Israel: A Hotspot for Blockchain Innovation

Israel: A Hotspot for Blockchain Innovation February, 2016 1

Foreword Dear Reader Over the last year Deloitte has researched, engaged and actively participated in building the foundations of the global ecosystem of blockchain. Although blockchain has already become a trending buzz word (for better or worse), we believe 2016 will be the year in which this technology will start making waves within traditional businesses and industries. This publication is a first-of-its-kind overview of the rising Israeli blockchain ecosystem. The report focuses on the potential of the Israeli blockchain ecosystem and offers unique mapping of the leading players within this ecosystem. Deloitte Israel has positioned itself as a bridge to innovation and is actively connecting global organizations with Israeli startups and entrepreneurs. We encourage you to reach out, discuss and explore ,together with us, how you can leverage the power of our ecosystem both locally and globally. Best regards, Amit Harel Innovation Practice Leader Deloitte Israel 2

Introduction Blockchain, mostly known as the backbone technology behind Bitcoin, is one of the hottest and most intriguing technologies currently in the market. Since 2013 Google searches for “blockchain” have risen 1900%. Similar to the rising of the internet, blockchain has the potential to truly disrupt multiple industries and make processes more democratic, secure, transparent, and efficient. Entrepreneurs, startup companies, investors, global organizations and governments have all identified blockchain as a revolutionary technology. Israel, driven by a strong defense industry, technological military units and cutting-edge academic institutes, has become a hub for startups and hi-tech innovation. The country’s unique experience with fintech, cyber and cryptography, has positioned Israel as a hotspot for blockchain innovation. This report introduces 38 startups within Israel leading the blockchain revolution. Due to blockchain’s highly flexible nature, these startups span a wide variety of focuses from social networking through security to hardware. In conducting research for this report, the first to cover the Israeli blockchain ecosystem, we interviewed industry leaders, entrepreneurs and experts who offered their insight into the Israeli and global blockchain landscape. Deloitte Israel has become a global bridge to Israeli innovation for multi-national organizations. Understanding the disruptive nature of blockchain technology, Deloitte has positioned itself as an industry leader, with the ability to connect global organizations and investors to the emerging Israeli blockchain startup ecosystem. With profound industry knowledge and business expertise we offer our services as the guide to exploring and exploiting the tremendous opportunities involving blockchain technology. 3

Contents Background 5 Israel’s innovation 11 ecosystem The Blockchainstartup 16 landscape in Israel BL OCK CHAIN Deloitte Israel – Creating 21 Opportunities Appendix 25 4

Background: What is a Blockchain? 5

Blockchain, the technology behind Bitcoin, a true game-changer The digital currency ‘Bitcoin’ has been featured in numerous articles and has gained widespread recognition and some might even say notoriety. If you have read up a bit about bitcoin you might have also come across the term ‘Blockchain’, the underlying innovative technology that makes it possible. Although bitcoin has been the center of attention over the last few years, we believe that blockchain technology may be the game-changer that truly disrupts and revolutionizes many industries. So what is a Blockchain? A blockchain can be defined as a digital, chronologically updated, distributed and cryptographically sealed record, of all data transfer activity. It may be thought of as a cloud-based ledger that is shared among a network of users (the “participants”), recording all data being transferred between them. This record displays all the information related to the data, while at the same time allowing the identity of the involved participants to remain confidential. The record can be viewed by all participants, but updates can only be made after being agreed upon by a majority of participants. Furthermore, once the data is entered into the record it can no longer be deleted. Digital Given that almost any type of information can be expressed in digital format and subsequently referenced through a ledger entry, a wide and diverse range of potential implementations emerge. Chronologically updated The technology provides verification and authentication through permanent time stamping. Each block points and refers to the data stored in the previous block in the chain, so all blocks are linked to one another. Cryptographically Sealed Once a specific block in the chain is sealed, it can no longer be tampered with or changed, thus preventing deletion, copying or editing, essentially creating a truly digital asset. Distributed An identical copy of the record is shared by all, thus allowing each participant to independently verify its contents. The fact that the blockchain can only be updated by consensus of a majority of participants provides an inherent safeguard, mitigating the risk of fraud and eliminating the need for a centralized coordinated verification process. Any attempt to gain a majority, manipulate the system and alter its records, could be detected by other participants, consequently discrediting the system and preventing any benefit from being realized. Additionally, due to its dispersed architecture, being shared and duplicated across multiple sites, there is no single point of failure. If one node in the network fails, whether due to attack or outage, the remaining nodes can continue to operate unhindered, ensuring data availability and reliability. 6

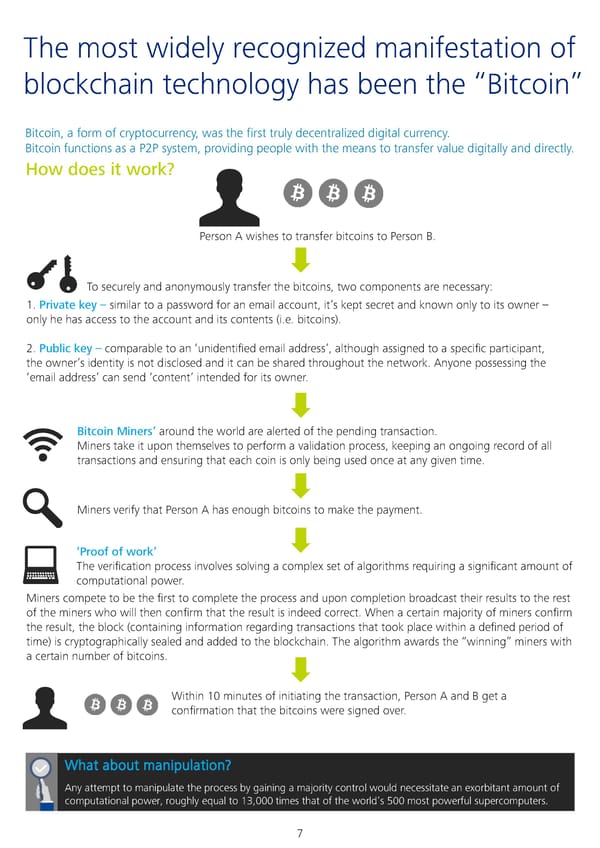

The most widely recognized manifestation of blockchain technology has been the “Bitcoin” Bitcoin, a form of cryptocurrency, was the first truly decentralized digital currency. Bitcoin functions as a P2P system, providing people with the means to transfer value digitally and directly. How does it work? Person A wishes to transfer bitcoins to Person B. To securely and anonymously transfer the bitcoins, two components are necessary: 1. Private key – similar to a password for an email account, it’s kept secret and known only to its owner – only he has access to the account and its contents (i.e. bitcoins). 2. Public key – comparable to an ‘unidentified email address’, although assigned to a specific participant, the owner’s identity is not disclosed and it can be shared throughout the network. Anyone possessing the ‘email address’ can send ‘content’ intended for its owner. Bitcoin Miners’ around the world are alerted of the pending transaction. Miners take it upon themselves to perform a validation process, keeping an ongoing record of all transactions and ensuring that each coin is only being used once at any given time. Miners verify that Person A has enough bitcoins to make the payment. ‘Proof of work’ The verification process involves solving a complex set of algorithms requiring a significant amount of computational power. Miners compete to be the first to complete the process and upon completion broadcast their results to the rest of the miners who will then confirm that the result is indeed correct. When a certain majority of miners confirm the result, the block (containing information regarding transactions that took place within a defined period of time) is cryptographically sealed and added to the blockchain. The algorithm awards the “winning” miners with a certain number of bitcoins. Within 10 minutes of initiating the transaction, Person A and B get a confirmation that the bitcoins were signed over. What about manipulation? Any attempt to manipulate the process by gaining a majority control would necessitate an exorbitant amount of computational power, roughly equal to 13,000 times that of the world’s 500 most powerful supercomputers. 7

Blockchain, moving beyond Bitcoin Alternative Blockchains The pursuit to enable wider functionality and address certain perceived drawbacks to the original Bitcoin- blockchain technology, has spurred the exploration of possibilities to create new alternative blockchains, while utilizing the same underlying technology. These new blockchains attempt to address various constraints of the original technology such as allowing faster settlement times, larger transaction sizes, additional consensus methods, varying degrees of anonymity, advanced functionality, adjustable permissions, etc. Permissioned vs. Unpermissioned Blockchains One subgroup of alternative blockchains are private or permissioned chains. The difference between a permissioned and unpermissioned blockchain essentially boils down to whether participation and interaction with the blockchain can be restricted. In a permissioned system only approved (whitelisted or blacklisted) participants have access and may interact with the ledger. This as opposed to an unpermissioned system, which is open to all and as such does not require identity disclosure. For example, Bitcoin is in essence an unpermissioned system, providing those who partake in it a degree of anonymity, which due to its attractiveness to criminal elements, has contributed to its notoriety. In light of security and regulatory concerns, the prospect of an unpermissioned system has been a deterrent for many financial institutions, although the core concept of a verifiable secure distributed ledger that negates the need for an intermediary component (with its inherent accompanying downfalls in the form of costs, delays, and risk) is compelling. This has led to a growing effort to examine the possibility of implementing various forms of private blockchains in these sectors. Unpermissioned blockchains • Everyone can participate • No identity disclosure • Manipulation is difficult due to its “distributed” nature (no trust needed) • Example: The Bitcoin blockchain Permissioned blockchains • Restricted participation • Identity disclosure • Trust is required since participants have greater control power • Example: The ‘utility settlement coin’ by UBS (prototype) 8

