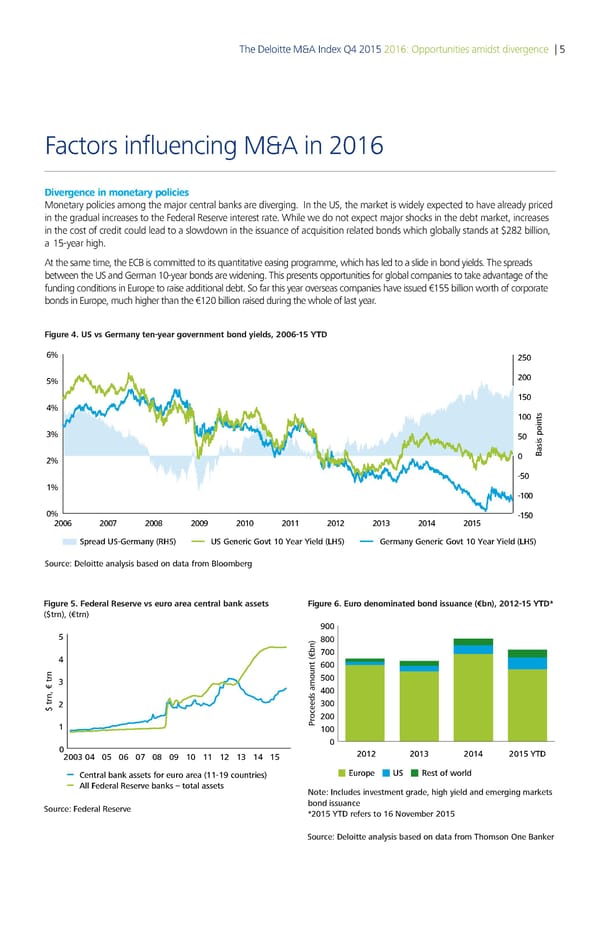

The Deloitte M&A Index Q4 2015 2016: Opportunities amidst divergence | 5 Factors influencing M&A in 2016 Divergence in monetary policies Monetary policies among the major central banks are diverging. In the US, the market is widely expected to have already priced in the gradual increases to the Federal Reserve interest rate. While we do not expect major shocks in the debt market, increases in the cost of credit could lead to a slowdown in the issuance of acquisition related bonds which globally stands at $282 billion, a 15-year high. At the same time, the ECB is committed to its quantitative easing programme, which has led to a slide in bond yields. The spreads between the US and German 10-year bonds are widening. This presents opportunities for global companies to take advantage of the funding conditions in Europe to raise additional debt. So far this year overseas companies have issued €155 billion worth of corporate bonds in Europe, much higher than the €120 billion raised during the whole of last year. Figure 4. US vs Germany ten-year government bond yields, 2006-15 Y ‚ 250 5 200 150 € 100 50 0 Basis points 2 -50 1 -100 0 -150 200‚ 200… 200„ 200ƒ 2010 2011 2012 201 201€ 2015 Spread US-Germany (S US Generic Got 10 ear ield (S Germany Generic Got 10 ear ield (S Source: Deloitte analysis based on data from Bloomberg Figure 5. Federal Reserve vs euro area central bank assets Figure 6. Euro denominated bond issuance (€bn), 2012-15 YTD ($trn), (€trn) 00 00 00 00 500 400 $ trn, € trn 300 oceeds amount …€bn‡200 1 „r 100 0 2012 2013 2014 2015 TD € 9 1 11 1 1 1 1 Central bank assets for euro area (11-19 countries) ‹uroŒe ŠS ˆest of ‰orld All Federal Reserve banks – total assets ote: ncludes inestment €rade‚ hi€h yield and emer€in€ markets Source Federal Reserve bond issuance ƒ2015 TD refers to 1 oember 2015 Source: Deloitte analysis based on data from Thomson One Banker

Deloitte M&A Index | Report Page 5 Page 7

Deloitte M&A Index | Report Page 5 Page 7