves-overstock-com-s-filing-to-issue-shares-using-Bitcoin- blockchain-1449539558 17. “State of Bitcoin Q3 2015: Banks Embrace Blockchain Amid Bitcoin Funding Slowdown”, Garrick Hileman, CoinDesk, October 2015. See also: http://www.coindesk.com/sob-q3-2015-banks-embrace-blockchain-amid-bitcoin-funding-slowdown/ 18. “Bitcoin: A Peer-to-Peer Electronic Cash System”, Satoshi Nakamoto, 2008. See also: https://Bitcoin.org/Bitcoin.pdf 19. Ibid. 20. See: http://cdn.americanbanker.com/media/ui/how-bit-works-big.jpg 21. For an excellent and simple introduction to blockchain technology, see http://bitsonblocks.net/2015/09/09/a-gentle-introduction- to-blockchain-technology/ 22. An example of what the Bitcoin blockchain contains can be found on the blog post, “How to Parse the Bitcoin Blockchain” by John W. Ratcliffe, January 2014. See also: http://codesuppository.blogspot.co.uk/2014/01/how-to-parse-Bitcoin-blockchain.html 23. “ Security firm Guardtime courting governments and banks with industrial-grade blockchain”, Ian Allison, International Business Times, January 2016. See also: http://www.ibtimes.co.uk/security-firm-guardtime-courting-governments-banks-keyless- blockchain-1535835 24. See: https://litecoin.org 25. See: https://ripple.com/ 26. “ A Next-Generation Smart Contract and Decentralized Application Platform”, Ethereum. See also: https://github.com/ethereum/ wiki/wiki/White-Paper 27. “Microsoft Explores Adding Ripple Tech to Blockchain Toolkit”, Pete Rizzo, CoinDesk, December 2015. See also: http://www. coindesk.com/microsoft-hints-future-ripple-blockchain-toolkit/ 28. “M aking Decentralized Economic Policy”, Jeff Garzik, weusecoins. See also: https://www.weusecoins.com/making-decentralized- economic-policy/ 29. Ibid. 30. For an explanation of ‘side-chains’, see: https://medium.com/zapchain-magazine/how-to-explain-sidechains-to-a-parent- 1739f6a28bd#.8u8tsqkh2 31. “B lockchain expert Tim Swanson talks about R3 partnership of Goldman Sachs, JP Morgan, UBS, Barclays et al”, Ian Allison, International Business Times, September 2015. See also: http://www.ibtimes.co.uk/blockchain-expert-tim-swanson-talks-about-r3- partnership-goldman-sachs-jp-morgan-ubs-barclays-1519905 32. “The Bitcoin Blockchain Just Might Save The Music Industry… If Only We Could Understand It”, George Howard, Forbes, May 2015. See also: http://www.forbes.com/sites/georgehoward/2015/05/17/the-Bitcoin-blockchain-just-might-save-the-music-industry-if- only-we-could-understand-it/ 33. “A Decision Tree for Blockchain Applications: Problems, Opportunities or Capabilities?”, William Mougayar, Startup Management, November 2015. See also: http://startupmanagement.org/2015/11/30/a-decision-tree-for-blockchain-applications-problems- opportunities-or-capabilities/ 34. “Understanding the blockchain”, William Mougayar, O’Reilly Radar, January 2015. See also: http://radar.oreilly.com/2015/01/ understanding-the-blockchain.html 35. “Why the blockchain will propel a services revolution”, James Eyers, Australian Financial Review, December 2015. See also: http:// www.afr.com/technology/why-the-blockchain-will-propel-a-services-revolution-20151212-glm6xf 36. “Will the blockchain model change insurance?”, Nick Kestrel, RiskHeads, January 2015. See also: http://www.riskheads.org/Bitcoin- blockchain-model-change-insurance/ 14