The Blockchain Ecosystem Transfer of Value Security Regulation The blockchain enables The blockchain's Blockchain employs self the transfer of digital permanent tamperproof governance of transfer assets, representing data record affords of ownership. It may F u various manifestations users a secure means complement existing nc t of value or possessing for conducting regulative systems io inherent value within transactions and through digitization ns themselves. performing other digital and cross-border activity. capabilities. Bitcoin-blockchain dependent Blockchain Technology Independent protocols and platforms Colored coins Utilizes bitcoin- Ripple An infrastructure for creating associated data as unique identifiers to global financial transfer networks, N represent other forms of value or compatible with existing financial o t a assets, allowing the transfer of systems and customizable to meet b ownership between participants. D le specific requirements. ev el Im o p pm le m en e t nt s a t Blockstream An open source Ethereum A platform and coding io framework for developing ‘sidechains’ - language for creating individualized ns a separate blockchain, with its own set blockchain implementations such as & of defined characteristics, yet linked and ‘smart contracts’ - computerized interoperable with main the Bitcoin automated processes which are triggered blockchain, allowing for the transfer of when certain predefined data is recorded assets between the two. in the blockchain. Cryptocurrency Ecosystem Legal Ecosystem Financial Ecosystem Companies developing National and international Regulated financial institutions & I n f r cryptographically secured digital authorities accepting and platforms exploring blockchain a s currencies and the means for implementing blockchain as technology as an alternative to tr u facilitating their use an official legal foundation, centralized & correspondent ctu r parallel to existing processes and payment processing e procedures Altcoins Authentication & Authorization Mortgages Exchanges Proof of Ownership (physical & digital assets) Forex Ap Mining E-identity Retail/Commercial Banks p lic ATMs Medical Information Trading & Markets a t Debt cards Cybersecurity Central Banks io Payment Processing Real Estate Credit Card issuers ns P2P IP Money Transfer Operators 9

What are the benefits & challenges associated with the implementation of blockchain technology? Benefits Disintermediation & trustless exchange Two parties are able to make an exchange without the oversight or intermediation of a third party, eliminating the counterparty risk Empowered users Users are in control of all their information and transactions High quality data Blockchain data is complete, consistent, timely, accurate, and widely available Durability, reliability, and longevity Due to the decentralized networks, blockchain does not have a central point of failure and is better able to withstand malicious attacks Process integrity Users can trust that transactions will be executed exactly as the protocol commands removing the need of a trusted third party Transparency and immutability Changes to public blockchains are publicly viewable by all parties creating transparency, and can never be altered or deleted, therefore creating immutability Ecosystem simplification With all transactions being added to a single public ledger, it reduces the clutter and complications of multiple ledgers Faster interbank clearing and settlement Previously banks and financial institutions would have to wait days for securities to clear; blockchain shortens this process to minutes Lower transaction costs By eliminating the need of a third party intermediary, users are able to exchange assets without paying a transaction fee Challenges Nascent technology Resolving challenges such as transaction speed, the verification process, and data limits will be crucial in making blockchain widely applicable Uncertain regulatory status Because modern currencies have always been created and regulated by national governments, blockchain and Bitcoin face a hurdle in widespread adoption by pre-existing financial institutions if its government regulation status remains unsettled Large energy consumption The Bitcoin blockchain network’s miners are attempting 450 thousand trillion solutions per second in efforts to validate transactions, using substantial amounts of computer power Control, security, and privacy While some solutions exist, including private or permissioned blockchains, there are still cybersecurity concerns Integration concerns Blockchain applications offer solutions that require significant changes to, or complete replacement of, existing systems. In order to make the switch, companies must strategize the transition Cultural adoption Blockchain represents a complete shift to a decentralized network which requires the buy- in of its users and operators Cost Blockchain offers tremendous savings in transaction costs and time but the high initial capital costs could be a deterrent 10

Israel’s innovation ecosystem 11

Israel - the world’s 2nd best entrepreneurial ecosystem Israel – The hotspot for disruptive innovation The 2015 Global Startup Ecosystem ranked Tel Aviv 2nd place after the US. For more than a decade Israel in general, and [Criteria: Performance, Funding, Talent, Market Reach, and Startup Experience] the city of Tel Aviv in particular, has positioned The 2015 Bloomberg Innovation Index ranked Israel #5, outpacing the US. itself as a global leader for innovation and of the [Criteria: R&D performance, tech education, patents, and other marks of technology process] faster growing hotspots for technology. Israel is mostly known for its rich ecosystem and ability to Over 1,000 exits = over $60 billion produce disruptive and cutting-edge innovations. The Israeli technology industry has turned into of Israeli technology companies in 2006 - 2015 in capital an economic success story by both local and international standards. 2015 per capita investment in startups $423 Technology in Israel Israel has the highest concentration of technical companies outside of Silicon Valley and the $186 highest number of NASDAQ-listed technology companies, after the U.S. and China. Also, Israel’s $16 $14 technology industry accounts for 15.7% of the Europe China USA Israel country’s GDP. 2015 was another strong year of exits & investments in Israeli startups with 104 deals of over $9 billion Exits by sector 6% 5% 3% Cleantech $8.4 bn. 12% Communications The total value of 96 Israeli Hi-Tech 16% Internet 2015 15% M&A deals in 2015 IT & Enterprise Software Life Sciences 43% Other $609 mn. Semiconductors From IPO activity in 2015 Buyers by geography, M&A deals 6% 3% East Asia 1,400 new startups, 4% 4% UK in 2015, out of which: USA/Canda 30% 2015 Israel 373 received funding over 53% $500K, totaling $3.58 bn. Europe (+62% compared to 2014) Other 12

Key reasons for Israel’s innovation success Unique Society Educated & skilled workforce: Ranked 2nd in the world in percentage of engineers and scientists in the work force Israel experienced several waves of highly educated immigrants coming from all over the world Young people already receive a high technical training during their military service and are equipped with a high sense of responsibility and success orientation Market Lack of natural resources led to a scientific-technological innovation system developed to ensure Israelis a high quality of life The country’s small size and geographical isolation from its neighbors enhanced domestic dynamics Government Support The government’s technology incubator program supports innovation and start-ups’ growth Demand for technical innovations for defense and military purposes The ‘Investment Law’ enables foreign companies to benefit from a company tax rate of only 10%, and investment grants of up to 24%. Strong R&D Focus No. 1 in the world in R&D expenditure per capita Israel invests about 4.25% of its GDP in R&D, which is the highest ratio of any country in the world Israel’s universities are ranked among the world’s leading research institutes VC Industry Ranked 5th in the world for venture capital availability Israel’s venture capital industry has approximately 70 active venture capital funds, of which 14 are international VCs with offices in Israel Highly innovative & strong managerial entrepreneurship Israeli managers were ranked 2nd in the world for business entrepreneurship Israel is world renowned as being the “start-up nation” and is the world leader for number of start-ups per capita with ~5,000 active technology start-ups Profit-driven Israeli innovations include a long list of market firsts such as disk-on-key technology, IP telephony, ZIP compression, the ingestible pill-size camera, modern drip- irrigation technology, ICQ instant messenger, and many more Leading multinational companies Fortune 500 companies such as Google, Microsoft, Facebook, Apple, IBM, Intel, SAP, Cisco, Johnson and Johnson and over 300 global tech leaders have local presence in Israel 13

Fintech, one of Israel fastest growing Hi-tech sectors Fintechencompasses a range of economic business-to-business (B2B) and business-to-customer (B2C) activities, including payments, money transfers, credit card charges, check scanning, ecommerce and digital consulting, customer relations management, and app trading services. Serving originally financial institutions, recent technological changes in global IT markets are pushing the fintech industry to seek solutions, that include virtual banks, currencies and NBFI (non-bank financial institutions). Israeli fintech companies, including large 430 enterprises as well as hundreds of local startups 14 Multinational fintechR&D centers in Israel $369 million raised capital by 61 fintech Israeli companies in 2014. During the first three quarters of 2015, about 43 Israeli companies are reported to have raised capital. Israel has an established legacy of fintech companies Israeli fintech covers all aspects of the growing that have become leaders in their respective fields demand for better payments systems and security (Actimize: fraud prevention, FundTech: transaction solutions. banking solutions, Retalix: Point-of-Sale, Trusteer: cybercrime prevention, and Sapiens: Insurance) Major international banks (e.g., Citibank, Barclays) and Israeli financial institutions have always been open to leading players in the financial market (SunGard, innovation. PayPal, Intuit, RSA) establish their presence in Israel, building up fintech innovation labs and startup accelerators. 14

