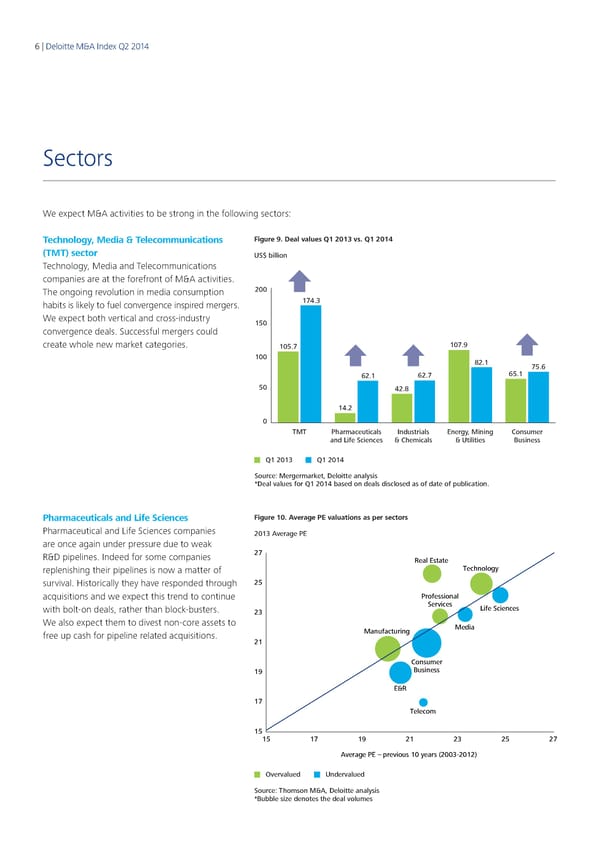

6 | Deloitte M&A Index Q2 2014 Sectors We expect M&A activities to be strong in the following sectors: Technology, Media & Telecommunications Figure 9. Deal values Q1 2013 vs. Q1 2014 (TMT) sector US$ billion Technology, Media and Telecommunications companies are at the forefront of M&A activities. The ongoing revolution in media consumption 200 habits is likely to fuel convergence inspired mergers. 174.3 We expect both vertical and cross‑industry 150 convergence deals. Successful mergers could create whole new market categories. 105.7 107.9 100 82.1 75.6 62.1 62.7 65.1 50 42.8 14.2 0 TMT Pharmaceuticals Industrials Energy, Mining Consumer and Life Sciences & Chemicals & Utilities Business Q1 2013 Q1 2014 Source: Mergermarket, Deloitte analysis *Deal values for Q1 2014 based on deals disclosed as of date of publication. Pharmaceuticals and Life Sciences Figure 10. Average PE valuations as per sectors Pharmaceutical and Life Sciences companies 2013 Average PE are once again under pressure due to weak R&D pipelines. Indeed for some companies 27 Real Estate replenishing their pipelines is now a matter of Technology survival. Historically they have responded through 25 acquisitions and we expect this trend to continue Professional with bolt‑on deals, rather than block‑busters. Services Life Sciences 23 We also expect them to divest non‑core assets to Media free up cash for pipeline related acquisitions. Manufacturing 21 Consumer 19 Business E&R 17 Telecom 15 15 17 19 21 23 25 27 Average PE – previous 10 years (2003-2012) Overvalued Undervalued Source: Thomson M&A, Deloitte analysis *Bubble size denotes the deal volumes

Q2 2014 The Deloitte M&A Index Page 5 Page 7

Q2 2014 The Deloitte M&A Index Page 5 Page 7