The impact of web traffic on revenues of traditional newspaper publishers

The impact of web traffic on revenues of traditional newspaper publishers A study for France, Germany, Spain, and the UK March 2016 1

Important Notice from Deloitte This final report (the “Final Report”) has been prepared by Deloitte LLP (“Deloitte”), the United Kingdom member firm of Deloitte Touche Tohmatsu Limited (“DTTL”), for Google Ireland Ltd (“Google”) in accordance with the contract with them dated 19/2/2015 (“the Contract”) and on the basis of the scope and limitations set out below. DTTL and each of its member firms are legally separate and independent entities. The Final Report has been prepared solely for the purposes of estimating the impact of web traffic on revenues of traditional newspaper publishers, as set out in the Contract. It should not be used for any other purposes or in any other context, and Deloitte accepts no responsibility for its use in either regard. The Final Report is provided exclusively for Google’s use under the terms of the Contract. No party other than Google is entitled to rely on the Final Report for any purpose whatsoever and Deloitte accepts no responsibility or liability or duty of care to any party other than Google in respect of the Final Report and any of its contents. As set out in the Contract, the scope of our work has been limited by the time, information and explanations made available to us. The information contained in the Final Report has been obtained from Google and third party sources that are clearly referenced in the appropriate sections of the Final Report. Any results from the analysis contained in the Final Report are reliant on the information available at the time of writing the Final Report and should not be relied upon in subsequent periods. All copyright and other proprietary rights in the Final Report remain the property of Deloitte LLP and/or Google and any rights not expressly granted in these terms or in the Contract are reserved. Any decision to invest, conduct business, enter or exit the markets considered in the Final Report should be made solely on independent advice and no information in the Final Report should be relied upon in any way by any third party. This Final Report and its contents do not constitute financial or other professional advice, and specific advice should be sought about your specific circumstances. In particular, the Final Report does not constitute a recommendation or endorsement by Deloitte to invest or participate in, exit, or otherwise use any of the markets or companies referred to in it. To the fullest extent possible, both Deloitte and Google disclaim any liability arising out of the use (or non-use) of the Final Report and its contents, including any action or decision taken as a result of such use (or non-use). Contacts: Chris Williams, Partner, Deloitte Economic Consulting chrwilliams@deloitte.co.uk Davide Strusani, Director, Deloitte Economic Consulting dstrusani@deloitte.co.uk Ana Aguilar, Director, Deloitte Economic Consulting anaaguilar@deloitte.co.uk

Contents Foreword 1 Key findings 2 Executive summary 3 1 Introduction 5 2 Newspaper publishing in the internet era 6 3 Revenue models for online newspaper publishing 11 4 The impact of web traffic on newspaper publishers 14 5 Appendix: Methodology 18 Deloitte LLP.

The impact of web traffic on revenues of traditional newspaper publishers Foreword The news industry has undergone unprecedented transformation over the last two decades. The Internet has accelerated the pace at which news is created and accessed by readers. At the same time, print circulation has been declining, which has put pressure on publishers to innovate both online and offline. In the current market where a growing amount of news is accessed online, it is critical to understand the interaction between newspaper publishers’ websites, online news aggregators, social networks, and search engines. However, the impact of web traffic on publishers has not been investigated to any significant degree, even though publishers’ advertising-funded business models rely directly on it. This study addresses this gap for the first time by analysing a number of key factors that drive newspaper publishers’ revenue in the digital age. These include total web traffic, which is defined as the traffic driven to news sites directly through a publisher webpage (“direct traffic”) and traffic driven by third party sources which include news aggregators, search engines, social networks and blogs (“referral traffic”). This study estimates the impact that this total web traffic has on publishers’ revenues, and furthermore it assesses the impact that referral traffic alone has on their revenues. The diversity of publishing companies, business models, and readers makes the estimation of revenue drivers challenging. This study estimates these complex relationships using robust econometric approaches with rigour comparable to academic studies. The econometric analysis is based on a sample of 66 newspaper publishers with both online and offline publications across France, Germany, Spain, and the UK, and covers the period between 2011 and 2013. Based on the results of the econometric modelling, the study estimates that a 10% increase in overall web traffic (direct as well as referral traffic) to newspaper publishers’ sites leads to an estimated 0.64% increase in their overall revenues. A 10% increase in referral traffic alone leads to an estimated 0.42% increase in total revenues. These findings are consistent with the existing level of offline and online revenues for publishers. It also finds that the average value of a web visit ranges between €0.04 and €0.08, which provides a valuable reference point for the industry. In conclusion, the value that referral traffic creates for the newspaper publishing industry can be material within the pool of revenue generated online by publishers and can help publishers increase their revenues. Professor Marc Cowling, PhD. Director of Research, Brighton Business School University of Brighton Deloitte LLP. 1

The impact of web traffic on revenues of traditional newspaper publishers Key findings This study measures the value of web traffic to newspaper publishers with both print and online components in France, Germany, Spain, and the UK in 2014. This has been assessed as the impact of total web traffic on publishers’ revenues, i.e. of traffic driven to news sites both directly through a publisher webpage (“direct traffic”) and traffic driven by online news aggregators, social networks and other online services that direct traffic to news (“referral traffic”), as well as the impact of referral traffic on publishers’ revenues alone. To measure the value of web traffic to news sites, this study employs econometric analysis based on a sample of 66 newspaper publishers that have both online and offline editions across in the four countries in scope. The sample covers years 2011 through 2013. During that period, referral traffic accounted for 66% of page views to these publishers on average, with direct traffic accounting for the remaining 34% of page views. The analysis estimates that on average, for the newspaper publishers in the sample, the total value of web traffic to news publishers in the four markets was €1,128m in 2014, whilst that from referral traffic was €746m. The value of a single visit is estimated to range between €0.04 and €0.08, irrespective of whether a visitor accesses a news site directly or through a referral site. Deloitte LLP. 2