Israel, and specifically Tel Aviv, at the forefront of blockchain technology Israel – a strong player in blockchain technology 1. Cyber security and cryptography play a key role in the Israeli defense establishment; as such, the military serves as a potent incubator for these fields. 2. There are numerous Israeli entrepreneurs and startups that are currently developing a wide range of blockchain applications. The dynamic nature of weekly blockchain meetings and the close cooperation between the science, innovation and finance sectors, function as a powerful driving force behind the blockchain industry in Israel. 3. The “Israeli Factor” – Israel is well known for its entrepreneurial spirit and booming startups scene, successfully introducing many cutting edge technologies to the world. 4. Israel is uniquely geographically positioned to serve as a gateway to numerous markets. Providing easy access to Europe as well as to Eastern Asian and African countries, Israel is ideally located for conducting business with foreign markets. 5. Israel's relatively small size (approximately 20,000 sq. km), provides for a highly concentrated business arena. Consequently, due to their fairly close proximity, it is very easy for companies throughout the country, to interact and collaborate with each other. Israeli universities with blockchain research pioneers Professor Adi Shamir, internationally recognized cryptographer expert, Turing Award winner, and Israeli Prize for Computer Sciences recipient Prof. Eli Ben-Sasson, leading computer science researcher and developer of zerocash protocol, whereupon users can exchange bitcoins without revealing any personal information Senior lecturer Dr. Aviv Zohar, author of several blockchain publications, including a proposal that would increase the transaction speed of bitcoin exchanges without compromising security concerns Senior lecturer Eron Tromer, expert in cryptography and information security, and head of the Lab for Experimental Information Security Bitcoin activity within Israel • 10K to 15K Bitcoin owners in Israel (worldwide estimate: about 10 mn.) • 4 Bitcoin ATMs located throughout Tel Aviv • About 150 - 230 businesses accept Bitcoin in Israel with almost 50 brick-and-mortar stores accepting Bitcoin as payment in the city, including kindergartens, tattoo parlors, lawyers, a car repair shop, and about 15 bars and restaurants in Tel Aviv • 2015 Bitcoin events hosted in Tel Aviv: (1) Inside Bitcoins Conference - 350 participants attending lectures of key Bitcoin experts and discussing the cryptocurrency ecosystem (2) Bitcoin Hackathon - 100 participants building decentralized apps (3) Weekly Bitcoin embassy meetings The Israeli Bitcoin Association (IBA) is a nonprofit organization The Bitcoin Embassy in Tel Aviv is the central hub of a large with a mission to ensure that the people of Israel will benefit as community of people and entrepreneurs, hosting lectures, courses, much as possible from Blockchain technology. tutorials, and collaborative work on Blockchain related projects. 15

The blockchain startup landscape in Israel 16

Selected Israeli blockchain startups Social P2P Payments Buy & Sell New Currency Hardware Others Security Notes: • As of January 2016. • In some cases, companies may belong to more than one category. • Inactive startups were excluded. 17

Israeli blockchain – 11 selected startups Colu Wave Founded: 2014, Founded: 2014 Management: CEO Amos Meiri, CTO Rotem Lev, VP of R&D Management: CEO Gadi Ruschin, CTO Or Garbash, VP R&D Yair Sappir David Ring Employees: 1-10 Employees: 13 Company type: Private Company type: Private Funding Stage: Bootstrapped Funding: 2.5 million Sub-space: Other Sub-space: P2P Website: http://wavebl.com Website: www.colu.co Colu uses blockchain technology to allow users to buy and store goods WaveBLaims to replace the use of paper in international shipping online in a secure and validated process. The company raised $2.5 million in agreements by storing the documents electronically on a blockchain ledger. seed investment in January 2015. The founders of Colu originally started The service connects all members of the supply chain to a decentralized ColoredCoins.org, a service for creating digital assets on the Bitcoin network and allows them to directly exchange documents, including blockchain. Colu expanded on this idea by creating an application contracts, receipts, and travel logs. Wave manages ownership of documents programming interface for developers and offering an app for consumers to via blockchain technology which therefore eliminates disputes, forgeries and make purchases on anything from sporting tickets to art pieces. unnecessary risks (lost shipments, counterfeiting, etc.). Recently, Colu has formed over 20 partnerships with different operations The company was selected to participate in the Barclays Accelerator including Deloitte. The Colu-Deloitte partnership aims to leverage Deloitte’s program. industry knowledge and Colu’s technological expertise to bring blockchain to companies across industries. They strive as well to improve blockchain operations for companies already beyond the implementation stage. In addition, Colu has partnered with Revelator, a company which provides sales and marketing intelligence for independent music producers. Colu stores digital copies of songs on its blockchain platform. If anyone attempts to access the songs illegally, the creator is immediately notified and their protection is insured. Colu has also partnered with the online exchange company, Bitt, in an effort to bridge the gap between the bitcoin-style currency and physical money. Focused in the Caribbean where as many as 200,000 people have no bank account but do have smartphones, blockchain technology through Colu will allow these citizens to convert money stored in a digital wallet into bills at ATMs. Getgems Logical Form Founded: 2014 Founded: 2014 Management: CEO Daniel Peled Management: Founder Dror Sam Brama Employees: 8 Employees: 1-10 Company type: Non-public Company type: Non-public Funding: $400K Seed on January 4, 2015 Funding stage: Bootstrapped Subspace: Social Sub-space: Hardware Website: http://getgems.org Websites: https://logicalform.com CEO Daniel Peled established GetGems as a social messaging app that allows Logical Form is an innovative company founded by Dror Sam Brama. Logical users to send cryptocurrencies. Similar to Whatsapp or Telegram, users can Form provides apps and blockchain data templates for banks and message each other after exchanging phone numbers or usernames. enterprises. Although blockchain digital currencies, such as bitcoin, seek to However, each profile is attached to a virtual wallet, so in addition to replace banks, Logical Form uses blockchain to authenticate and track items sending messages users can also transmit virtual currency. Every time a user and records for banking institutions. By using Logical Form technologies, invites someone to download the app, they are rewarded with 25 gems. banks are able to mitigate double spending, issue authentication without Eventually, users will have the opportunity to receive gems for watching identification, and verify digital signatures. advertisements. These gems can be converted to other cryptocurrencies such as bitcoins, gift certificates, or actual dollars depending on the users’ Most companies founded on the Bitcoin blockchain seek to replace the preference. As of October 2015, the app had 15,000 users and raised need of “trusted parties” such as banks or governmental organizations. approximately $1 million in total funding, including investments from Logical Form assumes that these entities are here to stay, and concentrates Magma VC, one of the early investors of the crowd-sourced navigation app on effectively utilizing the blockchain algorithm. Waze. The startup was awarded the title of “most visionary social media solution” at the Citi Mobile Challenge in Europe, the Middle East and Africa out of 750 applicants from 101 countries. Citi described the app as “a solution that could transform financial services.” 18

