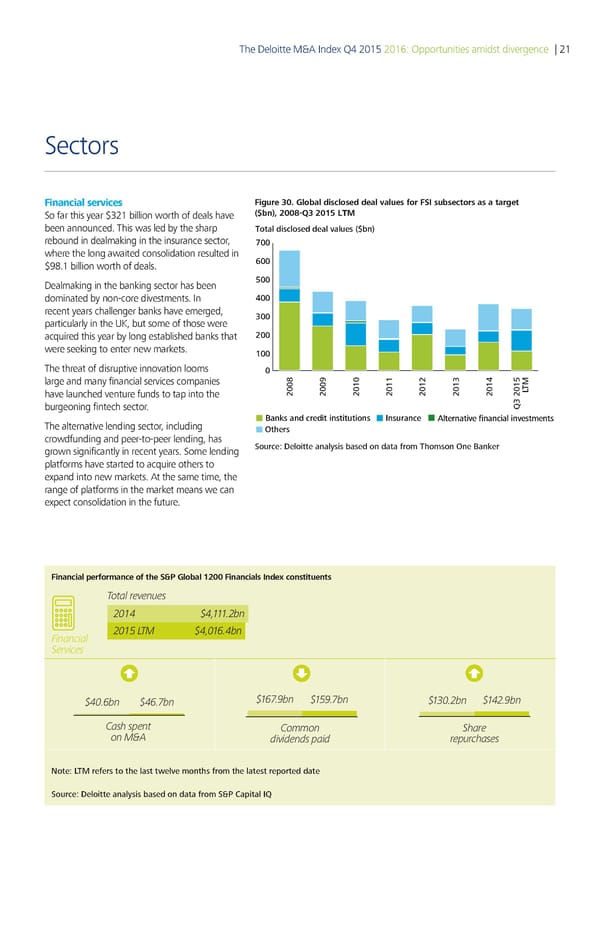

The Deloitte M&A Index Q4 2015 2016: Opportunities amidst divergence | 21 Sectors Financial services Figure 30. Global disclosed deal values for FSI subsectors as a target So far this year $321 billion worth of deals have ($bn), 2008-3 20 been announced. This was led by the sharp Total disclosed deal values ($bn) rebound in dealmaking in the insurance sector, 00 where the long awaited consolidation resulted in 00 $98.1 billion worth of deals. Dealmaking in the banking sector has been 00 dominated by non-core divestments. In 00 recent years challenger banks have emerged, 00 particularly in the UK, but some of those were acquired this year by long established banks that 00 were seeking to enter new markets. 00 The threat of disruptive innovation looms 0 large and many financial services companies ‚ have launched venture funds to tap into the 00„ 00ƒ 00 0 0 0 0 €T burgeoning fintech sector. 0 The alternative lending sector, including Banks and credit institutions Insurance …lternative financial investments Others crowdfunding and peer-to-peer lending, has Source: Deloitte analysis based on data from Thomson One Banker grown significantly in recent years. Some lending platforms have started to acquire others to expand into new markets. At the same time, the range of platforms in the market means we can expect consolidation in the future. Financial performance of the S&P Global 1200 Financials Index constituents Total revenues 2014 $4,111.2bn Financial 2015 LTM $4,016.4bn Services $40.6bn $46.7bn $167.9bn $159.7bn $130.2bn $142.9bn as sent oon Sare on M iviens ai reurcases Note: LTM refers to the last tele months from the latest reported date Source: Deloitte analysis based on data from S&P Capital IQ

Deloitte M&A Index | Report Page 25 Page 27

Deloitte M&A Index | Report Page 25 Page 27