Contacts David Sproul Harvey Lewis Senior Partner and Chief Executive Director of Insight +44 (0)20 7303 6641 +44 (0)20 7303 6805 dsproul@deloitte.co.uk harveylewis@deloitte.co.uk Vimi Grewal-Carr Alexander Shelkovnikov Managing Partner for Innovation Senior Manager, Corporate Venturing and Blockchain Lead +44 (0)20 7303 7859 +44 (0) 20 7303 8895 vgrewalcarr@deloitte.co.uk alshelkovnikov@deloitte.co.uk Stephen Marshall Tyler Welmans Partner Senior Manager, Blockchain Lab +44 (0)141 304 5743 +44 (0) 20 7303 5653 stephenmarshall@deloitte.co.uk twelmans@deloitte.co.uk Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Please see www.deloitte.co.uk/about for a detailed description of the legal structure of DTTL and its member firms. Deloitte LLP is the United Kingdom member firm of DTTL. This publication has been written in general terms and therefore cannot be relied on to cover specific situations; application of the principles set out will depend upon the particular circumstances involved and we recommend that you obtain professional advice before acting or refraining from acting on any of the contents of this publication. Deloitte LLP would be pleased to advise readers on how to apply the principles set out in this publication to their specific circumstances. Deloitte LLP accepts no duty of care or liability for any loss occasioned to any person acting or refraining from action as a result of any material in this publication. © 2016 Deloitte LLP. All rights reserved. Deloitte LLP is a limited liability partnership registered in England and Wales with registered number OC303675 and its registered office at 2 New Street Square, London EC4A 3BZ, United Kingdom. Tel: +44 (0) 20 7936 3000 Fax: +44 (0) 20 7583 1198. Designed and produced by The Creative Studio at Deloitte, London. J3980

Is your business ready for Blockchain?

Blockchain is changing our digital landscape.

It will change the way consumers interact with each other, and the way in which traditional digital services are provided across all industries, globally. Prepare for disruption, or prepare to disrupt.

Read more about Blockchain - a protocol for exchanging value over the internet without an intermediary.

Blockchain: A new kind of platform.

The capability boundaries of traditional systems have for decades constrained the shape of our digital landscape and the systems and services we use.

Simple intermediary services account for £trillions in annual revenue globally. Blockchain changes the boundaries of what can and cannot be automated; further still blockchain provides new public infrastructure, a world computer upon which new automated services can be built for consumption at no cost to the consumer.

Blockchain changes the rules.

Unbounded in scope

Like the internet, blockchain is poised to disrupt all industries. A platform for value in all forms to be managed, and for consumers, organisations and regulators alike to connect and interact securely across a rapidly accelerating range of use-cases.

Hotwired for innovation

Blockchain is ushering in a new era of more connected, better integrated and efficient digital services.

But beyond efficiency and customer experience, Blockchain is poised to connect and empower the internet of things - our devices will soon be capable of independently owning, negotiating and purchasing (even selling) products. How will your business adapt to the rise of the robot customer?

We are a specialist team within Deloitte who aim to disrupt and deliver positive results to businesses, via the power of blockchain technology.

We get blockchain - we understand its importance, functionality and how to overcome the challenges. Our team have experience in the application of blockchain; building and implementing solutions utilising the platform.

We span across all industries and are tightly connected on a global level with blockchain specialist groups across Deloitte.