Israeli blockchain – 11 selected startups Bits of Gold Bitrated Founded: 2013 Founded: 2014 Management: CEO Gil Assayag Management: Founder Nadav Ivgi Employees: 1-10 Employees: 1-10 Company type: Private Company type: Private Funding stage: Seed Funding stage: Pre-seed Sub-space: Buy and sell Sub-space: Security Website: www.bitsofgold.co.il Website: www.bitrated.com Bits of Gold specializes in bitcoin services to the Israeli market. The company Bitrated provides fraud prevention and consumer protection mechanisms for operates over 150 branches throughout the country where people can buy bitcoin transactions. The company builds a layer of trust on top of bitcoin, or sell bitcoins, many of which have bitcoin ATMs. By forming a partnership helping to protect consumers, and allowing merchants to build their with the Global Money Transfer (GMT), Bits of Gold can ensure its reputation. Bitrated serves as a reputation management system. Every user compliance with anti-money-laundering regulations within Israel. receives a score based upon ratings that were given by other users and based upon other social networks. This allows buyers and sellers to evaluate Besides offering a service for citizens to exchange cash for bitcoins, Bits of their counterpart and decide whether or not they want to do business with Gold also targets merchants who are looking to accept bitcoin as a payment them. option. Their “Checkout with bitcoin” service allows businesses to accept bitcoins from customers while maintaining their record books in Israeli Additionally, prior to Bitrated if a consumer used bitcoins to purchase an Shekels. This service is offered to physical stores as well as online stores with item and never received that item they would be left with very few options headquarters in Israel. Following its launch in Israel in 2013, the company is to recuperate their loses. Bitrated adds another level of security by currently planning to expand to other markets in South America and the introducing a “trust agent” to all bitcoin transactions. These intermediary Middle East. officials can resolve disputes and reverse payments if fraud is detected. Users can apply to serve as these arbitrators and receive compensation for “Israelis are early-adopters and many have begun their services. to see the potential of Bitcoin technology.” Jonathan Rouach, Director Bits of Gold Crypto Next Backfeed Founded: June 18, 2014 Founded: 2015 Management: CEO Sharon Greenberg, CTO Asaf Azulay Management: CEO MatanField Employees: 1-10 Employees: 11-50 Company type: Private Company type: Private Funding stage: Seed Funding stage: Series A Sub-space: New currency Sub-space: Social Website: www.cryptonext.net/ Website: http://backfeed.cc At the Inside Bitcoin Conference in Tel Aviv in 2014, Crypto Next announced its Backfeed provides an opportunity for people to coordinate, collaborate, and new product, the “White Label Exchange” which gives its customers the ability create decentralized organizations. CEO Matan Field describes Backfeed to set up their own currency exchange in a matter of hours. Users who are technologies as “similar to an Israeli kibbutz where members split the profits eager to create their own, customized cryptocurrency will be able to construct based on the contribution, each one makes as perceived by their network in a platform that is tailored to their own personal desires, or the needs of their real-time.” Backfeed will target a wide range of organizations who can reap community or organization. CEO Sharon Greenberg said that “setting up a benefits of decentralization including taxi services, social networks, insurance White Label Exchange will be as easy as registering a domain name.” Crypto companies, and school systems. Using schools as an example, if a teacher is Next’s management team hopes that digital currencies such as bitcoin will excellent and the students’ parents would like to reward her, they would become more mainstream through the creation of more user friendly have the power to increase her salary. In a decentralized organization, your exchanges. Improved service will lead to higher demand for the product, and contribution and your reward would be determined by your shared higher demand will encourage more merchants to accept the digital currencies, community instead of a single person or governmental organization. completing the cycle of buying and selling. Although the platform is currently in development, the founders predict it In 2015 Crypto Next created a new service which allowed users to pair and will launch sometime in 2016. exchange any cryptocurrency with any other cryptocurrency or fiat currency. Previously, exchanges were only interested in high volume trades, so relatively niche currencies were not able to be exchanged. The company has stated that its goal is to have at least 50 different currencies available for exchange by the end of the year. 19

Israeli blockchain – 11 selected startups Spondoolies-Tech CoinSpark Founded: 2013 Founded: 2014 Management: CEO Guy Corem, COO Kobi Levin Management: CEO & Founder Gideon Greenspan, CTO Michael Employees: 11 – 50 Rozantsev Company type: Private employees: 1 – 10 Funding: $6.5 million Company type: Private Sub-space: Hardware Funding stage: Bootstrapped Website: www.spondoolies-tech.com Sub-space: P2P Website: coinspark.org Spondoolies-Tech is a company focused on building mining rigs for CoinSpark allows users to send private messages attached to Bitcoin cryptocurrency. Currently the subsidy is 25 bitcoins, but this value will be transactions. This technology adds a personal touch to the exchanges of halved approximately every four years. This process allows new coins to be cryptocurrencies. “Every payment system has a way to attach information disseminated in the market in a decentralized manner and also motivates with payment, so if you’re sending money, you have the opportunity to people to provide security for the system. The process is intentionally explain if this is payment for a contract or it’s an investment in a company. designed to require significant computational power so that the number of That’s kind of necessary or the recipient might not always know what the blocks mined each day remains steady. Spondoolies-Tech specializes in purpose of a transaction is, and that’s something that’s always been missing producing this complex equipment. from Bitcoin,” said CEO Gideon Greenspan. If Bitcoin hopes to compete with digital exchanges such as PayPal or SWIFT, then adding personal The company constructs easy to use machines that are relatively simple to messages to transactions is a necessary component. set up, and are designed for both private and commercial users. In 2014 Spondoolies-Tech launched five different products and produced $28 million CoinSpark’s parent company, Coin Sciences, also offers a product called in revenue. In 2015 the company merged with Bitcoin Shop, a Bitcoin- MultiChain that allows organizations to rapidly design and operate private specific retail website. distributed ledgers. The public nature of the Bitcoin blockchain presents several security drawbacks. With MultiChain, companies have far greater control, including limiting who can connect to their blockchain, who can send and receive transactions, and who can create assets and blocks. Simplex Simplex provides Bitcoin exchanges, broker websites and Founded: 2014 wallet applications with a safe, fraud-free and fully protected Management: CTO Erez Shapira, CRO Netanel Kabala, CEO Nimrod Lehavi platform for selling Bitcoins online. Simplex is unique in Employees: 11 – 50 offering the ability for users to buy Bitcoin online via credit Company type: Private card transactions. Funding: $8.4 million in 2 rounds The company has no minimum amount of purchase, can be Sub-space: Buy and Sell accessed globally and has low barriers to entry for users Website: www.simplexcc.com without strong technical knowledge. In the event of fraud or a chargeback, Simplex absorbs the cost and the customer still receives the money. 20

Deloitte Israel – Creating Opportunities BL 21

Deloitte Israel – Your bridge to innovation Deloitte Value Proposition: Deloitte Israel is the right partner to connect and integrate startups and innovative Hi-Tech firms with key global players from multiple industries SCOUTING SERVICES Extensive experience and insights from similar assignments with major global multinational companies from the USA, Japan, Europe, China, and more. STRATEGY COMPETENCY Cutting edge methodologies to assess target synergy fit, acquisition implications – through industry renowned thought leadership and understanding of success/failure drivers in alliances, JVs, and acquisitions. MARKET PRESENCE An experienced team, based in Tel Aviv, combining cross-functional background in fintech, IT, blockchain, and corporate finance. With 20+ years of experience and relations, we develop unique methodologies to nurture local innovation, fuel entrepreneurship and assist global power-houses with matchmaking services. PARTNERSHIPS Strong partnerships/alliances with VCs, accelerators, innovators in Israel. Global experience serving leading PE and VC firms leading to an extensive network of institutional investors. What we offer: What we offer: Develop scouting objectives Implementation of strategies and Track startups concepts (on going) Facilitation & supporting POC Screening deal (proof of concept) flow with the client Advising on the right cooperation model 22

Deloitte - blockchain as a service Our global network is very active and offers a wealth of insight into blockchain applications, including service platforms, publications and participation in blockchain related events/panels. Rubix, a leading edge blockchainplatform launched by Deloitte in 2015, allows companies to prototype, test, and build their own customized blockchain. Additionally, companies can tap into the emerging technology of smart contracts. Rubix has assembled a team of blockchain experts who have the capability to advise companies through the complicated yet powerful offering that the technology provides. Blog Deloitte has coordinated an ecosystem of blockchain pioneers Since 2014 we have been combining Deloitte’s strategy and innovation consulting practices with a growing ecosystem of the world’s top entrepreneurs, scientists, technologists and business leaders which has led to groundbreaking blockchain initiatives such as: Deloitte Cryptocurrency World Economic Community (DC3) Forum Collaboration An internal group of over 200 members across 18 Deloitte partnered with the WEF to countries. The group was created as a cross-industry, explore the transformative cross-functional group exploring the potential of potential of innovation over 15 blockchain for our clients while also facilitating months. This exercise involved over connections between startups and established 40 financial industry leaders, over companies or investors. The three primary goals of the 100 technological innovators, and DC3 are to educate Deloitte and its clients on 6 global workshops. Industry opportunities in the space, investigate how blockchain Leader in can improve existing services and explore future solutions built on the blockchain. Blockchain MIT MediaLab Digital Singularity University Currency Initiative An educational institute that brings Working with Brian Forde, former together top experts, such as senior White House advisor for Michael Rhodin, Peter Diamandis mobile and data innovation, and and Marc Goodman, to inform world-renowned faculty members financial services leaders how from Sloan School of Management technology is impacting business. and the MIT media Lab to research Blockchain and its possible implications on society. 23

