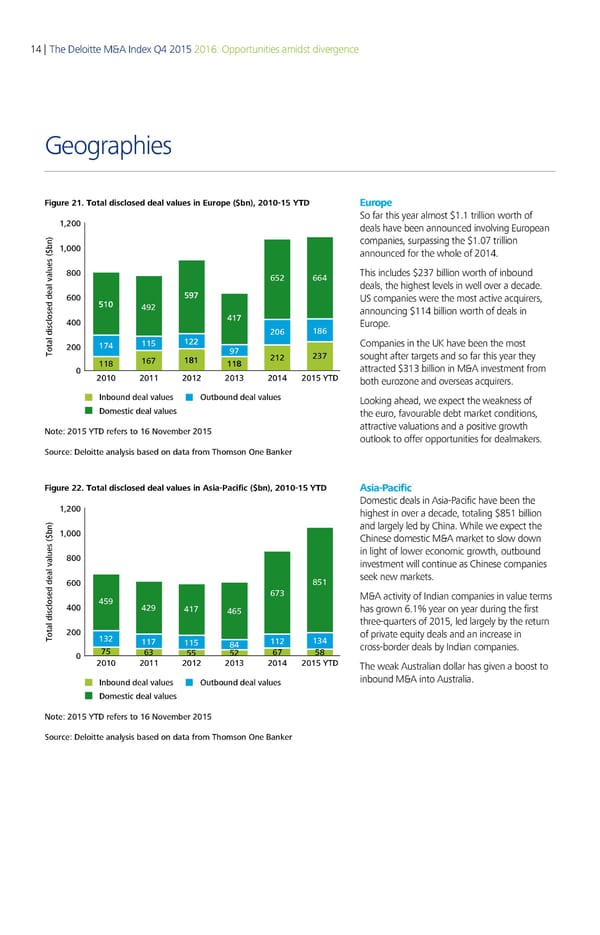

14 | The Deloitte M&A Index Q4 2015 2016: Opportunities amidst divergence Geographies Figure 21. Total disclosed deal values in Europe ($bn), 2010-15 YT Europe So far this year almost $1.1 trillion worth of 1,200 deals have been announced involving European 1,000 companies, surpassing the $1.07 trillion announced for the whole of 2014. 800 652 664 This includes $237 billion worth of inbound deals, the highest levels in well over a decade. 600 5„ƒ US companies were the most active acquirers, 510 4„2 announcing $114 billion worth of deals in 400 41ƒ Europe. 206 186 200 1ƒ4 115 122 Companies in the UK have been the most Total disclosed deal values ($bn) „ƒ 212 23ƒ sought after targets and so far this year they 118 16ƒ 181 118 attracted $313 billion in M&A investment from 0 2010 2011 2012 2013 2014 2015 YTD both eurozone and overseas acquirers. Inbound deal values utbound deal values Looking ahead, we expect the weakness of Doestic deal values the euro, favourable debt market conditions, Note 2015 YTD ees to 16 Novebe 2015 attractive valuations and a positive growth outlook to offer opportunities for dealmakers. ouce Deloitte analsis based on data o T oson ne €an‚e Figure 22. Total disclosed deal values in Asia-Pacific ($bn), 2010-15 T Asia-Pacific Domestic deals in Asia-Pacific have been the 1,200 highest in over a decade, totaling $851 billion 1,000 and largely led by China. While we expect the Chinese domestic M&A market to slow down 800 in light of lower economic growth, outbound investment will continue as Chinese companies 600 851 seek new markets. 6ƒ3 M&A activity of Indian companies in value terms 400 45„ 42„ 41ƒ 465 has grown 6.1% year on year during the first three-quarters of 2015, led largely by the return Total disclosed deal values ($bn)200132 of private equity deals and an increase in 11ƒ 115 84 112 134 cross-border deals by Indian companies. 0 ƒ5 63 55 52 6ƒ 58 2010 2011 2012 2013 2014 2015 YTD The weak Australian dollar has given a boost to Inbound deal values utbound deal values inbound M&A into Australia. Doestic deal values Note 2015 YTD ees to 16 Novebe 2015 ouce Deloitte analsis based on data o T oson ne €an‚e

Deloitte M&A Index | Report Page 17 Page 19

Deloitte M&A Index | Report Page 17 Page 19