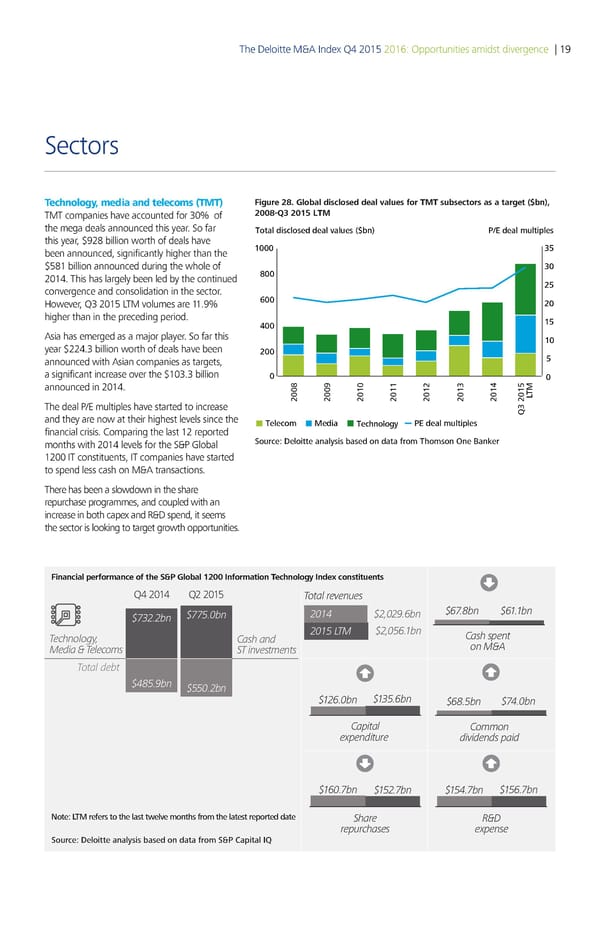

The Deloitte M&A Index Q4 2015 2016: Opportunities amidst divergence | 19 Sectors Technology, media and telecoms (TMT) Figure 28. Global disclosed deal values for TMT subsectors as a target ($bn), TMT companies have accounted for 30% of 2008-Q 20 TM the mega deals announced this year. So far Total disclosed deal values ($bn) P/E deal multiples this year, $928 billion worth of deals have € ƒ„ been announced, significantly higher than the $581 billion announced during the whole of ƒ 2014. This has largely been led by the continued convergence and consolidation in the sector. „ However, Q3 2015 LTM volumes are 11.9% higher than in the preceding period. €„ Asia has emerged as a major player. So far this € year $224.3 billion worth of deals have been announced with Asian companies as targets, „ a significant increase over the $103.3 billion announced in 2014. † € €€ € €ƒ € …T The deal P/E multiples have started to increase ‚ƒ €„ and they are now at their highest levels since the Telecom edia Technolo‡y PE deal multiples financial crisis. Comparing the last 12 reported months with 2014 levels for the S&P Global Source: Deloitte analysis based on data from Thomson One aner 1200 IT constituents, IT companies have started to spend less cash on M&A transactions. There has been a slowdown in the share repurchase programmes, and coupled with an increase in both capex and R&D spend, it seems the sector is looking to target growth opportunities. Financial performance of the S&P Global 1200 Information Technology Index constituents Q4 2014 Q2 2015 Total even es $732.2bn $775.bn 24 $2,2.bn $7.8bn $.bn Technology, Cash and 25 TM $2,5.bn Cash sent Media & Telecoms ST investments on M&‚ Total debt $485.bn $55.2bn $2.bn $35.bn $8.5bn $74.bn Caital Common e€endit e dividends aid $.7bn $52.7bn $54.7bn $5.7bn Note: LTM refers to the last tele months from the latest reported date Shae ƒ&„ e chases e€ense Source: Deloitte analysis based on data from S&P Capital IQ

Deloitte M&A Index | Report Page 23 Page 25

Deloitte M&A Index | Report Page 23 Page 25