Summary The Israeli Hi-Tech ecosystem is characterized by fast movers and is on the cusp of breakthrough technological advancements. The “startup nation” offers a unique atmosphere of collaboration, innovation, and entrepreneurship, and is supported by unique academic knowledge, with some of the leading cryptographers and computer science engineers in the world. The fintech and cybersecurity industries, with obvious connections to blockchain technology, are two of the strongest fields within the Israeli startup community. Israel offers many opportunities for companies interested in blockchain, such as investments, M&As, strategic partnerships, innovative solutions, collaborations with tech industry leaders, and many more. This report highlights 38 startups located in Israel and involved in the blockchain technology boom, but there are more companies currently being formed, with the potential of advancing blockchain technology to new frontiers. Although the blockchain ecosystem is currently mostly associated with Bitcoin, the Israeli companies and entrepreneurs are developing solutions that has the potential to disrupt various industries. Deloitte Israel is uniquely positioned to be the bridge between the leading global organizations and investors and the vibrant Tel Aviv blockchain startup ecosystem. With our vast rolodex of connections, we have the ability to create mutually beneficial relationships between companies. Having in-depth experience with organizations across all stages of the business spectrum from startups through established hi-tech companies to large financial institutions, Deloitte is the right partner for bringing companies together to maximize their potential. 24

Appendix 25

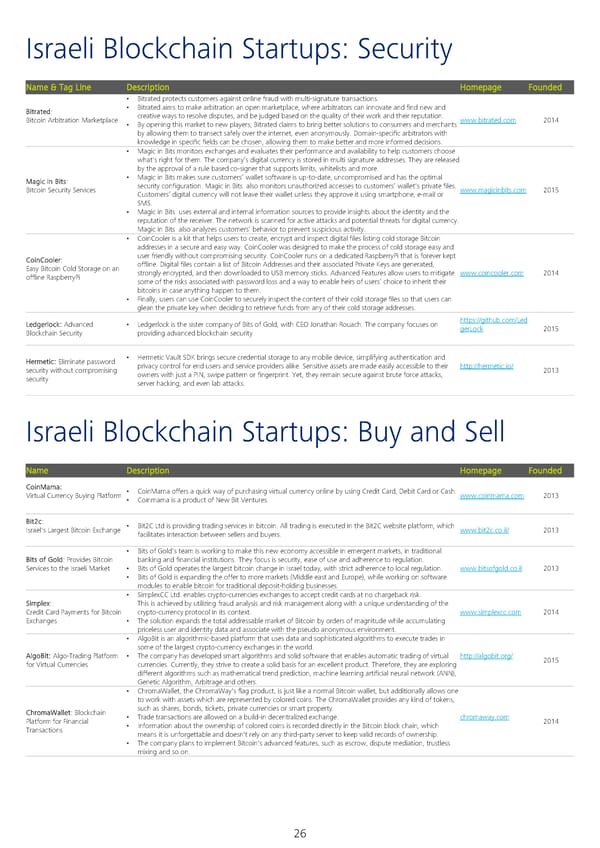

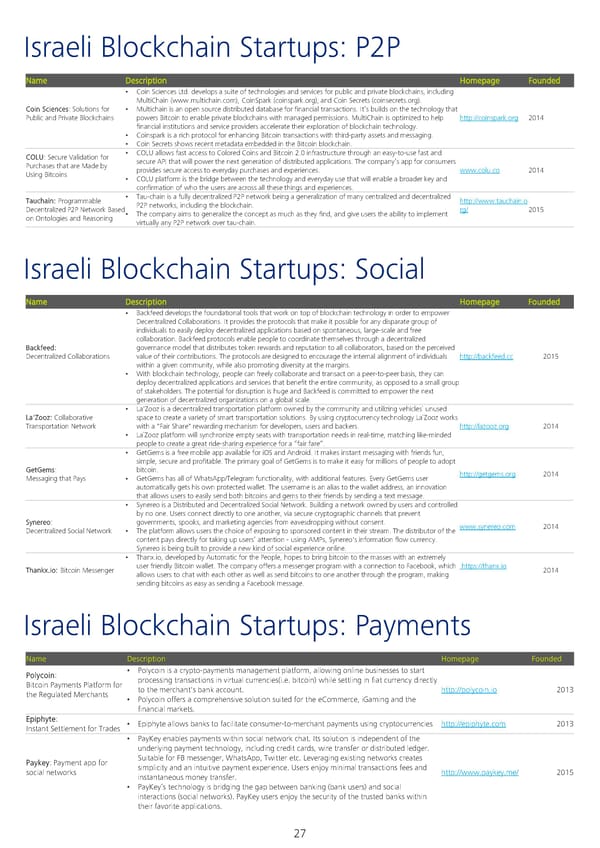

Israeli Blockchain Startups: Security Name& Tag Line Description Homepage Founded • Bitrated protects customers against online fraud with multi-signature transactions. Bitrated: • Bitrated aims to make arbitration an open marketplace, where arbitrators can innovate and find new and Bitcoin Arbitration Marketplace creative ways to resolve disputes, and be judged based on the quality of their work and their reputation. www.bitrated.com 2014 • By opening this market to new players, Bitrated claims to bring better solutions to consumers and merchants by allowing them to transect safely over the internet, even anonymously. Domain-specific arbitrators with knowledge in specific fields can be chosen, allowing them to make better and more informed decisions. customers choose • Magicin Bits monitors exchanges and evaluates their performance and availability to help what's right for them. The company’s digital currency is stored in multi signature addresses. They are released by the approval of a rule based co-signer that supports limits, whitelists and more. Magic in Bits: • Magicin Bits makes sure customers’ wallet software is up-to-date, uncompromised and has the optimal Bitcoin Security Services security configuration. Magic in Bits also monitors unauthorized accesses to customers’ wallet's private files. www.magicinbits.com 2015 Customers’ digital currency will not leave their wallet unless they approve it using smartphone, e-mail or SMS. • Magicin Bits uses external and internal information sources to provide insights about the identity and the reputation of the receiver. The network is scanned for active attacks and potential threats for digital currency. Magicin Bits also analyzes customers’ behavior to prevent suspicious activity. • CoinCooler is a kit that helps users to create, encrypt and inspect digital files listing cold storage Bitcoin addresses in a secure and easy way. CoinCooler was designed to make the process of cold storage easy and CoinCooler: user friendly without compromising security. CoinCooler runs on a dedicated RaspberryPi that is forever kept Easy Bitcoin Cold Storage on an offline. Digital files contain a list of Bitcoin Addresses and their associated Private Keys are generated, offline RaspberryPi strongly encrypted, and then downloaded to USB memory sticks. Advanced Features allow users to mitigate www.coincooler.com 2014 some of the risks associated with password loss and a way to enable heirs of users’ choice to inherit their bitcoins in case anything happen to them. • Finally, users can use CoinCooler to securely inspect the content of their cold storage files so that users can glean the private key when deciding to retrieve funds from any of their cold storage addresses. Ledgerlock: Advanced • Ledgerlock is the sister company of Bits of Gold, with CEO Jonathan Rouach. The company focuses on https://github.com/Led Blockchain Security providing advanced blockchain security gerLock 2015 Hermetic: Eliminate password • Hermetic Vault SDK brings secure credential storage to any mobile device, simplifying authentication and security without compromising privacy control for end users and service providers alike. Sensitive assets are made easily accessible to their http://hermetic.io/ 2013 security owners with just a PIN, swipe pattern or fingerprint. Yet, they remain secure against brute force attacks, server hacking, and even lab attacks. Israeli Blockchain Startups: Buy and Sell Name Description Homepage Founded CoinMama: • CoinMamaoffers a quick way of purchasing virtual currency online by using Credit Card, Debit Card or Cash. Virtual Currency Buying Platform • Coinmama is a product of New Bit Ventures. www.coinmama.com 2013 Bit2c: • Bit2C Ltd is providing trading services in bitcoin. All trading is executed in the Bit2C website platform, which Israel's Largest Bitcoin Exchange facilitates interaction between sellers and buyers. www.bit2c.co.il/ 2013 • Bits of Gold's team is working to make this new economy accessible in emergent markets, in traditional Bits of Gold: Provides Bitcoin banking and financial institutions. They focus is security, ease of use and adherence to regulation. Services to the Israeli Market • Bits of Gold operates the largest bitcoin change in Israel today, with strict adherence to local regulation. www.bitsofgold.co.il 2013 • Bits of Gold is expanding the offer to more markets (Middle east and Europe), while working on software modules to enable bitcoin for traditional deposit-holding businesses. • SimplexCC Ltd. enables crypto-currencies exchanges to accept credit cards at no chargeback risk. Simplex: This is achieved by utilizing fraud analysis and risk management along with a unique understanding of the Credit Card Payments for Bitcoin crypto-currency protocol in its context. www.simplexcc.com 2014 Exchanges • The solution expands the total addressable market of Bitcoin by orders of magnitude while accumulating priceless user and identity data and associate with the pseudo anonymous environment. • AlgoBit is an algorithmic-based platform that uses data and sophisticated algorithms to execute trades in some of the largest crypto-currency exchanges in the world. AlgoBit: Algo-Trading Platform • The company has developed smart algorithms and solid software that enables automatic trading of virtual http://algobit.org/ 2015 for Virtual Currencies currencies. Currently, they strive to create a solid basis for an excellent product. Therefore, they are exploring different algorithms such as mathematical trend prediction, machine learning artificial neural network (ANN), Genetic Algorithm, Arbitrage and others. • ChromaWallet, the ChromaWay's flag product, is just like a normal Bitcoin wallet, but additionally allows one to work with assets which are represented by colored coins. The ChromaWallet provides any kind of tokens, ChromaWallet: Blockchain such as shares, bonds, tickets, private currencies or smart property. Platform for Financial • Trade transactions are allowed on a build-in decentralized exchange. chromaway.com 2014 Transactions • Information about the ownership of colored coins is recorded directly in the Bitcoin block chain, which means it is unforgettable and doesn't rely on any third-party server to keep valid records of ownership. • The company plans to implement Bitcoin's advanced features, such as escrow, dispute mediation, trustless mixing and so on. 26

