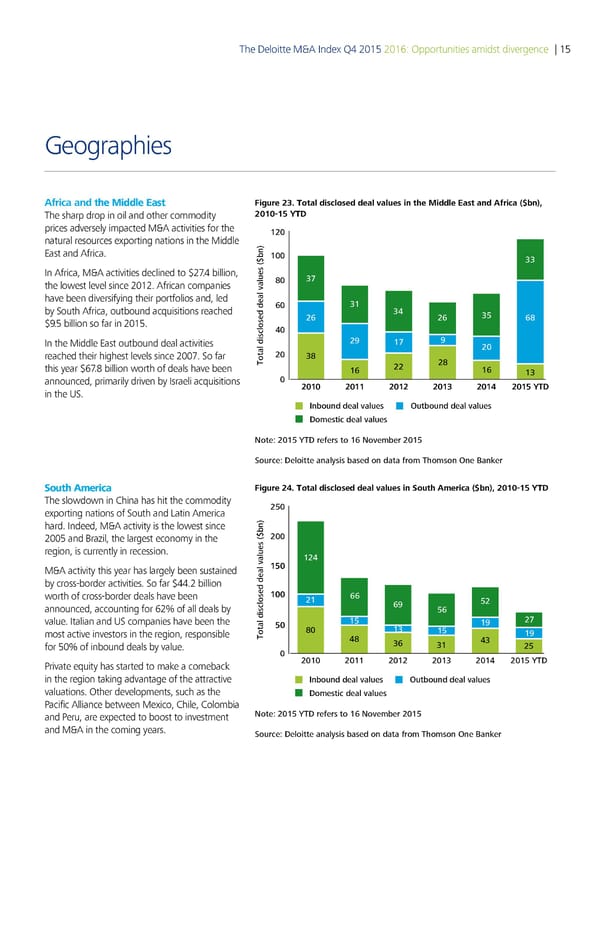

The Deloitte M&A Index Q4 2015 2016: Opportunities amidst divergence | 15 Geographies Africa and the Middle East Figure 23. Total disclosed deal values in the Middle East and Africa ($bn), The sharp drop in oil and other commodity 200 T prices adversely impacted M&A activities for the 120 natural resources exporting nations in the Middle East and Africa. 100 33 In Africa, M&A activities declined to $27.4 billion, 80 3‚ the lowest level since 2012. African companies have been diversifying their portfolios and, led 60 31 by South Africa, outbound acquisitions reached 26 34 26 35 68 $9.5 billion so far in 2015. 40 In the Middle East outbound deal activities 2ƒ 1‚ ƒ 20 reached their highest levels since 2007. So far Total disclosed deal values ($bn)2038 this year $67.8 billion worth of deals have been 22 28 16 16 13 announced, primarily driven by Israeli acquisitions 0 2010 2011 2012 2013 2014 2015 YTD in the US. Inbound deal values utbound deal values Doestic deal values Note: 2015 YTD ees to 16 Novebe 2015 ouce: Deloitte analsis based on data o Toson ne an€e South America Figure 24. Total disclosed deal values in South America ($bn), 20101 T The slowdown in China has hit the commodity 250 exporting nations of South and Latin America hard. Indeed, M&A activity is the lowest since 2005 and Brazil, the largest economy in the 200 region, is currently in recession. 124 M&A activity this year has largely been sustained 150 by cross-border activities. So far $44.2 billion worth of cross-border deals have been 100 21 52 announced, accounting for 62% of all deals by ‚ 5 value. Italian and US companies have been the 50 15 1‚ 2ƒ most active investors in the region, responsible Total disclosed deal values ($bn)€013 15 1‚ for 50% of inbound deals by value. 4€ 3 31 43 25 0 2010 2011 2012 2013 2014 2015 YTD Private equity has started to make a comeback in the region taking advantage of the attractive Inbound deal values utbound deal values valuations. Other developments, such as the Doestic deal values Pacific Alliance between Mexico, Chile, Colombia and Peru, are expected to boost to investment Note: 2015 YTD refers to 1 Noveber 2015 and M&A in the coming years. ource: Deloitte analsis based on data fro Toson ne aner

Deloitte M&A Index | Report Page 18 Page 20

Deloitte M&A Index | Report Page 18 Page 20