The impact of web traffic on revenues of traditional newspaper publishers Executive summary The transformation of news delivery and consumption Newspapers play a vital role in our society through the dissemination of information. They are also a key medium for advertisers to reach their target population. Over the past decades, newspaper publishers have faced competition from a variety of media, including broadcast, radio, and most recently the Internet, and have experienced declining print circulation and print revenues. In the UK, the daily print circulation of leading newspapers decreased from just over 12m in 2001 to less than 7m in 2014, and this trend has become more pronounced in recent years. The catalysts for this decline are numerous. While in the past newspapers used to be the primary source of news, an increasing number of media channels, particularly television and the Internet, are now competing with newspapers for people’s attentions and for advertising funds. Newspapers online compete for readers with other newspapers and for attention with other sites such as social networks. Many of these sites display advertising to their readers and users, which allows them to provide information, entertainment, or a space to place classified ads services for free. Their usage has been growing steadily and advertisers have been increasingly devoting more money to reach their users. In the process, advertisers have reduced their spending in media such as print. Publishers’ initial response to the Internet was the creation of online editions. While the initial industry practice of providing online news for free made it difficult for newspaper publishers to establish a digital equivalent of circulation revenues, paywalls for online access to content have created a new revenue stream. However, advertising remains the main source of revenues for online news. Online advertising revenues depend on the volume of visitors they are able to attract and how many pages these visitors view, in addition to factors such as the type of content, the time spent on the webpage, and the demographic of readership. Publishers have benefitted from increasing Internet penetration and growth of the overall online advertising market, which rose globally by 47% in the five years to 2013. They also benefitted from the ability to reach global audiences that the Internet offers them, especially for newspapers published in languages with large speaking bases such as English and Spanish. The role of news aggregators and search engines as well as their relationships with content publishers is currently being debated across Europe. This study estimates the impact that web traffic has on the revenues of traditional newspaper publishers in France, Germany, Spain, and the UK. This has been assessed as both the impact of total web traffic, traffic driven to news sites directly through a publisher webpage (“direct traffic”) and traffic driven by online news aggregators, social networks and other online services that direct traffic to news (“referral traffic”), and further as the impact of referral traffic alone. Value of web traffic to news sites This study provides quantitative analysis of factors that drive newspaper publishers’ revenues to estimate the value of web traffic, considering 66 leading newspaper publishers with print and online components across the UK, Germany, France and Spain between 2011 and 2013. The analysis draws on data from external sources, which are referenced in the main report. The study estimates only the value of referral traffic and not of other services that referral sites may provide to newspaper publishers; for example, it does not consider any special arrangements regarding advertising or other programmes. The study also only considers the newspaper publishers with online and offline editions. Online-only new sites such as The Huffington Post or broadcasters such as the BBC are not considered in this study. Deloitte LLP. 3

The impact of web traffic on revenues of traditional newspaper publishers Disaggregated data for online and offline segments were not available on a consistent basis across countries. The availability of separated online revenues would have allowed for the assessment of the impact of total web traffic on that segment only; however, the aggregated data do not impact the robustness of the results. In addition, considering the total revenues allows the analysis to examine possible cross-segment effects of website traffic or circulation. The results show a positive relationship between website visits and revenue generated by publishers, with a 10% increase in total website traffic increasing publishers’ revenues by an estimated 0.64%. The share of referral traffic to newspaper publishers’ websites has been around 66% across the four countries for this period. This suggests that a 10% increase in referral traffic alone is associated with an estimated 0.42% increase in publishers’ overall revenues. Based on these results, and assuming the effects hold for all publishers in a market, the value of referral traffic to news sites across the four markets in 2014 would be €746m. Country-level impacts are proportional to the size of the market: publishers in Germany, the biggest market in the study, experienced the highest impact worth €326m, followed by the UK (€208m), and France (€148m). Spanish publishers generated an estimated €264m through referrals in 2014. The value of a single visit is estimated to range from €0.04 to €0.08. On average, the visitors who access a news site directly view more pages than those who arrive from other referral sources, although the value of each page view does not vary with the source of access. Table 1: Impact of total web and referral traffic on publishers’ revenues (2014) Market Publishers’ total Estimated value of total Estimated value of referral revenue (€bn) web traffic (€m) traffic (€m) France 3.5 224 148 Germany 7.7 494 326 Spain 1.5 96 64 UK 4.9 314 208 Total 17.6 1,128 746 Figure 1: Estimated value of referral traffic to newspaper publishers $326m $208m $148m $64m Source: Deloitte analysis based on sources and methodologies described in the report. Figures may not sum due to rounding Conclusion In summary, this study has estimated the value of total web traffic for newspaper publishers and focussed on the contribution of referral traffic to publishers’ revenues. Referral traffic to news websites delivered an estimated €746m in online revenues to publishers in France, Germany, Spain, and the UK in 2014. This represents 4.2% of the publishers’ overall revenues and there exist wider impacts of the Internet on newspaper publishers, the contribution is important in the context of the overall declining trend of traditional print revenues. The current share of publishers’ revenues driven by referral traffic and the expected growth of internet usage suggest that there may be an opportunity for newspaper publishers to further increase visits to their websites and the associated revenues. Deloitte LLP. 4

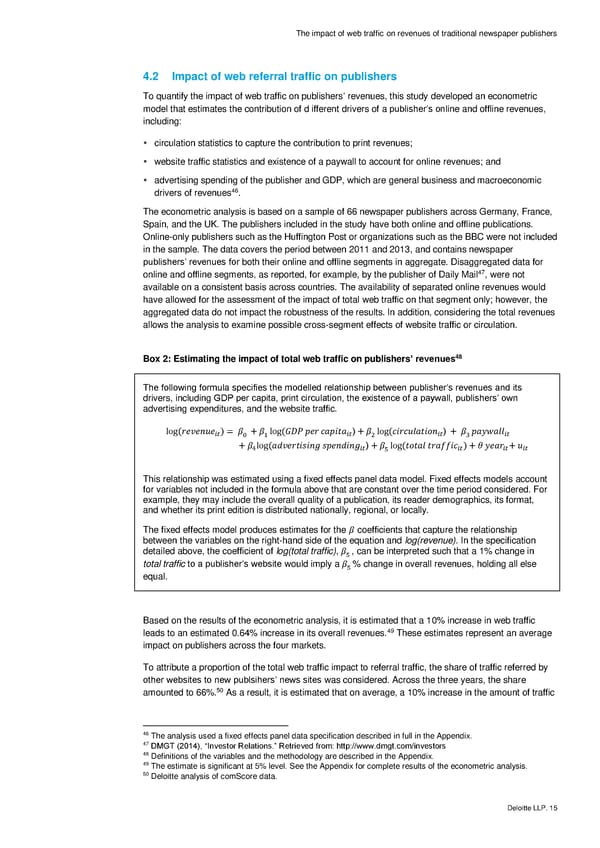

The impact of web traffic on revenues of traditional newspaper publishers 1 Introduction Google has commissioned this study to review how newspaper publishing has changed in the internet era, and how business and revenue models, as well as consumption patterns, have developed in recent years in Europe (Section 2 and Section 3). This study then estimates the value of the web traffic to newspaper publishers in France, Germany, Spain, and the UK (Section 4). To quantify the impact of web traffic on publishers’ revenues, this study developed an econometric model that estimates the contribution of different drivers of a publisher’s online and offline revenues, including circulation statistics to capture the contribution to print revenues; website traffic statistics and existence of a paywall to account for online revenues; and advertising spending of the publisher and GDP, which are general business and macroeconomic drivers of revenues. Compared to a traditional “market sizing” approach, econometric analysis isolates the impacts of different revenue drivers in order to more accurately attribute their contribution to the publishers’ bottom lines. For example, it allows one to assess the differential impacts of print and online readership, or provide data-driven insights into the value of the visitors. The econometric analysis is based on a sample of 66 newspaper publishers with both online and offline publications across France, Germany, Spain, and the UK, and covers the period between 2011 and 2013. Disaggregated data for online and offline segments were not available on a consistent basis across countries. The availability of separated online revenues would have allowed for the assessment of the impact of total web traffic on that segment only; however, the aggregated data do not impact the robustness of the results. In addition, considering the total revenues allows the analysis to examine possible cross-segment effects of website traffic or circulation. The analysis has looked at the impact of total web traffic, defined as traffic driven to news sites directly through a publisher webpage (“direct traffic”) and traffic driven by third party sources which include news aggregators, search engines, social networks and blogs (“referral traffic”), on news publisher’s total revenues. It further assesses the impact that referral traffic alone has on their revenues. A methodology appendix provides more details on the methodology, on the data employed, and on the results obtained in the impact estimation. Deloitte LLP. 5

