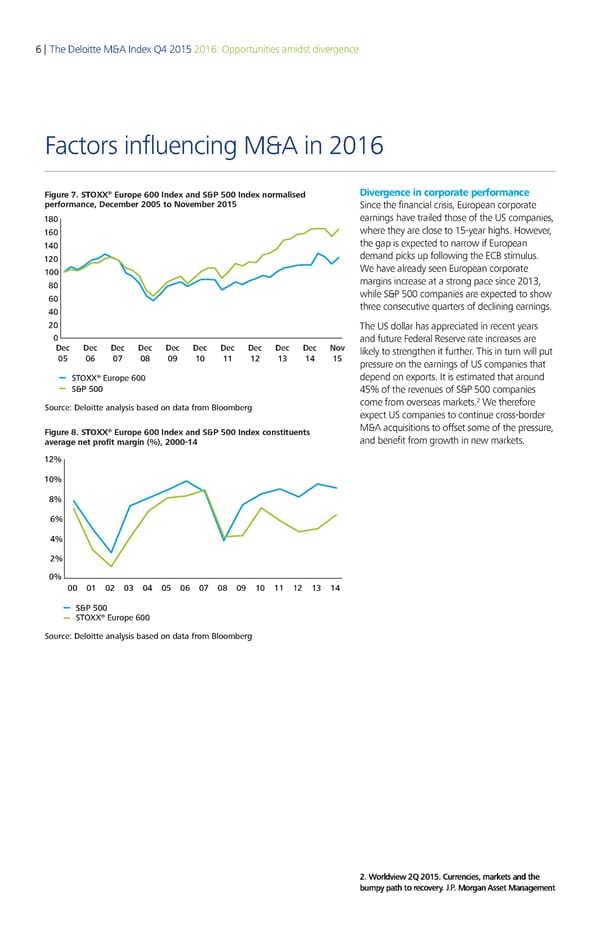

6 | The Deloitte M&A Index Q4 2015 2016: Opportunities amidst divergence Factors influencing M&A in 2016 ® Divergence in corporate performance Figure 7. STOXX Europe 600 Index and S&P 500 Index normalised performane eemer 005 o oemer 0€5 Since the financial crisis, European corporate 0 earnings have trailed those of the US companies, 60 where they are close to 15-year highs. However, 0 the gap is expected to narrow if European 0 demand picks up following the ECB stimulus. 00 We have already seen European corporate 0 margins increase at a strong pace since 2013, 60 while S&P 500 companies are expected to show 0 three consecutive quarters of declining earnings. 0 The US dollar has appreciated in recent years 0 and future Federal Reserve rate increases are Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec o likely to strengthen it further. This in turn will put 05 06 0ƒ 0 0‚ 0 € 5 pressure on the earnings of US companies that STOXX® Europe 600 depend on exports. It is estimated that around S&P 500 45% of the revenues of S&P 500 companies 2 Source: Deloitte analysis based on data from loomber come from overseas markets. We therefore expect US companies to continue cross-border ® M&A acquisitions to offset some of the pressure, Figure 8. STOXX Europe 600 Index and S&P 500 Index constituents and benefit from growth in new markets. average net profit argin 000€‚ 0 6 0 00 0 0 0 0 05 06 0‚ 0 0€ 0 S&P 500 STOXX® Europe 600 Source: Deloitte analysis based on data from loomber 2. Worldview 2Q 2015. Currencies, markets and the bumpy path to recovery. J.P. Morgan Asset Management

Deloitte M&A Index | Report Page 6 Page 8

Deloitte M&A Index | Report Page 6 Page 8