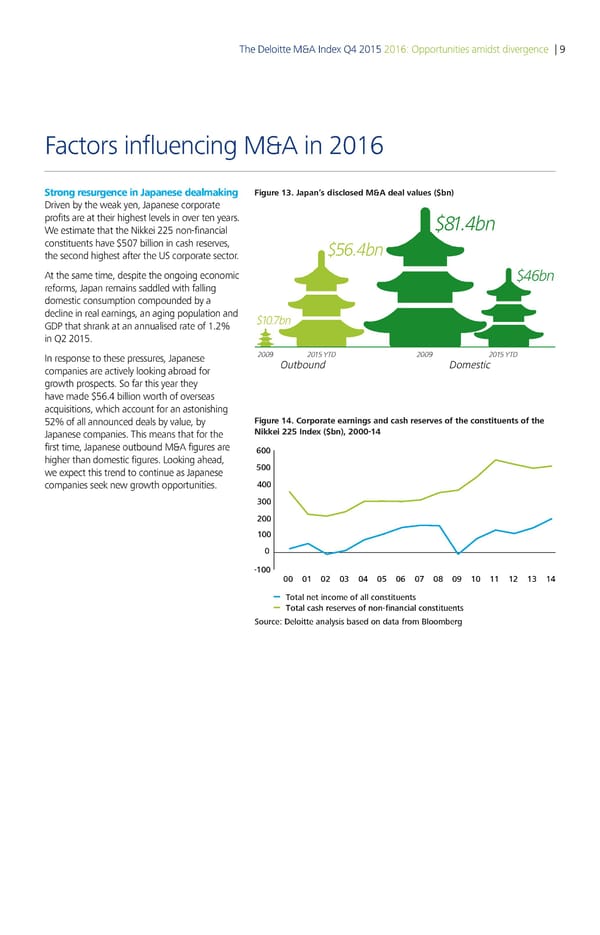

The Deloitte M&A Index Q4 2015 2016: Opportunities amidst divergence | 9 Factors influencing M&A in 2016 Strong resurgence in Japanese dealmaking Figure 13. Japan’s disclosed M&A deal values ($bn) Driven by the weak yen, Japanese corporate profits are at their highest levels in over ten years. $81.4bn We estimate that the Nikkei 225 non-financial constituents have $507 billion in cash reserves, $56.4bn the second highest after the US corporate sector. At the same time, despite the ongoing economic $46bn reforms, Japan remains saddled with falling domestic consumption compounded by a decline in real earnings, an aging population and $10.7bn GDP that shrank at an annualised rate of 1.2% in Q2 2015. In response to these pressures, Japanese 2009 2015 YTD 2009 2015 YTD companies are actively looking abroad for Outbound Domestic growth prospects. So far this year they have made $56.4 billion worth of overseas acquisitions, which account for an astonishing 52% of all announced deals by value, by Figure 14. Corporate earnings and cash reserves of the constituents of the Japanese companies. This means that for the Nikkei 225 Index ($bn 214 first time, Japanese outbound M&A figures are 00 higher than domestic figures. Looking ahead, 00 we expect this trend to continue as Japanese companies seek new growth opportunities. 00 300 200 100 0 -100 00 01 02 03 0 0 0 0 0 0 10 11 12 13 1 Total net income of all constituents Total cash reserves of non-financial constituents Source: Deloitte analysis based on data from Bloomberg

Deloitte M&A Index | Report Page 9 Page 11

Deloitte M&A Index | Report Page 9 Page 11