Israeli Blockchain Startups: P2P Name Description Homepage Founded • Coin Sciences Ltd. develops a suite of technologies and services for public and private blockchains, including MultiChain (www.multichain.com), CoinSpark (coinspark.org), and Coin Secrets (coinsecrets.org). Coin Sciences: Solutions for • Multichain is an open source distributed database for financial transactions. It’s builds on the technology that Public and Private Blockchains powers Bitcoin to enable private blockchains with managed permissions. MultiChain is optimized to help http://coinspark.org 2014 financial institutions and service providers accelerate their exploration of blockchain technology. • Coinspark is a rich protocol for enhancing Bitcoin transactions with third-party assets and messaging. • Coin Secrets shows recent metadata embedded in the Bitcoin blockchain. COLU: Secure Validation for • COLU allows fast access to Colored Coins and Bitcoin 2.0 infrastructure through an easy-to-use fast and Purchases that are Made by secure API that will power the next generation of distributed applications. The company’s app for consumers Using Bitcoins provides secure access to everyday purchases and experiences. www.colu.co 2014 • COLU platform is the bridge between the technology and everyday use that will enable a broader key and confirmation of who the users are across all these things and experiences. Tauchain: Programmable • Tau-chain is a fully decentralized P2P network being a generalization of many centralized and decentralized http://www.tauchain.o Decentralized P2P Network Based P2P networks, including the blockchain. rg/ 2015 on Ontologies and Reasoning • The company aims to generalize the concept as much as they find, and give users the ability to implement virtually any P2P network over tau-chain. Israeli Blockchain Startups: Social Name Description Homepage Founded • Backfeeddevelops the foundational tools that work on top of blockchain technology in order to empower Decentralized Collaborations. It provides the protocols that make it possible for any disparate group of individuals to easily deploy decentralized applications based on spontaneous, large-scale and free collaboration. Backfeed protocols enable people to coordinate themselves through a decentralized Backfeed: governance model that distributes token rewards and reputation to all collaborators, based on the perceived Decentralized Collaborations value of their contributions. The protocols are designed to encourage the internal alignment of individuals http://backfeed.cc 2015 within a given community, while also promoting diversity at the margins. • With blockchain technology, people can freely collaborate and transact on a peer-to-peer basis, they can deploy decentralized applications and services that benefit the entire community, as opposed to a small group of stakeholders. The potential for disruption is huge and Backfeed is committed to empower the next generation of decentralized organizations on a global scale. • La'Zooz is a decentralized transportation platform owned by the community and utilizing vehicles` unused La'Zooz: Collaborative space to create a variety of smart transportation solutions. By using cryptocurrency technology La`Zooz works Transportation Network with a "Fair Share" rewarding mechanism for developers, users and backers. http://lazooz.org 2014 • La`Zooz platform will synchronize empty seats with transportation needs in real-time, matching like-minded people to create a great ride-sharing experience for a “fair fare”. • GetGemsis a free mobile app available for iOS and Android. It makes instant messaging with friends fun, simple, secure and profitable. The primary goal of GetGems is to make it easy for millions of people to adopt GetGems: bitcoin. http://getgems.org 2014 Messaging that Pays • GetGemshas all of WhatsApp/Telegram functionality, with additional features. Every GetGems user automatically gets his own protected wallet. The username is an alias to the wallet address, an innovation that allows users to easily send both bitcoins and gems to their friends by sending a text message. • Synereo is a Distributed and Decentralized Social Network. Building a network owned by users and controlled by no one. Users connect directly to one another, via secure cryptographic channels that prevent Synereo: governments, spooks, and marketing agencies from eavesdropping without consent. www.synereo.com 2014 Decentralized Social Network • The platform allows users the choice of exposing to sponsored content in their stream. The distributor of the content pays directly for taking up users’ attention - using AMPs, Synereo's information flow currency. Synereo is being built to provide a new kind of social experience online. • Thanx.io, developed by Automatic for the People, hopes to bring bitcoin to the masses with an extremely Thankx.io: Bitcoin Messenger user friendly Bitcoin wallet. The company offers a messenger program with a connection to Facebook, which https://thanx.io 2014 allows users to chat with each other as well as send bitcoins to one another through the program, making sending bitcoins as easy as sending a Facebook message. Israeli Blockchain Startups: Payments Name Description Homepage Founded Polycoin: • Polycoin is a crypto-payments management platform, allowing online businesses to start while settling in fiat currency directly Bitcoin Payments Platform for processing transactions in virtual currencies(i.e. bitcoin) the Regulated Merchants to the merchant's bank account. http://polycoin.io 2013 • Polycoin offers a comprehensive solution suited for the eCommerce, iGaming and the financial markets. Epiphyte: • Epiphyte allows banks to facilitate consumer-to-merchant payments using cryptocurrencies http://epiphyte.com 2013 Instant Settlement for Trades • PayKey enables payments within social network chat. Its solution is independent of the underlying payment technology, including credit cards, wire transfer or distributed ledger. Paykey: Payment app for Suitable for FB messenger, WhatsApp, Twitter etc. Leveraging existing networks creates social networks simplicity and an intuitive payment experience. Users enjoy minimal transactions fees and http://www.paykey.me/ 2015 instantaneous money transfer. • PayKey’s technology is bridging the gap between banking (bank users) and social interactions (social networks). PayKey users enjoy the security of the trusted banks within their favorite applications. 27