The impact of web traffic on revenues of traditional newspaper publishers 2 Newspaper publishing in the internet era The European market for newspapers is characterised by diversity of tastes, titles, and print circulation. Figure 2 shows the leading newspapers in the four markets considered in this study. Tabloids, i.e., papers that include many photographs and focus more on popular stories, dominate readership in the UK and Germany, whereas quality press titles, which tend to give more detailed accounts of world events, business, or culture, lead the markets in Spain and France.1,2 The circulation varies according to title as well: Bild, a tabloid, had on average 2.3m readers in 3 Germany in 2014 while the Spanish El Pais, a quality paper, had on average 360,000 daily readers in 4 the same year. The reach of these papers also extends online, where they can have millions of 5 readers every month. However, print circulation has been declining and new online revenues currently do not offset the losses. Traditional newspaper publishers therefore face challenges on a number of fronts. Figure 2: Circulation of selected leading newspapers in France, Germany, Spain, and the UK United Kingdom • The Sun (2.2m) • Daily Mail (1.8m) • Daily Mirror (1.0m) • Daily Telegraph (0.6m) • The Times (0.4m) France • Ouest France (0.8m) Germany • Le Figaro (0.4m) • Bild (2.6m) • Le Parisien (0.3m) • Die Zeit (0.5m) • Le Monde (0.3m) • Frankfurter Allgemeine Zeitung (0.4m)* • Liberation (0.1m) • Suddeutsche Zeitung (0.4) • Die Welt (0.2m)** Spain • El Pais (0.3m) • El Mundo (0.2m) • La Vanguardia (0.2m) • ABC (0.1m) • El Periodico de Catalunya (0.1m) Source: Deloitte analysis of circulation audit bureaus figures for 2013 except for * FAZ.net statistics; ** Axel Springer statistics. Figures represent 2013 workday print circulation. 2.1 Business models are evolving The Internet has profoundly impacted newspaper publishers. The operating model of selling news to readers and, in turn, the readers’ attention to advertisers has been disrupted by the online space. Consumers split their attention among more sources and advertisers divide their budgets among more publishers. Together, these changes have contributed to the long-term trend of decreasing circulation and revenues for newspaper publishers. 1 Collins Dictionary (2015), ‘Definition of “tabloid”. Retrieved from: http://www.collinsdictionary.com/dictionary/english/tabloid 2 Collins Dictionary (2015), ‘Definition of “quality papers”. Retrieved from: http://www.collinsdictionary.com/dictionary/english/quality-papers 3 Meedia (2014), ‘Die große IVW-Analyse der Zeitungsauflagen’. Retrieved from http://meedia.de/2014/04/23/die- ivw-analyse-der-ueberregionalen-und-regionalen-zeitungen/ 4 Association pour le Contrôle de la Diffusion des Média (2014) 5 Deloitte analysis of comScore data. Deloitte LLP. 6

The impact of web traffic on revenues of traditional newspaper publishers The traditional newspaper industry is characterised by high barriers to entry for new companies. Publishing requires reporters, printing presses, and distribution channels that have high fixed costs that may be difficult to operate without sufficient scale. Print operations are expensive to maintain, even for large publishers. The total costs of paper, print, and distribution account for up to 50% of all newspaper publishing costs.6 As a result, the recent consolidation in the newspaper sector has been motivated by possible economies of scale, which makes publishing more affordable. Emerging online publishers that do not need to support legacy print business can achieve lower operating costs and economic sustainability. Many newspaper publishers launched their online editions soon after internet penetration started rising. However, the revenues generated from online advertising have not offset the decreasing revenues from print (revenue models in the internet age are discussed in Chapter 3). Before the Internet, newspapers’ revenue models were based on their ability to “bundle” different sections and advertising together and take advantage of higher advertising rates paid in certain segments. For example, classified ads for cars, real estate or jobs attracted high-paying advertisers. Their revenues allowed publishers to subsidise less profitable areas of the newspaper such as the 7 actual news. The business models based on bundling and cross-subsidisation have not transitioned well to the online world. Newspaper publishers’ online revenues face competition from other newspaper publishers as well as specialised advertising sites. Some of these sites, such as Craigslist, allow people and businesses to place classified advertisements for a small fee or for free. The impacts can be significant: it is estimated that between 2000 and 2007 in the United States, Craigslist, a free classifieds site, saved advertisers €4.1bn ($5.4bn) that they would otherwise have paid to local newspapers. 8,9 Even in the absence of free alternatives, the increased competition for advertising budgets online plays a role in newspapers’ transition to digital. In the UK for example, it has been estimated that national newspapers experience a loss of €4.5 (£3.6) of their print advertising for every 10 one pound they gained online between 2011 and 2013. The availability and success of other new digital platforms has led businesses to diversify their advertising spending from newspapers and therefore affected publishers, although estimates of the overall impacts are not available. 2.2 Circulation is declining Publishers of traditional print journalism have been experiencing declining circulation for several 11 decades. In the UK, the daily circulation of leading newspapers decreased from 12.1m in 2001 to 12 6.9m in 2014, and fell by 2m during the last five years alone. Publishing statistics in Germany, where circulation declined by 41% over the same period, and France, where it fell by 10% between 2001 and 13,14 2011, show similar recent trends. While the decline is noticeable across the spectrum of newspaper publishers, some types of publications have been affected more than others. For example, in the UK the recent decline in circulation and revenues has been driven by quality press, where circulation decreased by 6.6% year-on-year in 2013. However, this trend is not universal. For example, The 6 European Commission (2012), ‘Statistical, ecosystems and competitiveness analyses of the media and content industries: The newspaper publishing industry‘. Retrieved from: http://is.jrc.ec.europa.eu/pages/ISG/documents/FINALNewsreportwithcovers.pdf 7 WAN-IFRA (2013), ‘Classifieds – Completely different from the old days’. Retrieved from: http://www.wan- ifra.org/reports/2013/09/27/classifieds-completely-different-from-the-old-days 8 Seamans, R., Zhu, F. (2013), ‘Responses to entry in multi-sided markets: The impact of Craigslist on local newspapers’, Management Science, 60:2, 476-493. 9 Where applicable, all figures in this report have been converted from their local currency into Euros using the average exchange rate for 2014 based on Oanda.com. 10 Enders Analysis (2014), ‘Newspaper advertising: Temporary reprieve‘. 11 European Commission (2012), ‘Statistical, ecosystems and competitiveness analyses of the media and content industries: The newspaper publishing industry‘. 12 The Media Briefing (2014),‘Newspaper circulation: How far it’s fallen and how far it’s got to fall.’ Retrieved from: http://www.themediabriefing.com/article/newspaper-circulation-decline-2001-2014-prediction-5-years 13 Daily circulation in Germany fell from 23.7m in 2001 to 16.8m in 2014. See http://www.statista.com/statistics/380784/circulation-daily-newspapers-germany/ 14 Print circulation in France fell by 10% in the period 2001-2011 to 2.1m. See http://www.offremedia.com/media/deliacms/media/1231/123142-d013c5.pdf Deloitte LLP. 7