Blockchain applications in banking “ I don’t know what’s going to succeed. What I’m certain of is that we are going to see blockchain solutions, peer-to-peer solutions emerging in our industry and we want to be 1 close to that development.” Simon McNamara, Chief Administrative Officer, RBS A recent article from Let’s Talk Payments lists 26 In addition to the financial burden, Know Your Customer separate banks currently exploring the use of blockchain (KYC) requests can also delay transactions, taking 30 to 2 7 technology for payments processing. R3CEV, the New 50 days to complete to a satisfactory level. Current KYC York start-up, says that it is working with 42 banks to processes also entail substantial duplication of effort explore a common set of standards and best practices between firms. with a view to creating commercial applications using a 3 blockchain. While annual compliance costs are high, there are also large penalties for failing to follow KYC guidelines This doesn’t sound like an industry on the ropes. In fact, properly. Since 2009, regulatory fines, particularly in the the race to develop applications highlights a sector-wide US, have followed an upward trend, with record-breaking desire for change in traditional financial systems. In this fines levied during 2015.8 fast-moving environment, no one wants to be left behind. How the blockchain could help The thinking around blockchain concepts to facilitate The sharing of customer information is already starting the exchange of money is well-established. Indeed, this to take place. For example, SWIFT recently established is the original use-case for digital currencies like Bitcoin. its KYC Registry, with 1,125 member banks sharing KYC However, there are further opportunities for banks to documentation, but this amounts to only 16 per cent of 9 use the blockchain technology to improve other services the 7,000 banks in their network. and compliance activities less likely to be subject to disintermediation. The use of a distributed ledger system, such as a blockchain, however, could unlock advantages by Example: Know Your Customer automating processes and thus reducing compliance errors. A blockchain-based registry would not only remove What are the current bottlenecks or issues? the duplication of effort in carrying out KYC checks, Global efforts to prevent money laundering and the but the ledger would also enable encrypted updates to financing of terrorism are incredibly expensive for financial client details to be distributed to all banks in near real- firms to maintain. In 2014, it was estimated that global time. In addition, the ledger would provide a historical spending on Anti-Money Laundering (AML) compliance record of all documents shared and compliance activities 4 alone amounted to $10 billion. The banks are coming undertaken for each client. This record could be used to under pressure from investors and analysts to reduce provide evidence that a bank has acted in accordance costs, but many expect the budgets for their compliance with the requirements placed upon it should regulators teams to increase in the coming years rather than ask for clarification. It would also be of particular use decrease.5, 6 in identifying entities attempting to create fraudulent histories. Subject to the provisions of data protection regulation, the data within it could even be analysed by the banks to spot irregularities or foul play – directly targeting criminal activity. J3975_BlockchainInsert.indd 1 15/01/2016 17:00