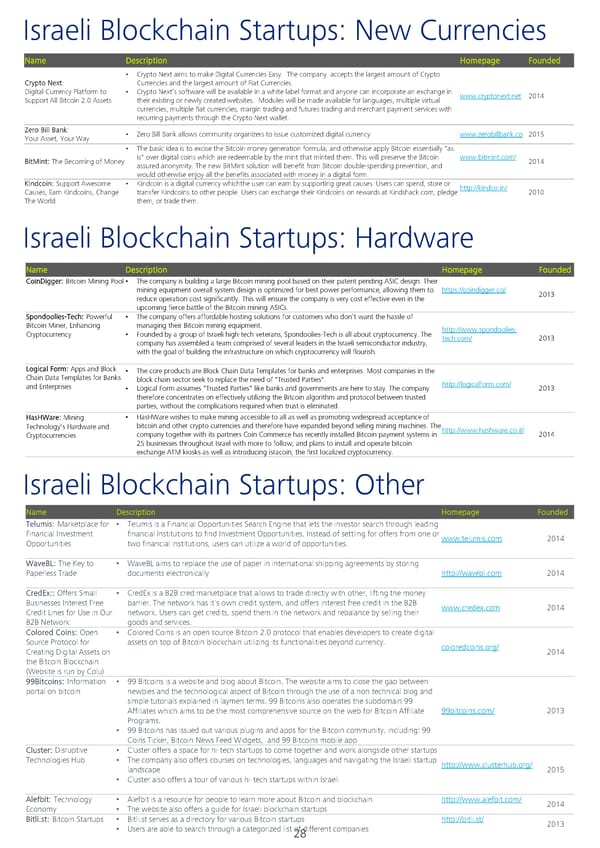

Israeli Blockchain Startups: New Currencies Name Description Homepage Founded • Crypto Next aims to make Digital Currencies Easy. The company accepts the largest amount of Crypto Crypto Next: Currencies and the largest amount of Fiat Currencies. Digital Currency Platform to • Crypto Next’s software will be available in a white label format and anyone can incorporate an exchange in www.cryptonext.net 2014 Support All Bitcoin 2.0 Assets their existing or newly created websites. Modules will be made available for languages, multiple virtual currencies, multiple fiat currencies, margin trading and futures trading and merchant payment services with recurring payments through the Crypto Next wallet. Zero Bill Bank: • Zero Bill Bank allows community organizers to issue customized digital currency www.zerobillbank.co 2015 Your Asset, Your Way • The basic idea is to excise the Bitcoin money generation formula, and otherwise apply Bitcoin essentially "as BitMint: The Becoming of Money is" over digital coins which are redeemable by the mint that minted them. This will preserve the Bitcoin www.bitmint.com/ 2014 assured anonymity. The new BitMint solution will benefit from Bitcoin double-spending prevention, and would otherwise enjoy all the benefits associated with money in a digital form. Kindcoin: Support Awesome • Kindcoin is a digital currency whichthe user can earn by supporting great causes. Users can spend, store or http://kindco.in/ Causes, Earn Kindcoins, Change transfer Kindcoins to other people. Users can exchange their Kindcoins on rewards at Kindshack.com, pledge 2010 The World them, or trade them. Israeli Blockchain Startups: Hardware Name Description Homepage Founded CoinDigger: Bitcoin Mining Pool • The company is building a large Bitcoin mining pool based on their patent pending ASIC design. Their mining equipment overall system design is optimized for best power performance, allowing them to https://coindigger.co/ 2013 reduce operation cost significantly. This will ensure the company is very cost effective even in the upcoming fierce battle of the Bitcoin mining ASICs. Spondoolies-Tech: Powerful • The company offers affordable hosting solutions for customers who don’t want the hassle of Bitcoin Miner, Enhancing managing their Bitcoin mining equipment. http://www.spondoolies- Cryptocurrency • Founded by a group of Israeli high-tech veterans, Spondoolies-Tech is all about cryptocurrency. The tech.com/ 2013 company has assembled a team comprised of several leaders in the Israeli semiconductor industry, with the goal of building the infrastructure on which cryptocurrency will flourish. Logical Form: Apps and Block • The core products are Block Chain Data Templates for banks and enterprises. Most companies in the Chain Data Templates for Banks block chain sector seek to replace the need of "Trusted Parties". and Enterprises • Logical Form assumes "Trusted Parties" like banks and governments are here to stay. The company http://logicalform.com/ 2013 therefore concentrates on effectively utilizing the Bitcoin algorithm and protocol between trusted parties, without the complications required when trust is eliminated. HasHWare Mining • HasHWarewishes to make mining accessible to all as well as promoting widespread acceptance of : Technology's Hardware and bitcoin and other crypto currencies and therefore have expanded beyond selling mining machines. The Cryptocurrencies company together with its partners Coin Commerce has recently installed Bitcoin payment systems in http://www.hashware.co.il/ 2014 25 businesses throughout Israel with more to follow, and plans to install and operate bitcoin exchange ATM kiosks as well as introducing isracoin, the first localized cryptocurrency. Israeli Blockchain Startups: Other Name Description Homepage Founded Telumis Marketplace for search through leading : • Telumis is a Financial Opportunities Search Engine that lets the investor Financial Investment financial Institutions to find Investment Opportunities. Instead of settling for offers from one or www.telumis.com 2014 Opportunities two financial institutions, users can utilize a world of opportunities. WaveBL: The Key to • WaveBLaims to replace the use of paper in international shipping agreements by storing Paperless Trade documents electronically http://wavebl.com 2014 CredEx:: Offers Small • CredEx is a B2B cred marketplace that allows to trade directly with other, lifting the money Businesses Interest Free barrier. The network has it's own credit system, and offers interest free credit in the B2B www.credex.com 2014 Credit Lines for Use in Our network. Users can get credits, spend them in the network and rebalance by selling their B2B Network goods and services. Colored Coins: Open • Colored Coins is an open source Bitcoin 2.0 protocol that enables developers to create digital Source Protocol for assets on top of Bitcoin blockchain utilizing its functionalities beyond currency. coloredcoins.org/ Creating Digital Assets on 2014 the Bitcoin Blockchain (Website is run by Colu) 99Bitcoins: Information • 99 Bitcoins is a website and blog about Bitcoin. The website aims to close the gap between portal on bitcoin newbies and the technological aspect of Bitcoin through the use of a non technical blog and simple tutorials explained in laymen terms. 99 Bitcoins also operates the subdomain 99 Affiliates which aims to be the most comprehensive source on the web for Bitcoin Affiliate 99bitcoins.com/ 2013 Programs. • 99 Bitcoins has issued out various plugins and apps for the Bitcoin community, including: 99 Coins Ticker, Bitcoin News Feed Widgets, and 99 Bitcoins mobile app Cluster: Disruptive • Cluster offers a space for hi-tech startups to come together and work alongside other startups Technologies Hub • The company also offers courses on technologies, languages and navigating the Israeli startup http://www.clusterhub.org/ landscape 2015 • Cluster also offers a tour of various hi-tech startups within Israeli Alefbit: Technology • Alefbit is a resource for people to learn more about Bitcoin and blockchain http://www.alefbit.com/ 2014 Economy • The website also offers a guide for Israeli blockchain startups Bitli.st: Bitcoin Startups • Bitli.st serves as a directory for various Bitcoin startups http://bitli.st/ 2013 • Users are able to search through a categorized list of different companies 28

Notable implementations and developments Bitcoin-blockchain dependent: Colored coins - An open source protocol that can utilize the existing Bitcoin protocol for creating specific markers or tokens representing different forms of value or assets. By attaching additional data (‘metadata’) to the data associated with bitcoins it is possible to ‘color’ the coins (or more precisely ‘color’ the bitcoin transaction data) in order to signify alternative value. Specialized wallets allow users to assign and read ‘labels’ which can be attached to the underlying bitcoin transaction data. Through this process the bitcoin data can serve as identifiers for various assets (stocks, coupons, real property, commodities etc.) allowing them to be securely transferred and traded between various parties. Blockstream - Offers an open source framework for developing ‘sidechains’. A sidechain is in essence a separate blockchain, with its own set of defined characteristics, yet linked (‘pegged’) and interoperable with the main Bitcoin blockchain, allowing for the transfer of assets between the two. The sidechains can include new and enhanced features, not available or sufficiently addressed in the Bitcoin blockchain, such as increased scripting capabilities, shorter confirmation periods or complete privacy protection. However at the same time by being linked to the bitcoin blockchain, they possess the ability to make use of the existing Bitcoin cryptocurrency, negating the need for additional cryptocurrencies, and afforded the benefits and strengths associated with the Bitcoin decentralized model. Independent protocols and platforms: Ethereum - Offers a blockchain based infrastructure coupled with an incorporated programming language, serving as a straightforward means for creating various customized blockchain implementations such as smart contracts, token systems and other decentralized applications. “Smart contracts” enlist the blockchain’s unique characteristics, in order to automatically perform and execute specific condition - dependent operations. They are essentially computer programs, which are synced with the ledger. These programs are set to be activated when certain predefined conditions have been met, recorded and verified by the blockchain. This provides for a secure, reliable and independent means of enforcing and maintaining the terms of a contract. For instance, if an online purchase was made, transfer of funds can be conditioned upon GPS delivery tracking data being transmitted and registered on the blockchain, confirming that the purchase was indeed delivered and triggering an automated command to release the funds. A more advanced implementation envisioned by blockchain pioneer Nick Szabo would involve actual interaction with an interconnected network of real-world objects, such as those enabled in “Internet of Things” (IoT). Ethereum has its own cryptocoin known as ‘Ether’. However unlike other cryptocurrencies, it is not meant to serve as a currency for trading value per se, but rather as a means of payment for computational resources consumed by programs running on the platform. Ripple - Provides the infrastructure for creating global financial transfer networks. The technology is meant to be compatible with existing financial systems and customizable to meet specific requirements. The incorporated network contains a distributed ledger which settles transactions through a ‘consensus process’. The process consists of independent servers repeatedly reviewing and comparing transactions and balances, with each iteration requiring an increasing level of certainty, until reaching a 100% consensus on the veracity of the remaining data. An additional element is a ‘path-finding’ algorithm which enables locating the lowest foreign exchange rate across all order books and currency pairs. 29