The impact of web traffic on revenues of traditional newspaper publishers 15 Guardian, a quality daily newspaper, marginally increased its circulation between 2012 and 2013. UK readership statistics, which measure how many adults read each issue, have fallen by 13% across the news spectrum in 2013-2014. Results from the London Evening Standard, a free regional daily whose 16 readership rose by 27% in the same period, show that there remain exceptions. Figure 3: Print circulation trends in the UK, 2000-2014 4 )s3.5 onlli3 Mi (2.5 on 2 atiul cr1.5 Ci 1 0.5 0 7 00 01 02 03 04 05 06 00 08 09 10 11 12 13 14 20 20 20 20 20 20 20 2 20 20 20 20 20 20 20 The Sun Daily Mail Daily Mirror The Guardian The Daily Telegraph Source: UK Audit Bureau of Circulations Print circulation has declined amidst the growth of alternative news sources. New media have been emerging, innovating, and becoming affordable for the average reader. Regular and cable television channels have introduced more news providers and the emergence of the 24-hours news cycle has accelerated the rate at which people learn about what is happening around them. Decreasing barriers to entry and syndication deals have made local news viable and formed competitors to regional and local newspapers. The Internet continued this trend by scaling 24-hour news coverage across regions and countries. At the same time, the Internet offers newspaper publishers the ability to reach a global audience. In the past, publishers’ reach was limited to the geography and periodicity of their circulation. In the online world, news can be published to readers at any time of the day and accessed by people around the globe. The Internet provides leverage particularly to newspapers published in languages with large speaking bases such as English and Spanish. For example, nearly 180,000 daily subscribers and point-of-sale buyers in the UK read the print version of the British newspaper The Guardian in 2014. Its online version attracted 90m unique visitors per month with more than 23m coming from the United 17,18 States and 4m from Australia. In October 2013, Mail Online, the web edition of the British Daily Mail tabloid, was read by more than 146m unique readers and this readership is more than two times higher 19 than the entire population of Mail Online’s domestic market. 2.3 Print revenues are falling The falling print circulation is affecting the publishers’ financial positions. The business model of print journalism relies on the combination of advertising and circulation streams, which are composed of recurring subscriptions and sales to end customers. The contribution of each stream to the news organisation’s bottom-line varies based on publication. Quality publications typically favour higher prices, while tabloids may focus on audience acquisition through lower prices and more space devoted to ads. 15 Enders Analysis (2014), ‘Newspaper advertising: Temporary reprieve.’ 16 The Media Briefings (2014): ‘UK newspaper readership falls twice as fast as circulation’. Retrieved from ‘http://www.themediabriefing.com/article/newspaper-publishers-nrs-abc-circulation-readership-digital-june-2014 17 The Guardian (2014): ‘ABCs: National daily newspaper circulation August 2014’. Retrieved from http://www.theguardian.com/media/table/2014/sep/05/abcs-national-newspapers 18 Journailsm.co.uk (2014), ‘The paywall horse has bolted for us’. Retrieved from: https://www.journalism.co.uk/news/guardian-ceo-the-paywall-horse-has-bolted-for-us/s2/a556033 19 Press Gazette (2013), ‘Metro and Mirror double online readership as Mail Online hits record 146m monthly browsers’. Retrieved from: http://www.pressgazette.co.uk/metro-and-mirror-double-online-readership-mail-online- hits-record-146m-monthly-browsers Deloitte LLP. 8

The impact of web traffic on revenues of traditional newspaper publishers Declining circulation has directly decreased revenues, as fewer issues are sold via subscriptions and at point-of-sale, even though prices have remained relatively stable. In efforts to boost print circulation and advertising revenues, publishers have been innovating their print businesses by launching supplemental magazines, weekend editions, or free newspapers. These new initiatives provide additional space for publishers to offer to advertisers. For example Metro, a free daily owned by the parent company of the Daily Mail, focuses on shorter, less expensive reporting and plentiful advertising space, which allows it to operate economically with lower break-even points. This strategy has proven rd 20 successful for the paper, which became the 3 most circulated newspaper in the UK. The London Evening Standard, a local daily newspaper in London that transitioned from a paid to a free newspaper 21 in 2009, doubled its circulation as a result. 2.4 Consumption patterns are changing The decreasing revenues do not appear to result from lower demand for news from readers. In fact, the interest in news is increasing but the way people choose to consume it is changing. The constant availability of fresh content on multiple screens has fragmented the process of news reading.22 While people tend to read news more frequently on a screen than on paper, each reading session has 23 become shorter. The level of reader engagement is one of the major differences between news consumption in print and online. For example, in the UK people spent on average two minutes per day reading online news 24 but twenty-one minutes reading a newspaper. Correspondingly, the revenues that publishers generate per minute of reading are proportional – publishers’ online revenues represent approximately 11% of their total revenues.25 Popular destinations for finding news have also changed with the rise of the Internet. This has affected 26 where people discover news and what prompts them to read articles. Search engines and news aggregators allow people to discover new sources of news while social networks have become an important source for discovering news. For example, 38% of surveyed internet users in Spain stated 27 they discovered news on social websites. Changes to consumption patterns are reinforced through the rise of news aggregators that collate articles from different sources and display them according to the user’s preferences. Google News and Yahoo! News are amongst the most popular aggregator services on the web. While desktop and laptop computers remain the most popular way of accessing news online, smartphone apps have quickly become the second most popular. On smartphones, users prefer to use dedicated apps to general 28 browsers (47% compared to 38%), while this share is reversed on tablets (37% compared to 48%). The shift towards mobile computing introduces further changes. As more people choose to consume 29 news on their smartphones and tablets, they stop buying print issues. While the advertising revenues for news on mobile are currently low, innovations in mobile devices and associated technologies, particularly the payment system, offer publishers an opportunity to monetise their content through mobile channels (see Chapter 3 for more details). Online readers value the convenience of access and the wider variety of sources that online news services provide. The large array of available news sources online allows people to select the type of coverage that matches their preferences. For example, according to a survey of news readers, 51% of 20 Metro (2015). ‘About Metro’. Retrieved from: http://metro.co.uk/about/ 21 The Guardian (2013), ‘London Evening Standard owner plots circulation increase to 900,000 copies.’ Retrieved from: http://www.theguardian.com/media/2013/jul/10/london-evening-standard-plan-circulation-increase 22 Enders Analysis (2013), ‘National newspapers: Print and digital audiences.’ 23 Bohmer et al. (2011), ‘Falling asleep with Angry Birds, Facebook and Kindle – A large scale study on mobile application usage’. Retrieved from: http://www.mendeley.com/catalog/falling-asleep-angry-birds-facebook-kindle- large-scale-study-mobile-application-usage/ 24 Press Gazette (2013), ‘UK readers spend the most time reading newspapers compared to rest of Europe’. Retrieved from: http://www.pressgazette.co.uk/uk-readers-spend-most-time-newspapers-compared-rest-europe 25 The Media Briefing (2013),‘News accounts for less than four percent of time spent online.’ Retrieved from: http://www.themediabriefing.com/article/news-accounts-for-less-than-four-percent-time-spent-online 26 Reuters Institute Digital News Report 2014 27 Ofcom ICMR (2014) 28 Reuters Institute Digital News Report 2014 29 Enders Analysis (2014), ‘Newspaper advertising: Temporary reprieve‘. Deloitte LLP. 9

