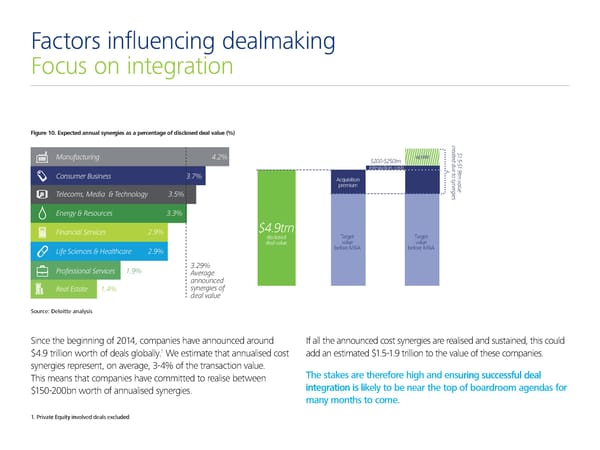

Figure 10. Expected annual synergies as a percentage of disclosed deal value (%) Figure 10. Expected annual synergies as a percentage of disclosed deal value (%) Manufacturing Manufacturing Consumer Business Consumer Business Telecoms, Media & Technology Telecoms, Media & Technology Factors influencing dealmaking Energy & Resources Energy & Resources inancial Services € inancial Services € Focus on integration Life Sciences & Healthcare € Life Sciences & Healthcare € Professional Services ƒ€ € Professional Services ƒ€ € ‚verage ‚verage announced announced Real Estate ƒ synergies of Real Estate ƒ synergies of Figure 10. Expected annual synergies as a percentage of disclosed deal value (%) deal value deal value c c r r e e a „ a „ t ƒ t ƒ e upside e Manufacturing upside d d d d† „……†„…‡n † „……†„…‡n „ „ u ƒ u ƒ integration costs e t integration costs e t€ € t t o sr o sr Consumer Business n v Acquisition y n v Acquisition y a n a n l e l premium e u premium r u r e g e g i i e Telecoms, Media & Technology e s s Energy & Resources „€trn € „€trn inancial Services Target Target disclosed Target Target disclosed deal value value value deal value value value before M&A before M&A before M&A before M&A Life Sciences & Healthcare € Professional Services ƒ€ € ‚verage announced Real Estate ƒ synergies of deal value c r Source: Deloitte analysis e Source: Deloitte analysis a „ t ƒ upside e d d „……†„…‡n † „ u ƒ integration costs e t € t o sr Acquisition y n v Since the beginning of 2014, companies have announced around If all the announced cost synergies are realised and sustained, this could n a e l premium r u 1 g e i $4.9 trillion worth of deals globally. We estimate that annualised cost add an estimated $1.5-1.9 trillion to the value of these companies. e s synergies represent, on average, 3-4% of the transaction value. This means that companies have committed to realise between The stakes are therefore high and ensuring successful deal $150-200bn worth of annualised synergies. integration is likely to be near the top of boardroom agendas for „€trn disclosed Target Target many months to come. deal value value value before M&A before M&A 1. Private Equity involved deals excluded Source: Deloitte analysis

Deloitte M&A Index | Presentation Page 8 Page 10

Deloitte M&A Index | Presentation Page 8 Page 10