Sources http://dupress.com/articles/trends-blockchain-bitcoin-security-transparency/ http://dupress.com/articles/bitcoin-fact-fiction-future/ https://www2.deloitte.com/content/dam/Deloitte/us/Documents/financial-services/us-fsi-bitcoin-the-new-gold- rush-031814.pdf http://www2.deloitte.com/us/en/pages/consulting/articles/state-sponsored-cryptocurrency-adpating-bitcoin- innovation.html Deloitte “The Future of Financial Services Infrastructure. Overview of Blockchain and its transformative potential”, December 2015 http://rubixbydeloitte.com/ http://crunchbase.com/ http://startupnationcentral.org/ http://www.timesofisrael.com/decades-worth-of-israeli-tech-success-worth-50-billion/ http://www.globes.co.il/en/article-deloitte-israel-best-for-investment-after-silicon-valley-1001069595 http://www.newsbtc.com/2015/09/24/vc-head-believes-israel-will-lead-blockchain-app-industry/ http://techcrunch.com/2015/12/19/israels-flourishing-fintech-has-many-fathers/ http://www.israelfintech.com/IsraeliFintechIndustryReview.htm; http://www.globes.co.il/en/article-deloitte-israel-best-for-investment-after-silicon-valley-1001069595 http://www.globes.co.il/en/article-fintech-one-of-israel-fastest-growing-high-tech-sectors-1001082804 http://www.israel21c.org/2015-was-red-hot-year-for-israeli-high-tech-scene/ https://www.google.com/trends/explore?q=blockchain#q=blockchain&cmpt=date&tz=Etc%2FGMT-2 http://www.geektime.co.il/geektime-zirra-2015-startups-report/ http://www.geekwire.com/2015/jeff-bezos-and-ashton-kutcher-just-backed-a-startup-that-helps-other-startups- better-manage-cash-flow/ http://www.geektime.com/2015/08/19/backfeed-wants-to-decentralize-the-internet-and-help-you-earn-what- you-deserve/ http://cointelegraph.com/news/112802/with-crypto-next-plc-anyone-can-setup-a-digital-currency-exchange-in- a-matter-of-hours http://www.bitcoincasinos.com/blog/crypto-next-integrates-all-cryptocurrencies-for-trading/ http://www.viola-notes.com/how-israel-came-to-be-at-the-forefront-of-fintech-innovation/ http://www.coindesk.com/information/how-bitcoin-mining-works http://www.coindesk.com/coinspark-blockchain-notarized-messaging/ http://www.coindesk.com/israels-dna-bits-moves-beyond-currency-with-genes-blockchain/ http://www.coindesk.com/bitcoin-messenger-app-getgems-raises-400k-waze-investor/ http://www.coindesk.com/israelis-can-now-buy-bitcoins-in-person-with-bits-of-gold-and-local-exchange- bureau/ http://www.coindesk.com/epiphyte-wins-sibos-startup-challenge-crypto-solution-banks/ http://www.coindesk.com/2016-blockchain-reality-deloitte/ http://www.timesofisrael.com/meet-the-kibbutznik-who-wants-to-disrupt-the-global-banking-system/ http://www.forbes.com/sites/investopedia/2013/08/01/how-bitcoin-works/#2715e4857a0b787df96f25ee http://www.timesofisrael.com/israeli-made-tech-behind-bitcoins-is-changing-everything-expert-says/ http://www.vbprofiles.com/companies/54c7ca75b229c3db5400823c; http://www.barclaysaccelerator.com/#/about/// http://www.newsbtc.com/2015/03/13/how-will-2017s-block-reward-halving-affect-bitcoin-price/ http://www.coindesk.com/spondoolies-bitcoin-shop-merger-mining/ 30

Sources https://bitcoinmagazine.com/articles/400000-people-gradually-adopting-bitcoin-tel-aviv-1433881829; https://www.cryptocoinsnews.com/bitcoin-inevitable-say-israeli-politicians-central-bankers/; http://www.newsbtc.com/2015/09/24/vc-head-believes-israel-will-lead-blockchain-app-industry/ www.economist.com www.forbes.com: “How Bitcoin works” https://www.crunchbase.com/ http://techcrunch.com/2014/07/21/startupbootcamp-fintech-2014-cohort/; http://techcrunch.com/2015/12/19/israels-flourishing-fintech-has-many-fathers/ http://www.israelfintech.com/IsraeliFintechIndustryReview.htm http://www.ivc-online.com/Portals/0/RC/Exits/2015/IVC-Meitar%20Exits%20Report%202015-Final.pdf http://recode.net/2015/07/05/forget-bitcoin-what-is-the-blockchain-and-why-should-you-care/ http://www.extremetech.com/extreme/219651-what-is-blockchain-and-can-ibm-intel-and-big-banks-use-it-to- remake-the-internet http://www.ofnumbers.com/wp-content/uploads/2015/04/Permissioned-distributed-ledgers.pdf http://storj.io/TheBlockchainReport.pdf https://www.barclayscorporate.com/content/dam/corppublic/corporate/Documents/insight/blockchain_ understanding_the_potential.pdf http://www.coindesk.com/companies/ripple-labs/ http://motherboard.vice.com/blog/beyond-bitcoin-a-guide-to-the-most-promising-cryptocurrencies https://ripple.com/knowledge_center/market-makers-2/ http://www.coindesk.com/colored-coins-paint-sophisticated-future-for-bitcoin/ http://bravenewcoin.com/news/ten-companies-using-the-blockchain-for-non-financial-innovation/ http://www.fastcolabs.com/3035723/app-economy/smart-contracts-could-be-cryptocurrencys-killer-app https://docs.erisindustries.com/explainers/ http://mapofcoins.com/technologies/ripple https://bitcoinmagazine.com/articles/introducing-ripple-1361931577 http://bluzelle.com/blog/ripple-and-blockchain https://www.ethereum.org/ http://insidebitcoins.com/news/ethereum-launches-frontier-ether-mining-begins-trading-to-follow/34124 https://blog.ethereum.org/2014/07/22/launching-the-ether-sale/ http://siliconangle.com/blog/2014/04/21/bitcoin-sidechains/ http://gendal.me/2014/10/26/a-simple-explanation-of-bitcoin-sidechains/ https://bitcoinmagazine.com/articles/blockstream-moves-ahead-sidechain-elements-first-implementation- sidechains-1433883105 https://blockstream.com/fact-sheet/ http://www.ibtimes.co.uk/ripple-chief-chris-larsen-sorting-out-payments-will-aid-innovation-securities- settlements-1533687 https://github.com/Colored-Coins/Colored-Coins-Protocol-Specification/wiki/Faq http://www.bitcoinisle.com/2016/02/04/simplex-raises-7-million-for-credit-card-bitcoin-buying-service/ http://www.geektime.co.il/simplex-raises-7m/ Antonopoulos, A. M. (2014). Mastering Bitcoin: unlocking digital cryptocurrencies. O'Reilly Media, Inc. Firstpartner: 2016 The Blockchain Ecosystem 31

Contact us Contact us Ran Feldboy Shally Tshuva Tal Chen Partner, Financial Services Industry Partner, Technology, Media & Partner, Corporate Finance Leader Telecommunications Deloitte Israel Deloitte Israel Industry Leader +972 (3) 6085580 +972 (3) 6085478 Deloitte Israel talchen@deloitte.co.il rfeldboy@deloitte.co.il +972 (3) 6070505 stshuva@deloitte.co.il Michael (Misha) Sorin Lior Yekoutieli Amit Harel Senior Manager, Senior Manager, Manager, Financial Advisory Global Alliances Innovation Practice Leader, Deloitte Israel Deloitte Israel Deloitte Israel msorin@deloitte.co.il lyekoutieli@deloitte.co.il hzachor@deloitte.co.il Hagai Zachor Consultant, Innovation and Strategy Deloitte Israel hzachor@deloitte.co.il Researched and written by: Michael (Misha) Sorin Stas Senyuk Deborah Ben-Yosef Gelernter Senior Manager, FAS Manager, FAS Senior Consultant, FAS Deloitte Israel Deloitte Israel Deloitte Israel Yakov Flaumenhaft Jeremy Cooper Hagai Zachor Consultant, FAS Junior Analyst, FAS Consultant, Innovation and Strategy Deloitte Israel Deloitte Israel Deloitte Israel Contributors: Lior Yekoutieli David Schatsky Inbar Ravid Senior Manager, Global Alliances Senior Manager, Innovation Business Development Manager, TMT Deloitte Israel Deloitte US Deloitte Israel Amit Harel Manager, Innovation Practice Leader Deloitte Israel Special thanks: Bitcoin emBassy TLV Meni Rosenfeld Nir Hirshman Chairman, Bitcoin emBassy TLV CEO at Nirshman’s PR Gitai Zach Dror Sam Brama Jonathan Rouach Co-founder, Bitcoin emBassy TLV CEO, Logical Form Founder, Bits of Gold 32

www.deloitte.co.il Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. Please see www.deloitte.com/about for a more detailed description of DTTL and its member firms. Deloitte provides audit, tax, consulting, and financial advisory services to public and private clients spanning multiple industries. With a globally connected network of member firms in 150 countries and territories, Deloitte brings world-class capabilities and high-quality service to clients, delivering the insights they need to address their most complex business challenges. Deloitte’s more than 225,000 professionals are committed to becoming the standard of excellence. Brightman Almagor Zohar & Co. (Deloitte Israel) is the member firm of Deloitte Touche Tohmatsu Limited in Israel. Deloitte Israel is one of Israel’s leading professional services firms, providing a wide range of world-class audit, tax, consulting, financial advisory and trust services. Through 83 partners and directors and approximately 1000 employees the firm serves domestic and international clients, public institutions and promising fast-growth companies whose shares are traded on the Israeli, US and European capital markets. © 2016 Brightman Almagor Zohar & Co. Member of Deloitte Touche Tohmatsu Limited. 33