The impact of web traffic on revenues of traditional newspaper publishers respondents in the UK noted that their news consumption has increased as a result of greater diversity 30 of news sources available online. In addition, 46% and 49% of respondents in the UK and Germany respectively agreed that such variety in news sources allowed easier access to a greater number of opinions and views. Readers are able to engage more actively in reported events by contributing to comment boards or discussion forums. On some modern news sites, readers can even participate in journalism itself by uploading videos of news 31 scene footage, and distribute the news to broader audiences through social networks. The uptake is noticeable. Approximately 25% of survey participants in both the UK and Germany stated that they share news stories via Facebook, with 15% of users regularly commenting on stories via Twitter or 32 Facebook. 30 Oliver and Ohlbaum News Consumer Survey (2013), in ‘Different media, different roles, different expectation: The nature of news consumption in the digital age.’ 31 Nguyen, A. (2013), ‘Harnessing the potential of online news: Suggestions from the study on the relationship between online news advantages and its post-adoption consequences’. Retrieved from: http://jou.sagepub.com/content/11/2/223.abstract. Summary available at: http://onlinejournalismblog.com/2010/04/27/why-do-people-read-online-news-research-summary/ 32 Oliver and Ohlbaum News Consumer Survey (2013), in ‘Different media, different roles, different expectation: The nature of news consumption in the digital age.’ Deloitte LLP. 10

The impact of web traffic on revenues of traditional newspaper publishers 3 Revenue models for online newspaper publishing Revenue models for print publications transitioning to online news have traditionally been centred on advertising. The initial online strategy of providing news for free has made it difficult for newspaper publishers to establish a digital equivalent of circulation revenues. However, the practices of including paywalls for viewers and other alternative revenue models are emerging. 3.1 Advertising relies on website traffic Advertising is the largest contributor to publishers’ online revenues. Publishers’ revenue streams have benefitted from the growth of the overall online advertising market, which rose globally by 47% in the 33, 34 five years to 2013 and reached parity with the print and TV segments of the market. The advertising revenues captured by newspaper publishers in the UK were estimated to reach €285m, or 35, 36 11% of the total local display advertising market in 2014. The transition of advertising formats to the web has been more fluid than that of other monetisation channels, and has also given publishers an opportunity to offer deals that bundle and cross-sell digital and print ads. Recently paywalls, which restrict non-paying visitors from accessing articles, emerged as another channel of monetisation. The existence of two competing paradigms allows publishers to choose from two business strategies - complete openness, selected by Die Zeit and The Guardian; or restrictiveness, chosen by The Times, on the two extremes. Newspaper publishers make slots on their websites available for “rent” to advertisers and charge based on the number of views. Prices are typically quoted in terms of cost per mille (CPM), which indicates the cost of displaying the advertisement to 1,000 viewers. The inventory of ad spaces on a news website is filled through two channels: direct sales and programmatic buying. Direct sales are the main channel for selling advertising. They account for approximately 65% to 75% of publishers’ online advertising revenues. Under this approach, the sales teams in the newspaper or its sales house make deals directly with advertisers. This system carries a higher average CPM and is generally regarded as more lucrative. For example, the premium slots on the homepage and category pages that boast high traffic tend to have a significant portion of their inventory sourced through direct 37 sales. Programmatic buying, which fills advertising spots automatically using computer algorithms, is an emerging trend in online advertising. It is estimated that it accounted for 35% and 25% of advertising sales in the UK and Germany respectively in 2014, across all segments of the market, including 38 news. 33 WAN-IFRA World Press Trends 2013 34 Online advertising is divided into three categories: display, search, and classifieds. Newspaper publishers typically employ display advertising, which is shown to visitors uniformly. Display advertising accounts for approximately 30% of the overall market. Search advertising customises ads based on the queries people enter into the search engine. Search advertising accounts for approximately 60% of the market. Classified ads account for the remainder. 35 Enders Analysis (2014), ‘Newspaper advertising: Temporary reprieve.’ 36 IAB Europe AdEx Benchmark 2013 Report. Retrieved from: http://www.iabeurope.eu/files/8214/0654/8359/IAB_Europe_AdEx_Benchmark_2013_Report_v2.pdf 37 Digiday (2014), ‘The global outlook for programmatic advertising in 5 charts’. Retrieved from: http://digiday.com/platforms/global-outlook-programmatic-advertising-5-charts/ 38 Magna Global as reported in Digiday (2014), ‘The global outlook for programmatic advertising in 5 charts’. Retrieved from: http://digiday.com/platforms/global-outlook-programmatic-advertising-5-charts/ The United States leads the adoption of programmatic ad buying with approximately 60% of all ads across all verticals originating in automated systems. Deloitte LLP. 11

The impact of web traffic on revenues of traditional newspaper publishers Programmatic buying requires limited labour input and therefore operates with minimal marginal costs. The low marginal costs and abundant supply of ads has allowed publishers to increase the number of available advertising slots, which has put pressure on its CPMs. However, the lower marginal costs imply that programmatic buying can be used to inexpensively match advertising supply with demand in instances where low CPMs would make direct sales uneconomical. Revenues from both directly sold and programmatic advertising are closely tied to the amount of traffic publishers receive online. The more visitors the site attracts, the more revenue it is typically able to generate. Higher traffic allows better segmentation of visitors who can then be served personalised ads with higher CPMs and attracts advertisers with large budgets that only participate on large sites. 3.2 Paywalls allow experimentation Paywalls are another popular method of monetising content for newspaper publishers online. Advances in web technologies and payment systems in recent years have enabled publishers to erect paywalls in order to restrict access to their content to paying customers. The variety of paywall types (see Table 2) allows publishers to experiment and gives them flexibility to set their revenue mix to a combination of free (ad-sponsored) and restricted paid content. Table 2: Types of paywall Hard paywall Soft paywall / metered Freemium paywall model Description Paywall that does not allow Metered models allow Under the freemium model, any direct access to content access to a limited number the content is available for without subscription. of articles for a selected free but users have the Exceptions could be referrals period, after which a user option of paying for “extras.” from search engines or has to purchase a These may include removal social media sites. subscription to continue of advertising from pages, reading. special mobile apps, or supplements and special reports. Impact of Significant drop Partial drop No / little drop paywall type on page views39 Examples The Times, The Wall Street The Daily Telegraph, El The Guardian, Die Welt, Le Journal Mundo Monde Source: Deloitte analysis Paywalls provide a new source of revenues but can also substitute some of the existing advertising income. A paywall typically leads to a decrease in page views and advertising revenue, as non-paying readers cannot access some or all content and associated advertising. Special focus, e.g., in-depth financial analysis in The Wall Street Journal, or unique content, such as the Premier League videos in The Sun, serve as differentiators for the websites with paywalls and motivate their readers to become paying subscribers. Publishers of general news that have moved to paywalled access include: The New York Times, a quality US daily, was among the first in the current wave of publishers to institute metered paywalls in 2010. In mid-2014, the publisher reported having over 800,000 paying subscribers of digital products with prices ranging from $3.75/week to $8/week depending on the types of devices used to access the content.40 Bild, a popular German tabloid, instituted a freemium-style paywall in mid-2013 along with other properties owned by its parent, Axel Springer AG. In October 2014, it counted nearly 250,000 paying customers, compared to 56,000 paying customers for Die Welt, a quality daily. Readers can 39 Deloitte analysis of comScore data. 40 New York Times (2014), ‘New York Times Co. gains circulation, but profit falls 21%’. Retrieved from: http://www.nytimes.com/2014/07/30/business/despite-circulation-gains-profit-falls-21-at-new-york-times-co.html Deloitte LLP. 12