Although many people perceive applications on the Endnotes blockchain to offer anonymity, the technology can actually 1. “ RBS Trials Ripple as Part of £3.5 Billion Tech Revamp”, be used to cement real-world identities to cryptographic Grace Caffyn, CoinDesk, June 2015. See also: http:// identities in the database. Companies like I/O Digital, Sho www.coindesk.com/rbs-trials-ripple-part-3-5-billion-tech- Card, Uniquid, Onename, Ascribe Gmbh and Trustatom revamp/ all offer businesses, including banks, the ability to scan 2. “ Know more about Blockchain: Overview, Technology, Application Areas and Use Cases”, Let’s Talk Payments. customer documents and identity information and then See also: http://letstalkpayments.com/an-overview-of- generate private and public keys to seal them before the blockchain-technology/ 3. “ R3’s distributed ledger initiative grows to 42 bank 10 data is encrypted and sent to the blockchain. The FinTech members and looks to extend reach to the broader startups Chainalysis and IdentifyMind Global help banks financial services community”, Jo Lang, R3CEV, December comply with KYC and AML regulations as they consider 2015. See also: http://r3cev.com/press/2015/12/17/r3s- whether to provide banking services to Bitcoin-related distributed-ledger-initiative-grows-to-42-bank-members- and-looks-to-extend-reach-to-the-broader-financial- 11 services-community businesses. 4. “ Global Anti-Money Laundering Survey 2014”, KPMG, Given the expectation that banks will increase their use January 2014. See also: https://home.kpmg.com/xx/en/ home/insights/2014/01/global-anti-money-laundering- of blockchain applications in areas such as transaction survey.html settlement and payment systems, the use of a common 5. “Banks face pushback over surging compliance and distributed ledger for KYC checks might also offer the regulatory costs”, Laura Noonan, Financial Times, May 2015. See also: http://www.ft.com/cms/s/0/e1323e18- opportunity to link many banks to enforce compliance. 0478-11e5-95ad-00144feabdc0.html#axzz3jN2kPKMc In the Netherlands, for example, Dutch banks are 6. “ Cost of Compliance 2015”, Thomson Reuters, May 2015. partnering with Innopay in an attempt to enrol a number See also: https://risk.thomsonreuters.com/special-report/ cost-compliance-2015 12 7. “ Cost of KYC too high says Swiss start up”, Elliott Holley, of other banks in a common digital identity service. This interoperability, combined with the application of smart Banking Technology, January 2014. See also: http://www. contracts could be used to automate some aspects of the bankingtech.com/195632/cost-of-kyc-too-high-says-swiss- start-up/ compliance process. For instance, transactions could only 8. See: http://graphics.thomsonreuters.com/15/bankfines/ be permitted to occur with parties for whom adequate KYC index.html evidence exists on the blockchain. 9. “ KYC Registry Factsheet”, SWIFT, December 2014. See also: https://complianceservices.swift.com/sites/ complianceservices/files/kyc_registry_factsheet_ Implications december_2014.pdf The burden of KYC compliance could be significantly 10. “ Blockchain tech powers identity management”, Bradley Cooper, Virtual Currency Today, August 2015. See also: reduced through the use of a shared database of client http://www.virtualcurrencytoday.com/articles/blockchain- background documentation. In some respects, use of a tech-powers-identity-management/ blockchain for settlements and payments creates an even 11. “ Can You Really ‘Know’ A Customer Who Uses Bitcoin?”, Penny Crosman, American Banker, December 2015. stronger case for tighter controls around KYC. See also: http://www.americanbanker.com/news/bank- technology/ Under the strain of regulation, creaking legacy IT systems 12. “ Dutch Interbank Digital Identity Service Announced”. See also: https://www.innopay.com/blog/dutch-interbank- and a tight market for technical talent, asking banks digital-identity-service-announced/ to make wholesale changes to their business models is difficult. Pilot programmes and proof-of-concept activities could allow banks to explore faster, cheaper, better ways of facilitating payments and improving KYC compliance. They Contact could also help regulators stay on top of changes in process Alexander Shelkovnikov Corporate Venturing and Blockchain Lead and technology. +44 (0) 20 7303 8895 alshelkovnikov@deloitte.co.uk Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Please see www.deloitte.co.uk/about for a detailed description of the legal structure of DTTL and its member firms. Deloitte LLP is the United Kingdom member firm of DTTL. This publication has been written in general terms and therefore cannot be relied on to cover specific situations; application of the principles set out will depend upon the particular circumstances involved and we recommend that you obtain professional advice before acting or refraining from acting on any of the contents of this publication. Deloitte LLP would be pleased to advise readers on how to apply the principles set out in this publication to their specific circumstances. Deloitte LLP accepts no duty of care or liability for any loss occasioned to any person acting or refraining from action as a result of any material in this publication. © 2016 Deloitte LLP. All rights reserved. Deloitte LLP is a limited liability partnership registered in England and Wales with registered number OC303675 and its registered office at 2 New Street Square, London EC4A 3BZ, United Kingdom. Tel: +44 (0) 20 7936 3000 Fax: +44 (0) 20 7583 1198. Designed and produced by The Creative Studio at Deloitte, London. J3980 J3975_BlockchainInsert.indd 2 15/01/2016 17:00

