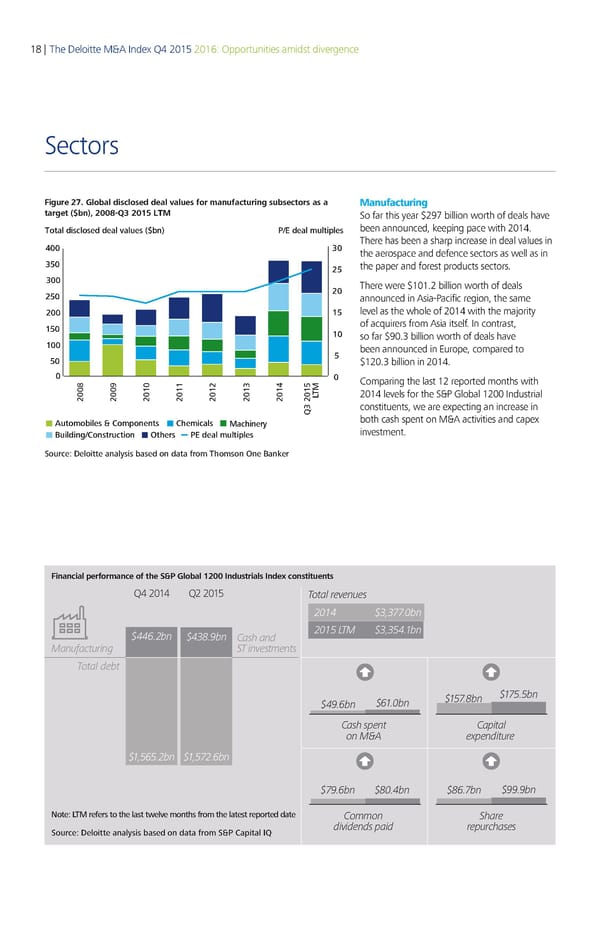

18 | The Deloitte M&A Index Q4 2015 2016: Opportunities amidst divergence Sectors Figure 27. Global disclosed deal values for manufacturing subsectors as a Manufacturing target ($bn), 2008-Q 20 So far this year $297 billion worth of deals have Total disclosed deal values ($bn) P/E deal multiples been announced, keeping pace with 2014. „ ƒ There has been a sharp increase in deal values in the aerospace and defence sectors as well as in ƒ ‚ the paper and forest products sectors. ƒ There were $101.2 billion worth of deals ‚ ‚ announced in Asia-Pacific region, the same ‚ € level as the whole of 2014 with the majority € of acquirers from Asia itself. In contrast, € so far $90.3 billion worth of deals have € been announced in Europe, compared to $120.3 billion in 2014. Comparing the last 12 reported months with ‡ 2014 levels for the S&P Global 1200 Industrial ‚ ‰ ‚ ˆ ‚ € ‚ €€ ‚ €‚ ‚ €ƒ ‚ €„ †T …ƒ ‚ € constituents, we are expecting an increase in utomobiles omponents hemicals ‡achinery both cash spent on M&A activities and capex uildin/onstruction Others PE deal multiples investment. Source: Deloitte analysis based on data from Thomson One aner Financial performance of the S&P Global 1200 Industrials Index constituents Q4 2014 Q2 2015 Total revenues 214 $,.bn $446.2bn $4.bn Cash and 215 TM $,54.1bn Manufacturing ST investments Total debt $61.bn $15.bn $15.5bn $4.6bn Cash s ent Ca ital on M€‚ e enditure $1,565.2bn $1,52.6bn $.6bn $.4bn $6.bn $.bn Note: LTM refers to the last tele months from the latest reported date Common Share Source: Deloitte analysis based on data from S&P Capital IQ dividends aid re urchases

Deloitte M&A Index | Report Page 22 Page 24

Deloitte M&A Index | Report Page 22 Page 24