The impact of web traffic on revenues of traditional newspaper publishers choose from a range of subscription options that start at 4.99 and 4.49 EUR per month for the Bild 41 and Die Welt respectively. The Times, a quality UK daily with a Sunday edition, launched a hard paywall in 2010. As of May 2015, The Times have over 400,000 paying subscribers, out of which 229,000 subscribe to a combined digital and print package and 172,000 pay for digital-only offers that are priced from £2 to 42 £8 per week. In a sample of 66 leading news websites in the UK, Germany, Spain, and France in this study, 43 approximately one fifth had a paywall in place in 2015. It is estimated that, for those publications with 44 paywalls, approximately 10% of their online revenues comes from paid digital content. In 2014, approximately 11% of news readers in the UK, Spain, and other Western European markets paid for digital content. This may change as the number of people who pay for news is projected to grow 45 between 7% and 23% in these markets. 3.3 Alternative revenue models In addition to advertising and paywalls, publishers are also experimenting with other revenue models (Figure 4). These alternative models provide an opportunity for publishers to test how consumers react to new pricing or content strategies without affecting their established product mix. If these innovations prove successful, publishers can roll them out to a wider consumer base. Figure 4: Alternative revenue models Revenue model Description Examples Revenue can be generated through payments for The Economist’s Mobile apps downloads of the app, subscription fees, and mobile Espresso app advertising. Digital Digital subscriptions allow readers to access the full print Orbyt established subscriptions version of the newspaper online for a subscription fee. by El Mundo Pay-per-article A micropayment system that allows people to purchase Die Zeit only the articles or issues in which they are interested. Users are granted access to premium articles when they Surveys complete online consumer surveys commissioned by Trinity Mirror advertisers and other companies. Voluntary Users have the opportunity to make a donation for the Die Tageszeitung donations upkeep of the site and production of content. Source: Deloitte analysis 41 Axel Springer Berenberg European Conference 2014 presentation. Retrieved from: https://www.axelspringer.de/dl/18722195/14-11-26_AS_Berenberg_Pennyhill.pdf 42 Press Gazette (2015), ‘Times and Sunday Times now claim more than 400,000 ‘members’’. Retrieved from: http://www.pressgazette.co.uk/times-and-sunday-times-now-claim-more-400000-members 43 Deloitte analysis of news sites. See appendix for methodology. 44 European Journalism Observatory (2014), ‘Another brick in the wall? A study on paywalls’. Retrieved from: http://en.ejo.ch/media-economics/business-models/another-brick-wall-study-paywalls 45 Reuters Institute Digital News Report 2014 Deloitte LLP. 13

The impact of web traffic on revenues of traditional newspaper publishers 4 The impact of web traffic on newspaper publishers Newspaper publishers still derive a majority of their online revenues from advertising and therefore their financial results depend on their ability to bring readers to their sites. Even paywall strategies rely on traffic, as bringing more visitors increases the possibility of converting them to paying customers. This study estimates the value of web traffic to websites of newspaper publishers in France, Germany, Spain, and the UK. As illustrated in Box 1, visitors to news publishers’ websites can either access content by navigating directly to the website (“direct traffic”), or can access content through a variety of referral sources which include news aggregators, search engines, social networks and blogs (“referral traffic”). As such, the analysis has looked both to quantify the impact that total web traffic (i.e. both direct and referral traffic) has on publishers’ revenues, along with the impact of referral traffic in isolation. Box 1: Sources of visits Direct (34%) Referrals (66%) Online audience News website Attracting visitors and visits is paramount for news sites funded by advertising. Visits are not the same as visitors because each page they view counts as a separate visit. For example, one visitor may land on a homepage and then read three articles. As a result, the statistics would record he made four visits (one to the homepage, three to article pages). The analysis of comScore data on news sites visits in this study shows that: 34% of visits came from users who navigate to the site directly, either by typing the URL into their address bar or by following their bookmarks. The remaining 66% of users were referred via other sources. These may include links via search engines, news aggregators or on blogs or social media, which users follow to the news sites. Source: Deloitte analysis of comScore data The results of the analysis are based on historical data. They do not represent incremental revenues and do not seek to measure what would have happened if web referral services did not exist. 4.1 Drivers of traffic There are multiple internal and external factors that drive website traffic. Internally, these may include the quality of content and presentation; externally it may be a brand value, an effective online promotion strategy, or discoverability of content. While a significant portion of publishers’ overall revenues derive from their print operations (see Section 2), online revenues enabled by website traffic are growing in size and importance. The website traffic can come from different sources: visitors can access a page directly, or via other sites such as search engines, news aggregators or through social media. On news sites funded by advertising, visitors are exposed to ads whenever they load a page, which directly translates to revenues for the publisher. Deloitte LLP. 14