To start a new section, hold down the apple+shift keys and click Document Variables to release this object and type the section title in the box below. Document Title Template Document Subtitle Subtitle Blockchain applications in insurance “ When I saw what the fundamental principles of the blockchain provided, it was just patently obvious to me that it would make sense around 1 reducing fraud related instances of valuables.” Leanne Kemp, Chief Executive Officer, Everledger Insurers, like banks, are intermediaries and, at first glance, Example: Claims handling there is great potential for insurers to use blockchain technology to streamline payments of premiums and What are the current bottlenecks or issues? claims. For customers, insurance contracts are typically complex and difficult to understand because of the legal language In addition, blockchain technologies could support the used. In addition, when accidents or crimes happen, significant digital transformation underway in the industry customers can often be faced with a complex and drawn- because much of this transformation relies on data. For out claims process. example, actuaries and underwriters are using the ever- expanding universe of data to build models that more From the insurer’s perspective, the industry is facing accurately estimate risk and price it accordingly. Arguably ever-tighter regulation and a growing threat from fraud the most exciting example of this trend is in telematics: – whether from small-claims fraud by individuals or more insurers are using data from sensors to price motor risk serious and organised fraud spanning multiple insurers in more accurately, reducing the premiums of young safe the industry. The Insurance Fraud Bureau (IFB) is a not-for- drivers, and this technology is spreading to other types of profit body set up to tackle organised crime affecting the cover, such as home insurance. UK general insurance industry. In a typical motor insurance scam, for example, drivers deliberately stage or cause an However, unlike in banking, the general view among accident or even pretend to have had an accident, and the industry is one of ‘wait and see’. “Insurers do not claims are then made by the various criminals involved. necessarily need a current Bitcoin strategy to remain These so-called ‘crash for cash’ scams cost the industry 4 competitive,” says one observer, “but should nonetheless around £400 million a year. Where claims are made continue to monitor the space and consider it as an area against multiple policies held by different insurers, it 2 for potential innovation”. becomes difficult to detect the fraud unless cross-industry data is shared. Early activity has tended to focus on optimising current ways of working within organisations rather than on How the blockchain could help investigating the potential of a blockchain to address Smart contracts powered by a blockchain could provide industry-wide problems and opportunities. customers and insurers with the means to manage claims in a transparent, responsive and irrefutable Everledger, for example, uses the blockchain to create a manner. Contracts and claims could be recorded onto distributed ledger that records details of precious stones a blockchain and validated by the network, ensuring 3 like diamonds. This ledger allows insurers (as well as only valid claims are paid. For example, the blockchain potential purchasers) to check the history of any individual would reject multiple claims for one accident because stone, including previous claims that have been made, the network would know that a claim had already been helping insurers prevent, detect and counter fraud. made. Smart contracts would also enforce the claims – for instance, triggering payments automatically when certain conditions are met (and validated). J3975_BlockchainInsert.indd 3 15/01/2016 17:00

Edgelogic provides a bridge between the Internet of Things Endnotes – devices connected to the internet – and a blockchain, 1. “Blockchain Tackling Insurance Woes”, Mario Cotillard, conceivably allowing accidents or problems detected by Brave NewCoin, July 2015. See also: http://bravenewcoin. sensors in the home to trigger a set of instructions that com/news/blockchain-tackling-insurance-woes/ 5 2. See: http://novarica.com/Bitcoin-and-insurance-overview- automatically transfer cash for repairs from an insurer. and-key-issues/ 3. “Bitcoin: possible bane of the diamond thief”, Sally Adopting a common blockchain across the sector could Davies, Financial Times, February 2015. See also: create a step-change in value in the insurance industry: http://www.ft.com/cms/s/0/f2b0b2ee-9012-11e4-a0e5- claims-handling could become more efficient and 00144feabdc0.html#axzz3Qm7XPPbZ 4. See: https://www.insurancefraudbureau.org/insurance- streamlined, resulting in an improved customer experience. fraud/crash-for-cash/ Such an approach could also help to reduce further, if not 5. “Bitcoin: possible bane of the diamond thief”, Sally entirely prevent, fraud if identity management was also Davies, Financial Times, February 2015. See also: http://www.ft.com/cms/s/0/f2b0b2ee-9012-11e4-a0e5- enforced on the blockchain – meaning that criminals could 00144feabdc0.html#axzz3Qm7XPPbZ no longer crash for cash, or exploit the current challenges of sharing data unless their methods for obscuring identities became significantly more sophisticated. Contact Implications Alexander Shelkovnikov Corporate Venturing and Blockchain Lead A common claims-handling platform would still make it +44 (0) 20 7303 8895 possible for individual insurers to compete for customers, alshelkovnikov@deloitte.co.uk offering a range of products and prices by virtue of the smart contracts they set up. Moreover, a blockchain could allow the industry as a whole to streamline its processing and offer a better user experience for customers who have to make a claim. Simultaneously, storing claims and customer information on a blockchain would cut down fraudulent activity – it would certainly make it much harder for criminals to mask their identities or attempt to claim more than once. Indeed, in many respects, with projects like the IFB now long-established, the general insurance industry faces a smaller cultural and organisational hill to climb than does banking and other sectors. Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Please see www.deloitte.co.uk/about for a detailed description of the legal structure of DTTL and its member firms. Deloitte LLP is the United Kingdom member firm of DTTL. This publication has been written in general terms and therefore cannot be relied on to cover specific situations; application of the principles set out will depend upon the particular circumstances involved and we recommend that you obtain professional advice before acting or refraining from acting on any of the contents of this publication. Deloitte LLP would be pleased to advise readers on how to apply the principles set out in this publication to their specific circumstances. Deloitte LLP accepts no duty of care or liability for any loss occasioned to any person acting or refraining from action as a result of any material in this publication. © 2016 Deloitte LLP. All rights reserved. Deloitte LLP is a limited liability partnership registered in England and Wales with registered number OC303675 and its registered office at 2 New Street Square, London EC4A 3BZ, United Kingdom. Tel: +44 (0) 20 7936 3000 Fax: +44 (0) 20 7583 1198. Designed and produced by The Creative Studio at Deloitte, London. J3980 J3975_BlockchainInsert.indd 4 15/01/2016 17:00

