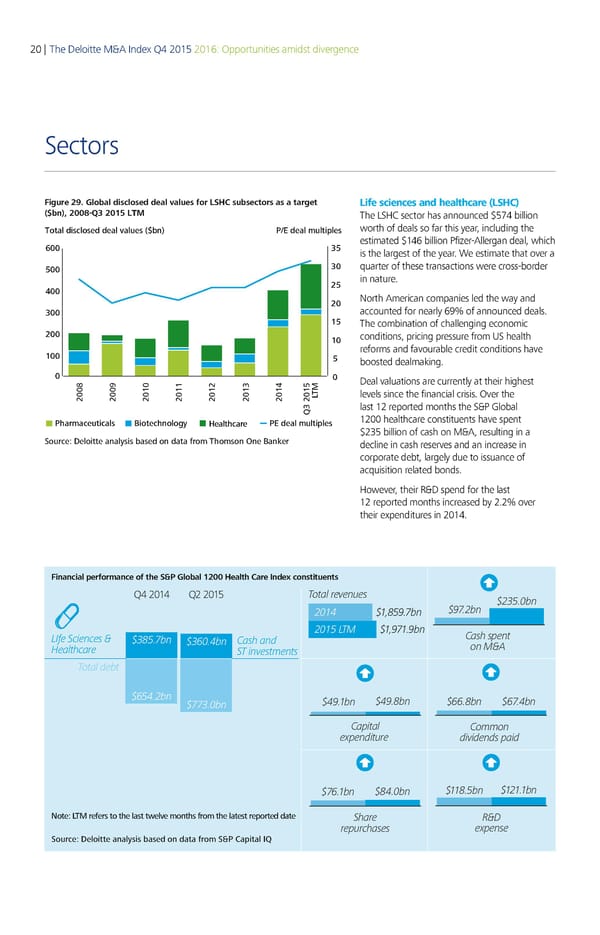

20 | The Deloitte M&A Index Q4 2015 2016: Opportunities amidst divergence Sectors Figure 29. Global disclosed deal values for LSHC subsectors as a target Life sciences and healthcare (LSHC) ($bn), 200 20 L The LSHC sector has announced $574 billion Total disclosed deal values ($bn) P/E deal multiples worth of deals so far this year, including the estimated $146 billion Pfizer-Allergan deal, which ‚ € is the largest of the year. We estimate that over a € quarter of these transactions were cross-border € in nature. North American companies led the way and accounted for nearly 69% of announced deals. € The combination of challenging economic conditions, pricing pressure from US health reforms and favourable credit conditions have € boosted dealmaking. Deal valuations are currently at their highest … levels since the financial crisis. Over the ‡ † „T ƒ € last 12 reported months the S&P Global Pharmaceuticals iotechnoloy ˆealthcare PE deal multiples 1200 healthcare constituents have spent $235 billion of cash on M&A, resulting in a Source: Deloitte analysis based on data from Thomson One aner decline in cash reserves and an increase in corporate debt, largely due to issuance of acquisition related bonds. However, their R&D spend for the last 12 reported months increased by 2.2% over their expenditures in 2014. Financial performance of the S&P Global 1200 Health Care Index constituents Q4 2014 Q2 2015 Total revenes $235.bn 24 $5.bn $.2bn 25 LT $.bn Cash s€ent LIfe Sciences & $35.bn $36.4bn Cash and on &ƒ Healthcare ST investments Total debt $654.2bn $3.bn $4.bn $4.bn $66.bn $6.4bn Ca€ital Common e‚€enditre dividends €aid $6.bn $4.bn $.5bn $2.bn Note: LTM refers to the last twelve months from the latest reported date Share „&… re€rchases e‚€ense Source: Deloitte analysis based on data from S&P Capital

Deloitte M&A Index | Report Page 24 Page 26

Deloitte M&A Index | Report Page 24 Page 26