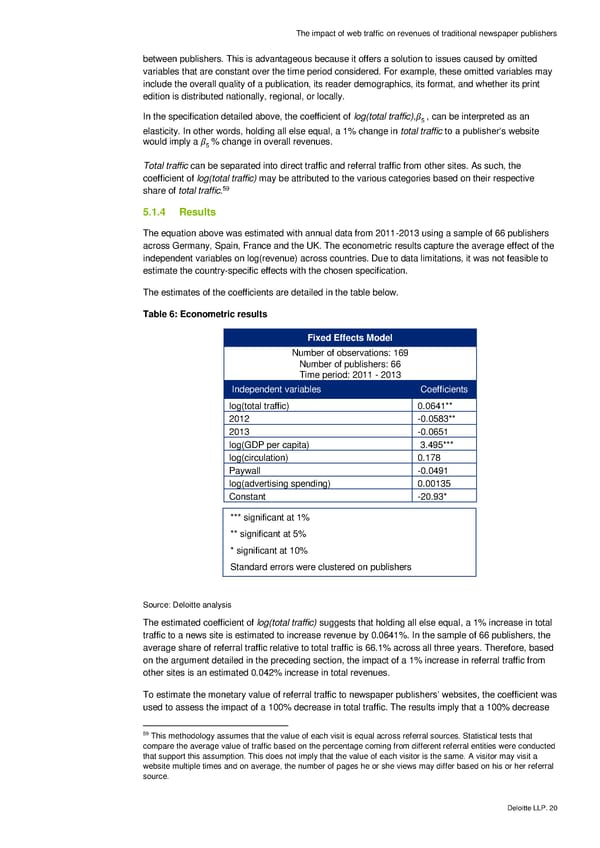

The impact of web traffic on revenues of traditional newspaper publishers referred to newspaper publishers’ websites from referral sites alone has led to an estimated 0.42% 51 increase to the publishers’ overall revenues. To estimate the total value attributed to referral traffic, the calculations assume a 100% decrease in referral traffic to publishers’ websites. This suggests that an estimated 4.2% of newspaper publishers’ 52 total revenues are driven by referral traffic. As the figure represents an average effect, referral traffic can represent a higher share of revenues for publishers with more substantive online operations and vice versa. These results were converted into monetary values by combining them with the sizes of the total 53 newspaper markets in each of the four countries. The calculation assumes that the relationships estimated in the sample of 66 publishers extend to the whole market. On this basis, total web traffic to newspaper publishers generated an estimated €1,128m across the 54 four markets in 2014, whilst referral traffic generated an estimated €746m. The contribution of total web traffic and referral traffic to publishers in individual countries is listed in Table 3. The relative size of referral contributions in each market isdriven by the differences in sizes of the overall newspaper markets. Table 3: Impact of total web and referral traffic on publishers’ revenues (2014) Market Publishers’ total Estimated value of total web Estimated value of referral revenue (€bn) traffic (€m) traffic (€m) France 3.5 224 148 Germany 7.7 494 326 Spain 1.5 96 64 UK 4.9 314 208 Total 17.6 1,128 746 Source: Deloitte analysis. Total market estimates from PwC. Figures may not sum due to rounding The results represent the estimated aggregate revenues that newspaper publishers in the four markets derived as a result of referral traffic. For example, these revenues could have been generated from ads provided by any provider, or any other source of monetisation that is based on web traffic. The estimated revenues from referral traffic represent approximately 4.2% of publishers' total revenues. The estimated revenues from overall web traffic then account for approximately 6.4% of their revenues. The findings are consistent with the broad newspaper publishing market, where publishers generate approximately 10% of their revenues via their online channels. While publishers can generate traffic and revenues by making their websites accessible via referral sites, the opposite is also true. For example, newspaper publishers in Germany and Spain experienced declines in website traffic after Google had to change the format of its results. In Germany, some newspaper publishers prohibited Google from displaying news snippets along with the hyperlinked headlines. Participating publishers saw declines in visits as news readers opted for competitors that 55 retained the snippets. In Spain, a shutdown of Google News following a court ruling reduced the 56 number of visits to news sites by 5-12%. 51 See Section 4.2.1 for explanation of valuing visits from different sources. 52 Deloitte analysis. Market sizes data from PwC (2014), ‘Global Media and Entertainment Outlook’ 53 Estimates of total market sizes were sourced from ‘Global Media and Entertainment Outlook’ published by PwC (2014). 54 As advertising represents the dominant model for funding online websites, the contribution primarily consists of advertising revenue. However, the holistic nature of the econometric analysis means that the overall contribution also includes any shares of revenues from paywalls and other means of monetisation that are driven by traffic. 55 Reuters (2014), ‘Germany's top publisher bows to Google in news licensing row’. Retrieved from: http://www.reuters.com/article/2014/11/05/us-google-axel-sprngr-idUSKBN0IP1YT20141105 56 telecompaper (2015), ‘Spanish news sites down up to 12% after google News closure’. Retrieved from: http://www.telecompaper.com/news/spanish-news-sites-down-up-to-12-after-google-news-closure--1062419 Deloitte LLP. 16

The impact of web traffic on revenues of traditional newspaper publishers 4.2.1 Estimating the value of a single visit Based on the data and results of the analysis, the study compared the value of visits by users who access the news sites directly and who access them via referral websites. The analysis found that on average, there is no difference in the revenue that individual visits (a single page view) from different sources generate. In other words, a page view by a visitor referred from another websiteis just as valuable as a page view from a visitor who comes in directly. The average value of a visit ranges from 57 €0.04 to €0.08. Analysis of the comScore data shows that the visitors who accessed from referral sites viewed on average 4.3 pages during their visit. This compares to 5.7 page views per visit from visitors who 58 accessed the site directly by typing the website address into their address bar. This difference may be due to the fact that visitors from referral sites may search for a particular subject, follow it to a page on the news site, and leave after reading the article and seeing the advertising. Visitors who arrive directly are more likely to visit the homepage and browse, seeing more pages in the process. 4.3 Conclusion This study has estimated the value of total web traffic for newspaper publishers. It has further assessed the contribution of referral traffic to publishers’ revenues. Referral traffic to news websites delivered over €746m in online revenues to publishers in France, Germany, Spain, and the UK in 2014. While this represents only 4.2% of the publishers’ overall revenues, the contribution is important in the context of the overall declining trend of traditional print revenues. The current share of publishers’ revenues driven by referral traffic and the expected growth of internet usage suggest that there may be an opportunity for newspaper publishers to further increase the amount of visits to their websites and the associated revenues. 57 Deloitte analysis, methodology provided in the appendix. Deloitte LLP. 17