To start a new section, hold down the apple+shift keys and click Document Variables to release this object and type the section title in the box below. Document Title Template Document Subtitle Subtitle Blockchain applications in the public sector “ The most efficient way to produce anything is to bring together under one management as many as possible of the activities needed to turn out the product.” Peter Drucker The public sector is a complex machine – centralised in Example: Asset registry respect of its responsibility for governance and public service delivery, yet fragmented and often disconnected What are the current bottlenecks or issues? in terms of its organisational structure and ability to share All land or property must be registered with the data. appropriate public sector body if it is bought, gifted, inherited, mortgaged or received in exchange for other 3 The effects of long-running austerity cut deep – property. In November 2015, the number of residential reductions in departmental budgets offer a stark choice property transactions in the UK exceeded 100,000, and to central and local government bodies alike: sweeping the number of non-residential transactions was nearly 4 cuts, shrinking headcount and reduced services on the 9,000. Across the financial year 2014-15, the total one hand or wholesale transformation of service delivery number of residential property transactions completed 5 on the other. with a value of £40,000 or above was over 1.2 million. Blockchains could be used to address inefficiencies in The size of the housing market makes it costly to keep current systems and increase the effectiveness of public track of the many property transactions that accumulate service delivery. For example, a blockchain could serve over time. And for buyers and sellers, information about as the official registry for government-licensed assets or the ownership of properties can only be accessed or intellectual property owned by citizens and businesses, updated via the central register held by the public sector. such as houses, vehicles and patents. A blockchain could facilitate voting in elections, ensuring that each eligible High property prices also make houses attractive to person uses only one vote. A blockchain could also help fraudsters who may use forged documents to transfer in back-office functions, to coordinate and streamline someone else’s property into their own name or to tendering and purchasing across departments, agencies, raise a mortgage on someone else’s property. Once and other arms-length bodies. In all cases, a blockchain they have raised money by mortgaging the property could reduce fraud and error while delivering big benefits without the owner’s knowledge they disappear without in terms of efficiency and productivity. making repayments, leaving the owner to deal with the 6 consequences. While interest in the technology appears to be growing, public sector applications using the blockchain are, as yet, Current measures to prevent property fraud have stopped rare. The government in Honduras, for example, kicked-off fraudulent applications on properties worth more than 7 a project last year with Factom to reduce fraud in its public £74 million. The challenge, though, is that property land registry by moving data onto a distributed ledger, but fraud is not easily detected so the responsibility falls on 1 this project has apparently stalled. And BitHealth, a US all parties, including home owners, the government, start-up, is investigating use of the Bitcoin blockchain to solicitors and mortgage lenders. And with interest rates store and transmit healthcare records securely to make it likely to rise in the future, the level of fraud may increase – 8 easier for patients to receive treatment wherever they are leaving more people to pick up the bill. 2 in the world. These are early days, though, and almost every part of the public sector could benefit in some way from blockchain technology. J3975_BlockchainInsert.indd 5 15/01/2016 17:00

