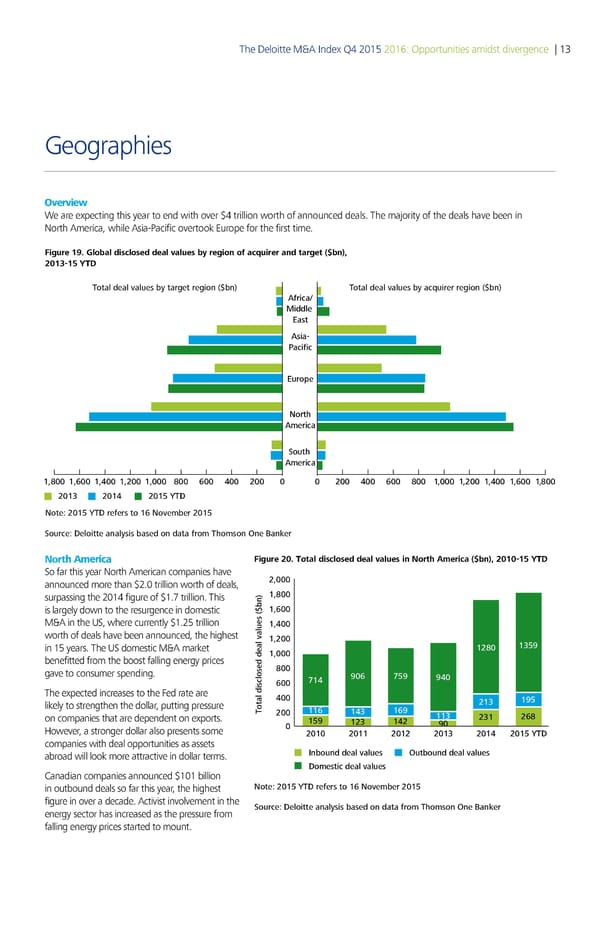

The Deloitte M&A Index Q4 2015 2016: Opportunities amidst divergence | 13 Geographies Overview We are expecting this year to end with over $4 trillion worth of announced deals. The majority of the deals have been in North America, while Asia-Pacific overtook Europe for the first time. Figure 19. Global disclosed deal values by region of acquirer and target ($bn), 20131 Total deal values by target region (bn Total deal values by auirer region (bn „friaŠ ‹iddle …ast „sia‡ ˆaifi …uro†e Nort „meria out „meria 1ƒ‚00 1ƒ600 1ƒ400 1ƒ200 1ƒ000 ‚00 600 400 200 0 0 200 400 600 ‚00 1ƒ000 1ƒ200 1ƒ400 1ƒ600 1ƒ‚00 2013 2014 2015 YTD Note: 2015 YTD refers to 16 November 2015 oure: Deloitte analysis based on data from Tomson ne an€er North America Figure 20. Total disclosed deal values in North America ($bn), 2010-1 T So far this year North American companies have announced more than $2.0 trillion worth of deals, 2,000 surpassing the 2014 figure of $1.7 trillion. This 1,800 is largely down to the resurgence in domestic 1,600 M&A in the US, where currently $1.25 trillion 1,400 worth of deals have been announced, the highest 1,200 in 15 years. The US domestic M&A market 1280 135ƒ benefitted from the boost falling energy prices 1,000 gave to consumer spending. 800 600 „14 ƒ06 „5ƒ ƒ40 The expected increases to the Fed rate are 400 1ƒ5 likely to strengthen the dollar, putting pressure 213 on companies that are dependent on exports. Total disclosed deal values ($bn)20011614316ƒ 113 231 268 0 15ƒ 123 142 ƒ0 However, a stronger dollar also presents some 2010 2011 2012 2013 2014 2015 YTD companies with deal opportunities as assets abroad will look more attractive in dollar terms. Inbound deal values utbound deal values Doestic deal values Canadian companies announced $101 billion in outbound deals so far this year, the highest Note 2015 YTD ees to 16 Novebe 2015 figure in over a decade. Activist involvement in the energy sector has increased as the pressure from ouce Deloitte analsis based on data o T oson ne €an‚e falling energy prices started to mount.

Deloitte M&A Index | Report Page 16 Page 18

Deloitte M&A Index | Report Page 16 Page 18