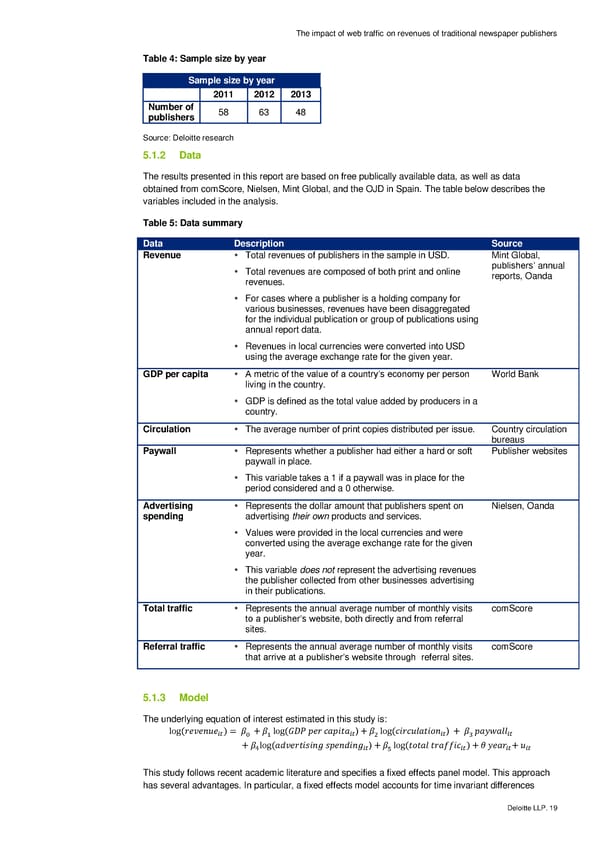

The impact of web traffic on revenues of traditional newspaper publishers 5 Appendix: Methodology This study has estimated the value of web traffic to newspaper publishers in France, Germany, Spain, and the UK. The study uses an econometric model to isolate and test the effects that different sources of total web traffic and other revenue drivers have on newspaper publisher revenues. This approach is described in more detail in Section 5.1. This study is based on publishers’ historical data. It does not seek to develop any counterfactual scenarios or answer any “what if?” questions related to the subject, as stated in Section 5.1. The newspaper publishers included in this analysis differ in their business models, product offerings, or readers’ demographics. These differences make the estimation complex. The techniques used in this study have been selected to most accurately tackle these challenges. The subsequent sections outline the approaches employed in the estimation and provide sources for the underlying data and explanations for any assumptions. 5.1 Econometrics methodology Econometric modelling was used to identify the impact that total web traffic has had on newspaper publishers’ revenues. 5.1.1 Sample The analysis considered a sample of 66 newspaper publishers across four European markets: Germany, France, Spain, and the UK. These publishers were selected based on data availability and their levels of circulation or online traffic within their respective market. In addition, the sample also included smaller regional publishers. The time period examined was from 2011 to 2013. Only publications with both a print and an online component were included in the sample. Online-only publishers such as Eurosport.fr and Goal.com were not considered, nor were the national broadcasters in the four markets, such as France TV, NDR, RTVE, and the BBC, that are otherwise popular sources of online news but do not have print editions and often are not funded by advertising revenues. Companies with divisions unrelated to newspaper publishing were excluded, unless their publishing divisions had separate financial results available. News sources removed due to this limitation include Sky News, whose parent company Sky is a provider of cable and internet services that does not provide financial statements disaggregated for its news section. In addition, Sky News is available only online and not in print. The inclusion of these publishers would have introduced noise into the model from the non-publishing revenues, which are not relevant to this study. In addition to these exclusions, where data for some publishers was unavailable or inaccurate, these publishers were not included. The size of the sample varied across years due to missing values for some publishers. Different sample sizes did not affect the reliability of the estimation under the fixed effects methodology, which is described below. Deloitte LLP. 18

The impact of web traffic on revenues of traditional newspaper publishers in total traffic would lead to a 6.41% decrease in total revenue. Consequently, a 100% decrease in referral traffic would imply a 4.2% decrease in total revenues. The coefficient of the variable log(GDP per capita) implies that the variable has a positive impact on publishers’ revenues. As the citizens of a country grow wealthier, publishers may attain higher revenues. The countries examined also exhibit different GDP per capita patterns over the period. Negative coefficients on the variables 2012 and 2013 indicate a declining trend in newspaper publishers’ revenues over time. This finding is consistent with the general market trends discussed in the main body of the report. The time period of three years does not allow for significant year-on-year variations in some of the other key variables estimated by the fixed effects model. As a result, the properties of the fixed effects model do not identify a significant impact of circulation and paywall on revenue. However, an alternative approach undertaken using a random effects model does capture a positive and significant effect of circulation, even when controlling for other firm-specific factors, while also maintaining a 60 similar, significant coefficient on log(total traffic). Given the advantages of estimating a fixed effects model in this study, the random effects model was not used in this report.61 Finally, the model has not identified a statistically significant relationship between advertising spending, as measured by log(advertising spending), and revenues for these publishers in the sample over this time period for similar reasons as for circulation. 5.1.5 Robustness checks To assess the sensitivity of the estimates, additional specifications were run to test how the coefficients of interest varied if other variables were excluded. These specification tests did not produce material differences in the coefficient on log(total traffic) and did not affect its significance. Recent literature by Cozzolino and Giarratana (2014) suggests that endogeneity may have been 62 introduced with the inclusion of both circulation and total traffic variables in the model. Additional specifications omitting circulation as well as employing a two-stage least squares estimation using the instruments proposed by Cozzolino and Giarratana have been estimated. Differences between the coefficients of these specifications and the original specification were not material. 5.1.6 Calculating the value of a visit The average value was derived from the estimated revenue impact on the publishers in the sample and the traffic they received as follows: Estimated revenue impact / total traffic = average value of a visit The estimated value of a visit ranges between €0.04 and €0.08. The range represents the average value across the four markets for the years covered in the sample. 5.2 Relevant literature The main sections of the report and the appendix reference a number of sources that provide evidence for statistics and arguments made in the analysis. In addition, the study has consulted and taken into consideration other research on the subject of newspaper publishers, website traffic, and market performance. Summaries of the literature are presented below. The impact of news aggregators on internet news consumption Athey & Mobius (2012) analyse the impact of news aggregators on the quantity and composition of news in France.63 60 Results of the random effects model are available upon request. 61 For more details on panel data models please refer to Wooldridge (2010), “Econometric Analysis of Cross Section and Panel Data” 62 Cozzolino and Giarratana (2014), “Mechanisms of Value Creation in Platform Markets” 63 Athey,S. and Mobius,M. (2012), ‘The impact of news aggregators on internet news consumption: The case of localisation’ , mimeo, Harvard University. Deloitte LLP. 21

The impact of web traffic on revenues of traditional newspaper publishers Using a case study analysis, where Google News added local content to users’ home pages who chose to enter their location, they find that the inclusion of local content by Google News had mixed effects on local new sites. It increased traffic, especially in the short run, but it also increased the reliance of users on Google News for their choice of news, and increased the dispersion of user attention across outlets. Furthermore, they find that the adoption of Google News leads to greater consumption of local news, both unconditionally (by more than 26%) and conditional on Google News page views. They find a 5% increase in direct navigation to local outlets (bypassing Google News altogether, presumably because the user had learned that they like the outlet and actively chooses it in the future), and a 13% increase in clicks on local outlets from the Google News home page. However, over time, incremental local news consumption is derived primarily from increased use of Google News. The impact of online news advertising on print advertising Sridhar and Sriram (2014) analyse how firms choose to transfer their budgets over time between online and print newspaper publishing. Using monthly advertising data for a large US newspaper over the period 2007-2011, they carry out an empirical study to determine whether online advertising is substituting print advertising revenues. 64 They find that, whilst online traffic is increasing, online advertising prices remain low. They report that 4-9% of the decline in print advertising revenues was due to substitution from the transition to online media, with most of the decline being attributed to the substitution of advertisers to alternative media options other than newspapers. Media, aggregators and the link economy Dellarocas, Katona, and Rand (2012) develop a theoretical model to determine how hyperlinking affects the incentives of news providers to produce quality content, rather than link to third party content, and the resulting impacts on the profits and content quality of both news providers and 65 aggregators. They find that the Internet has been disruptive in breaking up geographical monopolies, with all content competing for online readers. Linking allows similar sites to coordinate content production in ways that increase their joint profits and quality, thus benefiting consumers. The main benefit of aggregators to content creators comes from traffic expansion. Assuming content aggregators form links to the best available content, their presence makes it easier for consumers to access good content, and increases the attractiveness of the entire content ecosystem. However, the presence of aggregators incurs costs that need to be considered, such as the appropriation of attention and revenues to news content providers. Their net effect is positive for content creators only if the traffic expansion they induce is sufficient to offset the loss of attention and advertising revenue. 64 Sridhar, S. and Sriram, S. (2013), ‘Is online newspaper advertising cannibalizing print advertising?’, University of Michigan. 65 Dellarocas, C., Katona, Z., and Rand, W. (2013), ‘Media, aggregators and the link economy: Strategic hyperlink formation in content networks’ in Management Science 59:10, 2360-2379. Deloitte LLP. 22