How the blockchain could help Endnotes Property transactions could be handled on a blockchain 1. “Factom’s Blockchain Land Registry Tool trial stalls in a similar way to how payments between parties are due to the politics of Honduras”, Duncan Riley, Silicon handled using digital currencies like Bitcoin. However, Angle, December 2015. See also: http://siliconangle.com/ instead of assuming that each ‘coin’ is the same, it would blog/2015/12/27/factoms-blockchain-land-reigstry-tool- be possible to associate a unique house or piece of land trial-stalls-due-to-the-politics-of-honduras/ 2. “ Solving Real World Problems With the Bitcoin with a particular coin, or fraction of a coin, and exchange Blockchain”, NewsBTC, January 2015. See also: http:// it just like in any other transaction using digital currency. www.newsbtc.com/2015/01/23/solving-real-world- The entire transaction history of the property could then problems-bitcoin-blockchain/ 3. See: https://www.gov.uk/registering-land-or-property- be followed through the blockchain. This concept is known with-land-registry/when-you-must-register as ‘coloured coins’ because the coins are ‘coloured’ to 4. “ UK Property Transaction Statistics”, HM Revenue & Customs, December 2015. See also: https://www.gov.uk/ 9 represent a specific asset, such as a house. government/uploads/system/uploads/attachment_data/ file/486888/UK_Tables_Dec_2015__cir_.pdf In the blockchain, assets are held by the owners of private 5. Ibid. keys, the cryptographic ‘identity’ created when a user first 6. “ Property fraud line helps nearly 2000 people in its first two years”, Jessica Prasad, Land Registry, January 2015. registers for the blockchain. The title deeds and identity See also: http://blog.landregistry.gov.uk/property-fraud- documents proving ownership do not themselves need line-helps-nearly-2000-people-in-its-first-two-years/ to be stored on the blockchain. Instead, they can be 7. “ Protect yourself from property fraud during scams awareness month”, Jessica Prasad, Land Registry, July ‘hashed’ – a mathematical transformation that converts 2015. See also: http://blog.landregistry.gov.uk/protect- long documents of text and other characters to a much yourself-from-property-fraud-during-scams-awareness- shorter, fixed-length string of text and numbers. The hash is month/ 8. “‘ Title fraud costing Land Registry millions’ – claim”, unique to the original document and can be stored with the Estate Agent Today, August 2015. See also: https://www. coloured coin on the blockchain in much less space. estateagenttoday.co.uk/breaking-news/2015/8/title-fraud- costing-land-registry-millions--claim 9. “ Smart Property, Colored Coins and Mastercoin”, Tim Using smart contracts, asset exchange could also follow Swanson, CoinDesk, January 2014. See also: http://www. specific instructions encoded as part of the transaction to coindesk.com/smart-property-colored-coins-mastercoin/ be executed automatically once agreed criteria have been met. Implications Contact Alexander Shelkovnikov A blockchain-based approach to registering property titles Corporate Venturing and Blockchain Lead could increase the efficiency of transaction processing and +44 (0) 20 7303 8895 reduce, if not entirely prevent, property fraud. alshelkovnikov@deloitte.co.uk A property registry could be delivered via a centrally administered public blockchain, which, although replicating large elements of the current registration process, would simultaneously provide enhanced security against fraud, increased resilience and improved transparency – since the historical transaction records could be read by the public. A blockchain could also help in resolving disputes over property ownership since each transaction would be verified and stored in the distributed ledger. For the registration authorities, a blockchain thus provides a way of combining many processes and systems into one, increasing efficiency through distributed processing and thus reducing cost. Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Please see www.deloitte.co.uk/about for a detailed description of the legal structure of DTTL and its member firms. Deloitte LLP is the United Kingdom member firm of DTTL. This publication has been written in general terms and therefore cannot be relied on to cover specific situations; application of the principles set out will depend upon the particular circumstances involved and we recommend that you obtain professional advice before acting or refraining from acting on any of the contents of this publication. Deloitte LLP would be pleased to advise readers on how to apply the principles set out in this publication to their specific circumstances. Deloitte LLP accepts no duty of care or liability for any loss occasioned to any person acting or refraining from action as a result of any material in this publication. © 2016 Deloitte LLP. All rights reserved. Deloitte LLP is a limited liability partnership registered in England and Wales with registered number OC303675 and its registered office at 2 New Street Square, London EC4A 3BZ, United Kingdom. Tel: +44 (0) 20 7936 3000 Fax: +44 (0) 20 7583 1198. Designed and produced by The Creative Studio at Deloitte, London. J3980 J3975_BlockchainInsert.indd 6 15/01/2016 17:00

