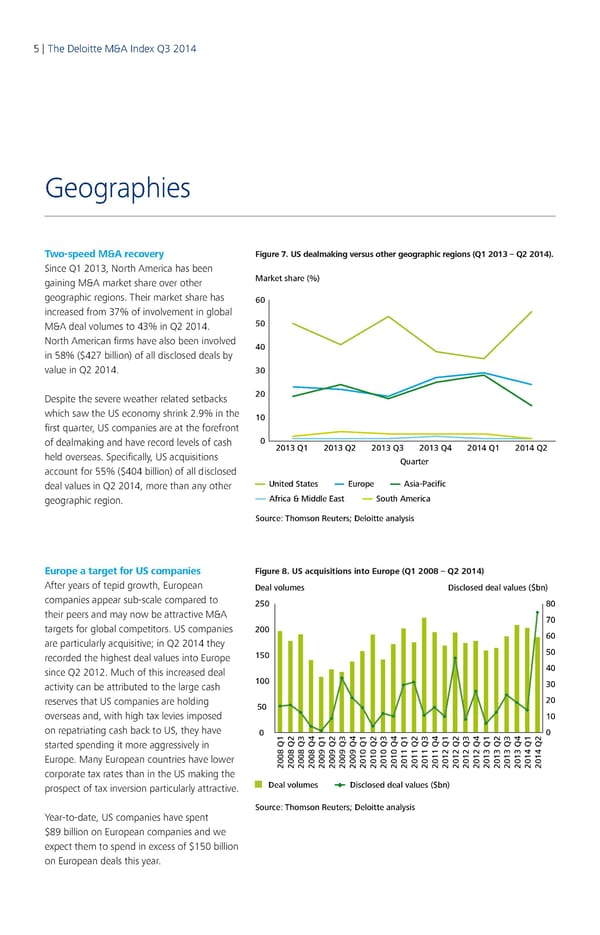

5 | The Deloitte M&A Index Q3 2014 Geographies Two‑speed M&A recovery Figure 7. US dealmaking versus other geographic regions (Q1 2013 – Q2 2014). Since Q1 2013, North America has been gaining M&A market share over other Market share (%) geographic regions. Their market share has 60 increased from 37% of involvement in global M&A deal volumes to 43% in Q2 2014. 50 North American firms have also been involved 40 in 58% ($427 billion) of all disclosed deals by value in Q2 2014. 30 Despite the severe weather related setbacks 20 which saw the US economy shrink 2.9% in the 10 first quarter, US companies are at the forefront of dealmaking and have record levels of cash 0 2013 Q1 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 held overseas. Specifically, US acquisitions Quarter account for 55% ($404 billion) of all disclosed deal values in Q2 2014, more than any other United States Europe Asia-Pacific geographic region. Africa & Middle East South America Source: Thomson Reuters; Deloitte analysis Europe a target for US companies Figure 8. US acquisitions into Europe (Q1 2008 – Q2 2014) After years of tepid growth, European Deal volumes Disclosed deal values ($bn) companies appear sub‑scale compared to 250 80 their peers and may now be attractive M&A 70 targets for global competitors. US companies 200 60 are particularly acquisitive; in Q2 2014 they recorded the highest deal values into Europe 150 50 since Q2 2012. Much of this increased deal 40 activity can be attributed to the large cash 100 30 reserves that US companies are holding 50 20 overseas and, with high tax levies imposed 10 on repatriating cash back to US, they have 0 0 started spending it more aggressively in Europe. Many European countries have lower 2008 Q12008 Q22008 Q32008 Q42009 Q12009 Q22009 Q32009 Q42010 Q12010 Q22010 Q32010 Q42011 Q12011 Q22011 Q32011 Q42012 Q12012 Q22012 Q32012 Q42013 Q12013 Q22013 Q32013 Q42014 Q12014 Q2 corporate tax rates than in the US making the prospect of tax inversion particularly attractive. Deal volumes Disclosed deal values ($bn) Source: Thomson Reuters; Deloitte analysis Year‑to‑date, US companies have spent $89 billion on European companies and we expect them to spend in excess of $150 billion on European deals this year.

Q3 2014 The Deloitte M&A Index Page 4 Page 6

Q3 2014 The Deloitte M&A Index Page 4 Page 6