To start a new section, hold down the apple+shift keys and click Document Variables to release this object and type the section title in the box below. Document Title Template Document Subtitle Subtitle Blockchain applications in the media industry “We are at an amazing point in history for artists. A revolution is going to happen, and next year it’s going to take over. It’s the ability of artists to have the control and the say of what they do with their music at large. The answer to this is in the 1 blockchain.” Imogen Heap, British singer and songwriter Digital technologies have transformed content production For example, in an industry that has already undergone and distribution in the global entertainment and media significant digital disruption, many musicians are hopeful industry over the last two decades. The market is forecast that blockchain technology can help them reinvent the to continue to grow over the next five years, and is music business. currently estimated to be worth just over $2 trillion.2 Example: Royalty payments in the music industry Acute challenges remain, though, especially relating to the way in which digital content can be copied and What are the current bottlenecks or issues? freely distributed on the internet, and how artists are Despite the industry at large being in rude health, the compensated when their materials are used or bought inner workings of the music business are struggling through legitimate channels. to keep up with digital technologies. The industry has traditionally been highly intermediated: artists’ contracts In the news media, for example, several newspapers written years ago do not necessarily reflect the way that keep their digital content behind paywalls, charging fees music is now consumed, and royalty payments depend to access articles and stories online, but they have had upon airplay statistics gathered by music labels and 4 varying degrees of success. One of the latest experiments copyright databases maintained by licensing bodies. involves micropayments – payments by consumers of Streaming services are also shaking up the traditional very small sums of money to read individual articles or business model since many earn their revenues through even portions of articles – sufficient to make a difference advertising rather than from selling music. The system to rights holders but not enough to put off consumers. works increasingly well for consumers, but such is its Although this approach does not use a blockchain, it is complexity and lack of transparency that earning money a sign of the interest that now permeates the industry in as an artist is fraught with difficulty. finding commercial models that work for content creators, consumers and corporations alike. How the blockchain could help A blockchain could be used to store a cryptographic ‘hash’ Blockchain technology could help to resolve a number of the original digital music file, associating it with the of these challenges by connecting authors, musicians addresses – and, potentially, the identities – of the people and videographers directly with consumers, as well as involved in its creation. The blockchain could also store the by making the organisations at the heart of the industry instructions, in the form of a smart contract, for how the operate more efficiently. The opportunity goes beyond artists would be compensated for the song or music. simply enforcing payment for content, it could help digital rights to be identified and managed more effectively across the industry, and appropriate compensation paid to the right artists and content owners. J3975_BlockchainInsert.indd 7 15/01/2016 17:00